Underwriting means being paid to be willing to be liable for or incur a potential contingent risk. Underwriting is also the process of assessing the eligibility of a customer to receive capital from corporations and governments that are issuing securities.

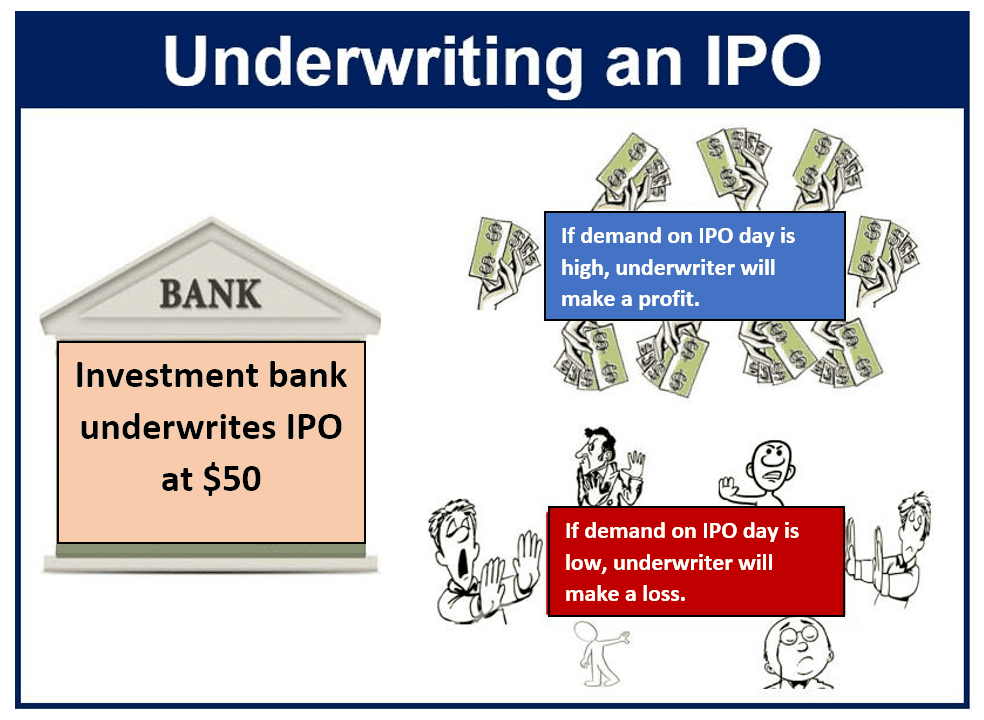

It is also a term used in investment banking to describe the process in which an underwriter (in exchange for a fee) guarantees a specific price for a certain number of securities to the entity issuing the security.

In this context, the issuer is provided with security that a certain minimum will be raised from the issue, while the underwriter bears the risk.

The term traces back to the Lloyd’s of London insurance market. Specifically, when bankers would accept some of the risk on a given venture in exchange for a premium.

They would write their names on a slip that Lloyd’s created. The slip stated that they accept the risk.

Insurance underwriter

In the insurance industry, an underwriter is a professional who evaluates the risk of insuring a person or thing, e.g., a factory, car, house, etc.

The underwriter uses that data to set an insurance policy premium.

Insurance companies have underwriters who help price, for example:

- homeowners insurance,

- health insurance,

- life insurance,

- property/casualty insurance,

- travel insurance, and many other types of cover.

When calculating risk during the life of an insurance policy, underwriters use computer programs and actuarial (risk calculation) data.

The higher the estimated risks, the greater the premiums will be. For example, the life insurance premiums for a librarian will generally be considerably lower than for a Formula 1 professional racing driver or a bullfighter.

Underwriting in banking

Underwriting in banking is the comprehensive credit analysis that takes place before the granting of a loan. Lenders base their analysis on credit data.

For a consumer loan, underwriting includes checking the applicant’s employment history, financial statements, salary, credit history, etc. A mortgage, for example, is a consumer loan.

For a commercial loan, underwriting involves evaluating the company’s financial information, including its balance sheet and tangible net worth. It also involves evaluating the ratio of debt to worth (leverage) and available liquidity.

Forensic underwriting

This is an ‘after-the-fact’ process lenders use to determine what went wrong with a loan, typically a mortgage.

Forensic refers to the use of technical or scientific methods to determine why something happened.

Forensic underwriting refers to the borrower’s ability to work out a modified scenario with the current lien holder. We do not use it for refinancing or qualifying a candidate for a new loan.