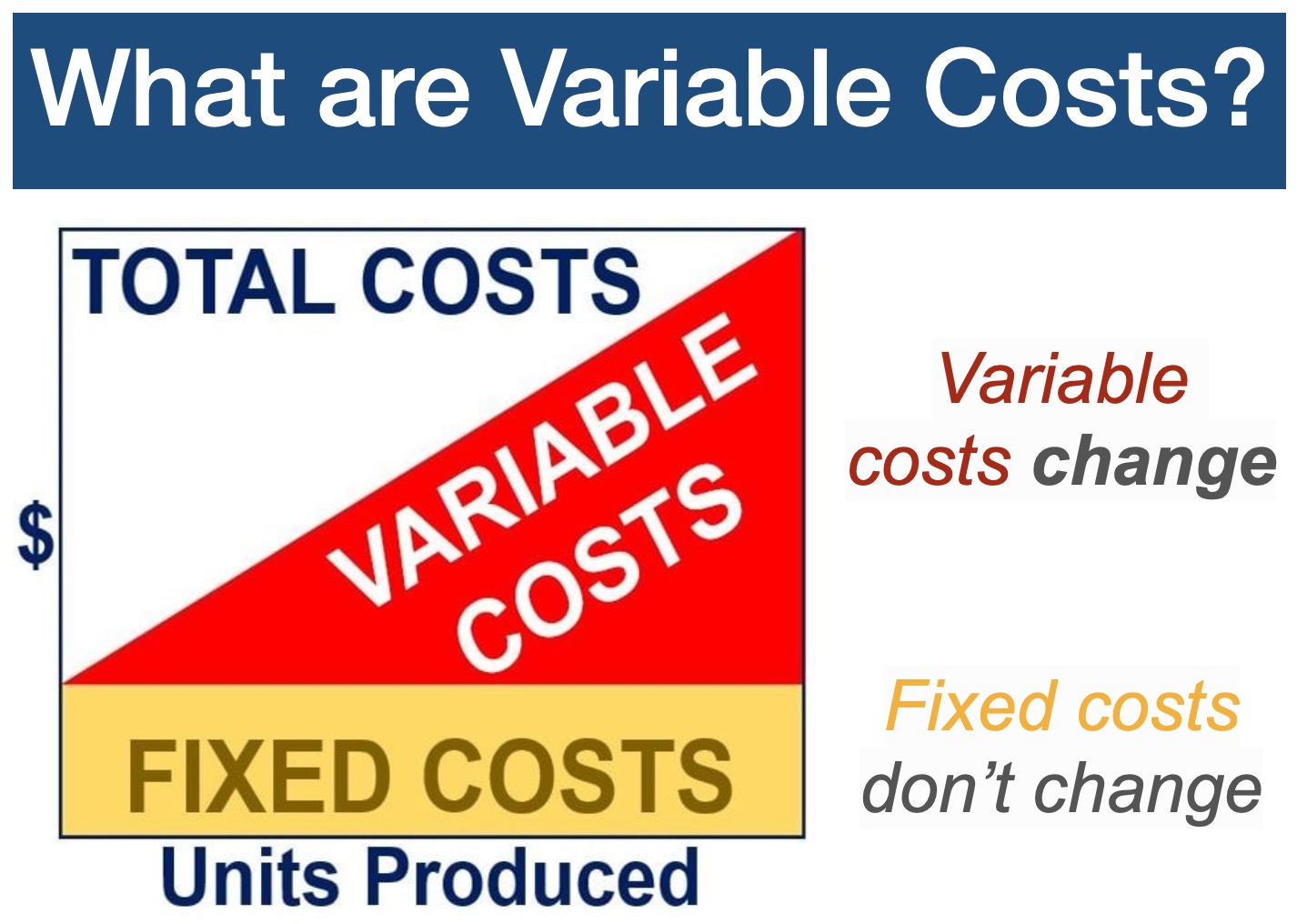

Variable costs are costs that vary in direct proportion to production volume.

