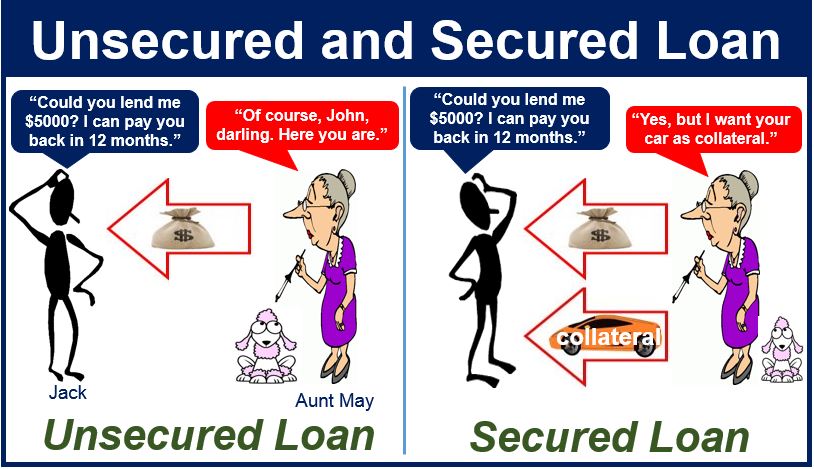

An unsecured loan, also known as unsecured debt, is a loan where the borrower agrees to make regular payments to the lender until the debt is paid in full, but no assets such as a house or car have been pledged as security (collateral). This type of loan has no second person acting as a guarantor (a person who guarantees the loan).

If borrowers do not make the payments, i.e. if they default, unless they come to some arrangement with the lender, it will have to go to court to try and get its money back, which may include applying for a charging order on the borrower’s home.

As an unsecured loan is riskier because there is no collateral tied to it, the interest rates tend to be higher compared to a secured loan, and the amounts lent are usually smaller.

Creditworthiness

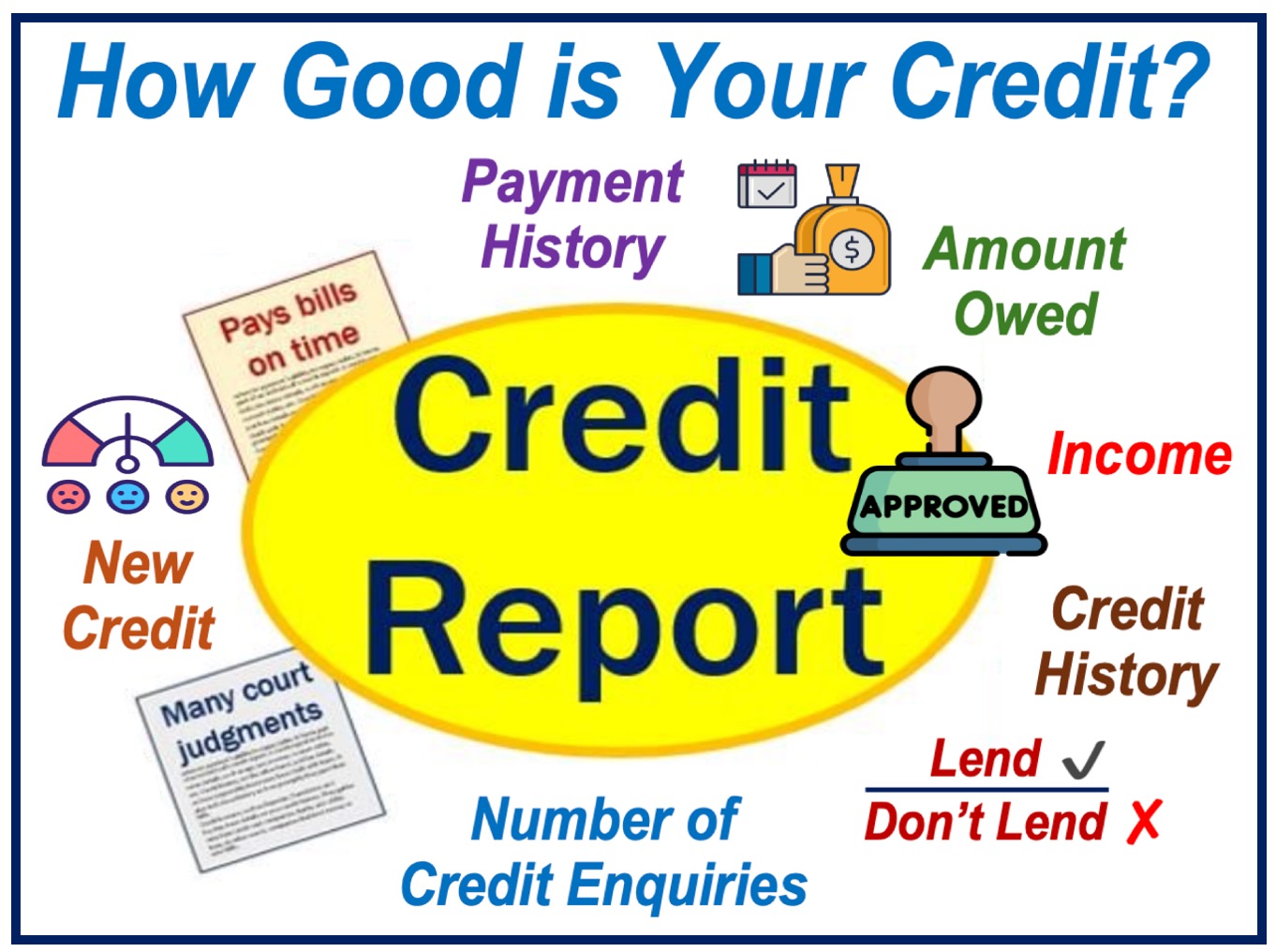

To grant an unsecured loan, all the lender can do to minimize the risk is carefully check the borrower’s creditworthiness. To be approved the borrower must have a high credit rating.

