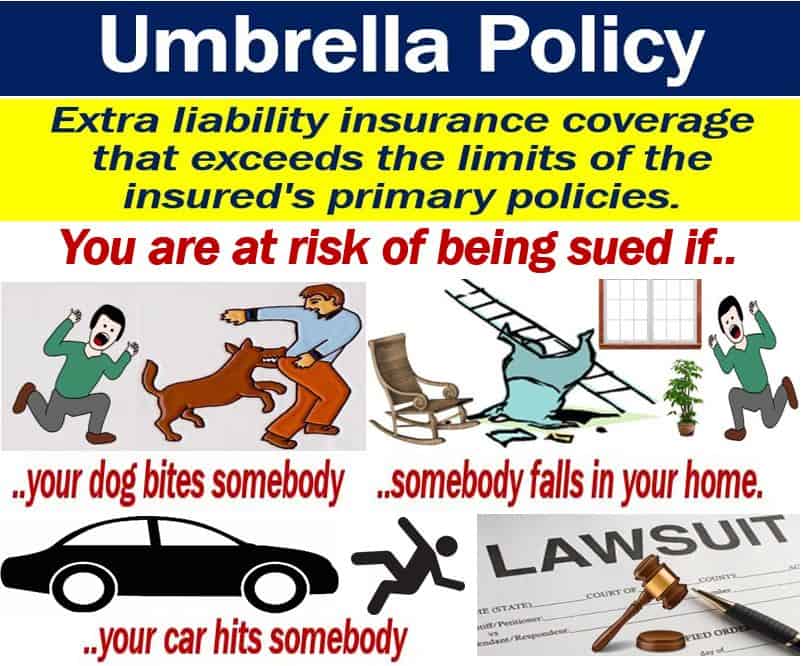

An umbrella policy is an insurance policy that provides extra liability insurance coverage. The coverage exceeds the limits of the insured’s car, boat, house, etc. An umbrella policy provides an extra layer of security to people who believe they are at risk of lawsuits resulting from damage to other people’s property. The insured also believes that he or she is at risk of lawsuits resulting from injuries in an accident.

Put simply; it is an insurance policy that covers you for amounts above those covered under primary policies. In most cases, the insurance company pays out nothing until the losses reach a specific sum. However, in some policies, it pays right from the beginning.

Umbrella insurance usually covers injuries, property damage, lawsuits, and certain personal liability situations.

American auto insurance company GEICO says the following regarding this type of insurance:

“Umbrella insurance is extra liability insurance. This type of insurance policy is designed to help protect you from major claims and lawsuits, and as a result, it helps protect your assets and your future.”

GEICO stands for Government Employees Insurance Company.

Primary policy and umbrella policy

When the insured starts incurring losses because of damage, for example, the primary insurance policy starts paying out. As soon as the losses reach the policy’s limit, the umbrella policy pays the additional amount.

The umbrella policy continues paying up to the limit that the parties agreed to in the contract.

Insurance companies brought umbrella policies to the marketplace in 1949. However, it was not until the 1960s that they became popular. In this context, the term ‘marketplace’ means ‘market’ in its abstract sense.

Excess vs. umbrella policy

Umbrella policies are similar to excess policies. They both pay after an underlying primary policy has reached its limit.

Excess policies

However, excess policies are typically ‘follow form’ policies. In other words, they conform precisely to the coverage of the underlying primary coverage, except that they have their own unique excess limit.

The excess policy adds the excess on top of the primary policy’s limit, i.e., it is like an extension.

Umbrella policies

An umbrella policy, on the other hand, tends to provide insurance coverage over one, two, or more primary policies. However, it lacks ‘follow form’ clauses.

An umbrella policy’s definition of what it covers tends to be broader than those in the primary policies. Umbrella policies also usually lack the exclusions that most underlying primary policies have.

Therefore, an umbrella policy may provide coverage right from the insured’s first dollar of loss of liability.

According to Wikipedia:

“For those risks that are left uncovered by primary policies but are covered under the umbrella policy, the latter is said to “drop down” to cover them as primary insurance and fill in the gaps in the underlying policies.”

“Hence, the ‘umbrella’ nomenclature is a reference to the broader coverage of the policy.”

What is insurance?

Insurance is a financial product that insurance companies sell. They sell them in the form of policies.

Insurance policies safeguard the policyholder against the risk of loss, damage, theft, or even death. Some types of insurance, such as car insurance, are compulsory in most countries.

Video – Personal umbrella policy

This Central Insurance video explains the risks we face if we own a car, dog, or home. The speaker then explains what a personal umbrella policy is.