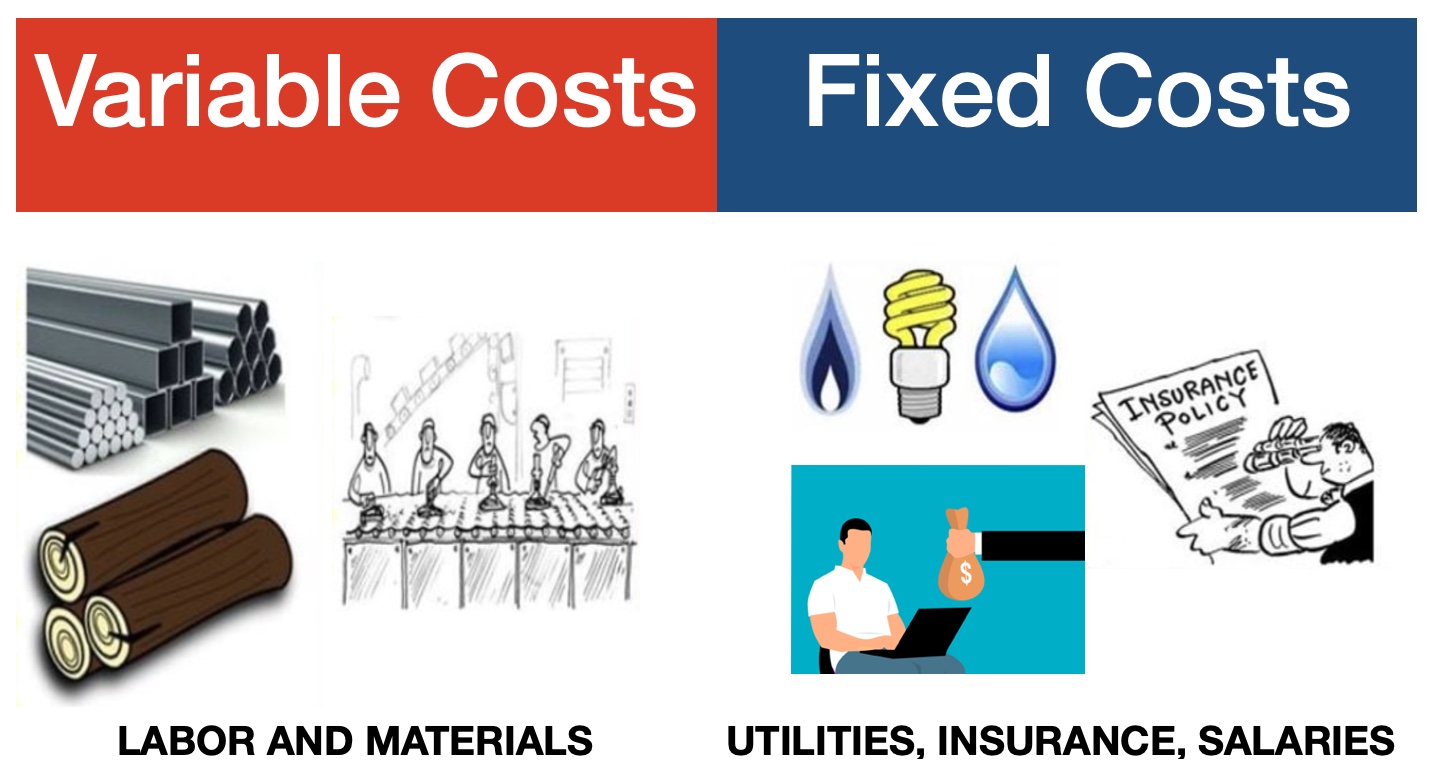

Variable costs, along with fixed costs, make up the total cost of production. These types of costs include the costs that can change, such as labor and materials. Labor and materials costs can go up or down according to the volume of production.

Put simply, variable costs rise as the production output level rises and fall as production decreases.