An unsecured loan may be a good option for people with a high credit rating who have no assets or not enough equity in their homes.

If you are already making payments for a secured loan, your only option may be an unsecured loan. Secured lenders often include language in their loan agreement that prevents the borrower from assuming additional secured loans or pledging any assets to creditors.

The vast majority of credit card loans are unsecured, unless the holder has a poor credit rating and has to deposit money as collateral into his or her account beforehand.

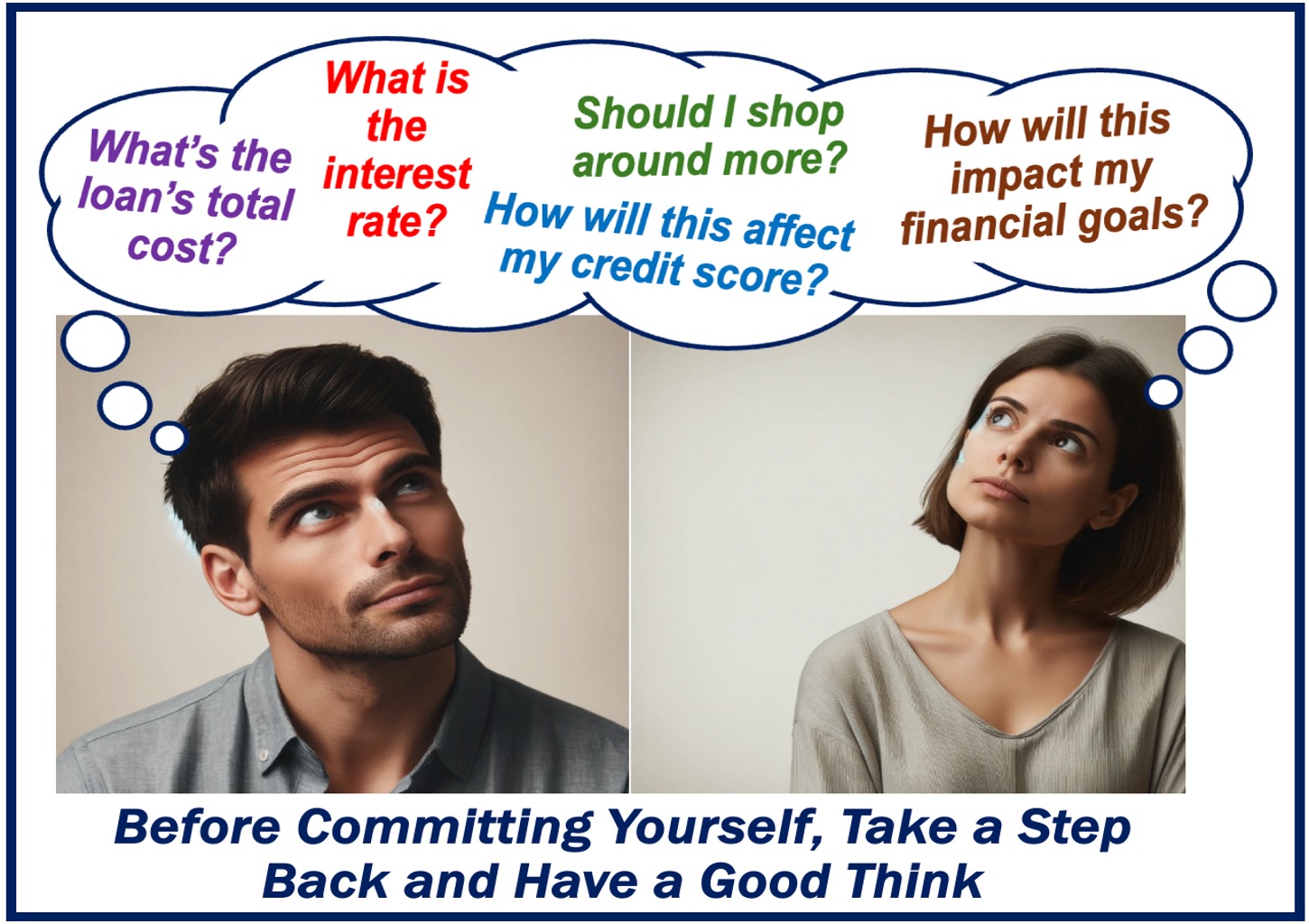

Things to consider when seeking an unsecured loan

- if your credit rating is poor, it will be harder to get approval from a lender for an unsecured loan.

- The lender may offer a smaller maximum loan amount compared to what might be offered for a secured loan.

- If you fall behind on payments your crediting rating could be affected. You would will probably have to pay late payment charges.

- Unsecured loans are more expensive than secured loans.

Why choose an unsecured loan?

People will seek an unsecured loan for smaller, short-term expenses, such as a funeral, wedding or medical treatment.

In the vast majority of cases, the borrower plans to pay the debt back within about one or two years.

Some people may seek an unsecured loan because of their simplicity, compared to a secured loan. They will not have to go through the hassle of transferring property titles and establishing a collateral relationship.

Most loans between family members and friends tend to be unsecured. This type of borrowing is usually informal, and typically involves no signing of documents – the lender and borrower come to a verbal agreement about how the debt will be repaid.

Video – What is an Unsecured Loan?

This video, from our sister YouTube Channel – Marketing Business Network – explains what an “Unsecured Loan” is using easy-to-understand language and examples: