Transaction costs are the costs incurred during trading – the process of selling and purchasing – on top of the price of the product that is changing hands. Transaction costs may also refer to a fee that a bank, broker, underwriter or other financial intermediary charges.

The difference between what a dealer and buyer paid for a security is one of the transaction costs.

Transaction costs may include legal fees, communication charges, the information cost of finding the price, or the labor required to bring a good or service to market. When deciding whether to make a product or purchase it, transaction costs are a critical factor.

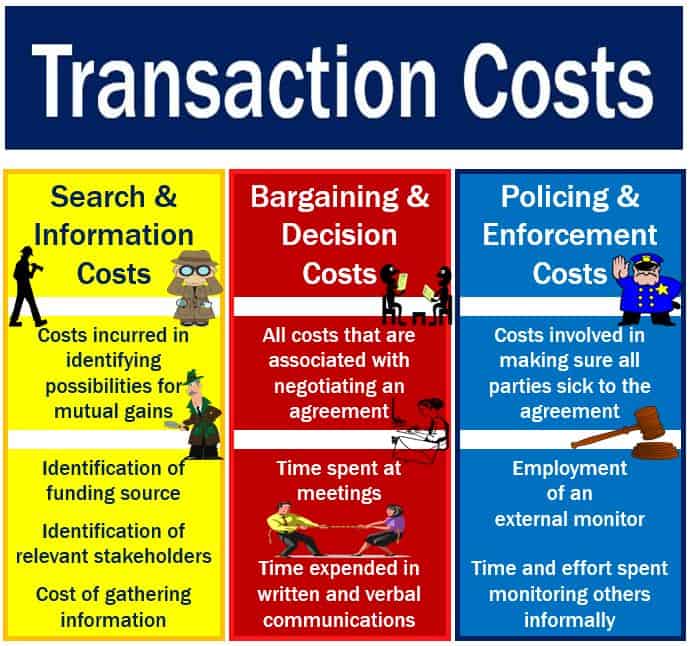

Examples of some transaction costs

Before a particular trade that may be mutually beneficial can occur, somebody has to figure out whether there is anybody out there with whom such a trade is potentially possible, search out possible trading partners, inform them of the opportunity, and negotiate exchange terms.

These activities all involve opportunity costs (looking and evaluating the option you gave up when you made a choice) in terms of money, energy and time.

If the trading terms are to be more complicated than a straightforward cash deal – such as payment in installments, warranties/guarantees, service/maintenance provisions, or options for future purchases at a fixed price – negotiating such a detailed contract is costly in terms of travel expenses, paying experts, etc.

After the trading parties have agreed terms, there could be additional costs involved in policing or monitoring the other party to make sure that he or she is adhering to the terms of the agreement.

These are some of the main transaction costs – policing and enforcement costs, bargaining and decision costs, and search and information costs.

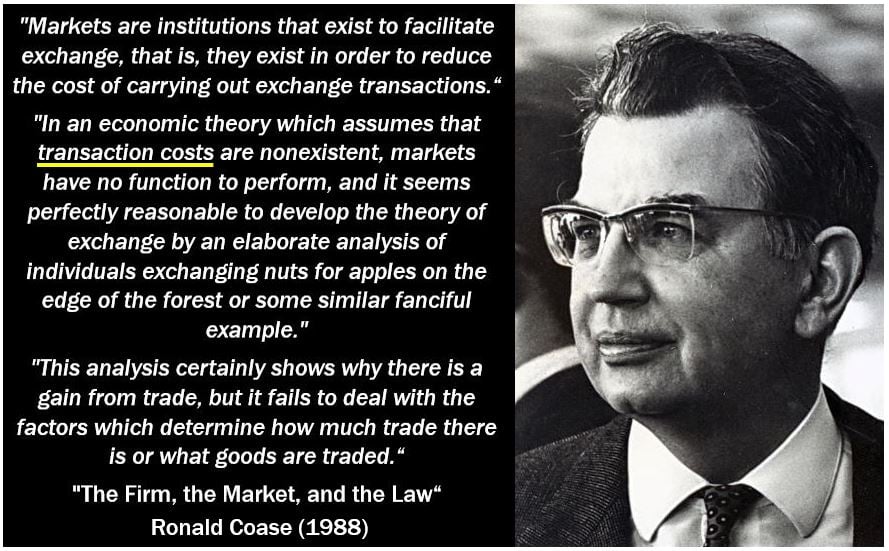

Ronald Harry Coase (1910-2013) was a British economist and author who spent much of his life at the University of Chicago Law School as the Clifton R. Musser Professor Emeritus of Economics. He was awarded the Nobel Prize in Economic in 1991 “For his discovery and clarification of the significance of transaction costs and property rights for the institutional structure and functioning of the economy.” (Image: en.wikiquote.org)

Ronald Harry Coase (1910-2013) was a British economist and author who spent much of his life at the University of Chicago Law School as the Clifton R. Musser Professor Emeritus of Economics. He was awarded the Nobel Prize in Economic in 1991 “For his discovery and clarification of the significance of transaction costs and property rights for the institutional structure and functioning of the economy.” (Image: en.wikiquote.org)

– Search & Information Costs: these are the costs involved in determining that the required product is available on the market, which has the best price, etc.

– Bargaining & Decision Costs: the costs required to come to a mutually-acceptable agreement, drawing up the contract, etc.

– Policing & Enforcement Costs: the costs required to make sure that the other party does not veer from the terms of the contract, and taking the necessary or appropriate action if the other party violates those terms.

The term ‘transaction costs’ is believed by many to have been coined by Ronald Coase (1910-2013), a British economist and author who received the Nobel Prize in Economics in 1991. Prof. Coase used it to develop a theoretical framework for predicting when specific economic tasks would be performed on the market or by firms.

Others say that nobody consciously ‘coined’ the term, which can be traced back to monetary economics articles of the 1950s.

Portfolio transaction costs

Portfolio transaction costs are incurred when a fund buys and sells investments. They include broker execution commission and taxes.

Apart from these direct costs, there are indirect portfolio transaction costs arising from the difference between the buying and selling prices of underlying investments – dealing spread.

In some cases, there are no direct transaction costs, and just the dealing spread is paid – as in fixed interest securities.

Costs and charges in the USA: an article – An Investor’s Guide to Fees and Expenses 2014 – published in Bloomberg, Ben Steverman lists some of the investment portfolio transaction costs – the percentages below are averages:

– Actively Managed Funds: Bond funds – 0.65%. Equity funds – 0.89%.

– Index Mutual Funds: Bond funds – 0.11%. Equity funds – 0.12%.

– Exchange Traded Funds: 0.5% of assets (average expense ratio for non-leveraged ETFs in USA).

– 401(k) Plans: 0.35% of assets with plans worth over $1 billion in assets, and 0.94% for those worth less than $50 million.

– Financial Advisers: Less than 1.25% in management fees for clients with more than $100,000. Fees vary significantly, exceeding 2% for some smaller investors. One quarter of investors with just $100,000 in assets pay over 1.5% annually.

– Brokerage Charges: Flat services charges of 5 to 10 dollars for stock and ETF trades, and up to 5% front-end sales loads on fund purchases.

– Real Estate Investments: Six to seven percent in total transaction costs.

– Hedge Funds: An annual management fee of approximately 1.5% of assets, plus about 18% of any investment gains.

The Investment Management Association, a trade body that represents British investment managers, has an independent guide to portfolio transaction costs and charges on its website.

Video – Transaction costs

In this video, Paul Merison talks about transaction costs – specifically Transaction Cost Theory. He talks about what would be required if he wanted to open an accountancy college.