Variable cost vs. costing

The term ‘variable cost’ should not be confused with ‘variable costing.’ Variable costing is an accounting method we use when reporting variable costs.

Fixed costs rarely change on a month-to-month or quarter-to-quarter bases, while variable costs do. Examples of fixed costs include rent, insurance premiums, machine depreciation, and office supplies.

-

Examples

Examples of variable costs include:

- Direct Materials: when production rises, we purchase more raw materials.

- Commissions: sales representative do not sell the same amount each month. If they receive performance-related commissions, this cost will change from month-to-month.

- Labor Costs: billable labor costs are charged to expense when the associated sales transactions are completed, says accountingtools.com.

Piece-rate labor – employers pay their workers according to the number of units they produce – is also a cost that varies depending on production levels.

If we don’t add or subtract labor costs from the production process as activity levels change, then it might not be a variable cost. This may occur when we must have staff on the production line, regardless of production volumes.

Businesses with a high proportion of variable costs can generally generate a profit with relatively low sales levels. They can do this because their fixed costs are not high.

Precise management of variable costs can empower a company to optimize pricing strategies and enhance competitive positioning in the market.

Variable costs – example

Imagine John Doe Inc. has received an order for 5,000 door-handles for a total sales price of $10,000. It wants to find out what the gross profit will be when it has completed and delivered the order. Also, when the client has paid.

First, the company must determine the variable costs per door-handle.

Let’s assume that:

- It produces 100,000 door handles per year

- Material costs total $10,000

- Direct labor costs are $50,000

Therefore, each door handle costs $10,000 (material) ÷ 100,000 (units) = $0.10 or ten cents in raw materials, and $50,000 (labor) ÷ 100,000 (units) = $0.50 or fifty cents in direct labor costs.

By using this formula, it is possible to work out what John Doe’s total variable cost for this order is:

5,000 units x ($0.10 material cost per unit + $0.50 labor cost per unit) = $3,000

Therefore, the gross profit from this order should be $5000 minus $3,000 = $2,000.

Flexible budget

A flexible budget, as opposed to a static budget, reflects the changing costs that a company experiences. We can also use the term for departments.

Put simply; flexible budgets reflect a company’s or department’s fluctuating costs.

Businesses with high variable costs

Here are seven types of businesses with relatively high variable costs:

-

Restaurants

Costs for ingredients vary with daily customer count, requiring regular adjustment to food purchases.

-

Retail Clothing Stores

Inventory costs change with seasonal trends and demand, necessitating frequent stock updates.

-

Freight and Logistics

Fuel and maintenance expenses fluctuate with shipment volume.

-

Event Planning

Costs for venue, talent, and equipment hire change with each event’s scale.

-

Agricultural Businesses

Seed, fertilizer, and labor costs vary each season and are impacted by unpredictable yields.

-

Construction Companies

Material, labor, and machinery costs differ greatly across individual projects.

-

Manufacturing Businesses

Raw material and production costs are subject to market price changes and production volume.

Businesses with low variable costs

Here are 7 types of businesses with relatively low variable costs:

-

Software Companies (post development)

Marginal costs for distributing software are minimal after development.

-

Utility Companies

Infrastructure costs are fixed, making the cost to serve additional customers low.

-

Car Parks with Automatic Payment Systems

Once the initial setup is done, costs for each additional car are very low, primarily involving maintenance and occasional repairs.

-

Digital Content Providers

Additional subscribers can access content with minimal cost increase.

-

E-book Publishing

Costs remain low after initial production, as selling extra copies costs virtually nothing.

-

Subscription Software (SaaS)

Additional users represent a very low cost following platform establishment.

-

Automated Online Services

Systems scale to support more users at a negligible additional cost.

Two Educational Videos

These two interesting videos come from our sister channel on YouTube – Marketing Business Network. One explains what “Variable Costs” are, and the other is all about “Fixed Costs.” Both videos use easy-to-understand vocabulary and examples.

-

What are Variable Costs?

-

What are Fixed Costs?