What is a venture capitalist? Definition and examples

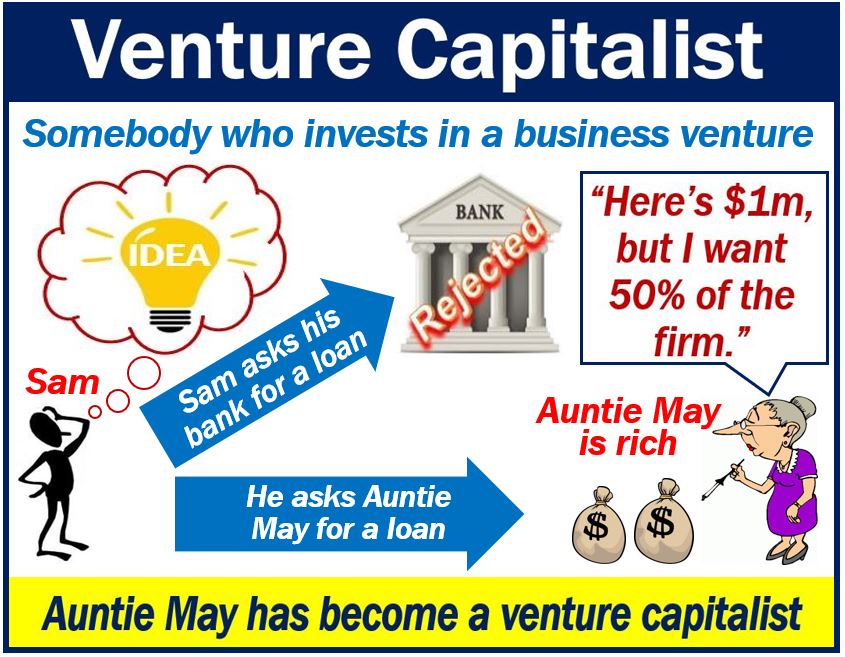

A Venture Capitalist is somebody who invests in a new business venture. They provide capital either for expansion or a startup business. Most of them work for venture capital firms and, therefore, do not invest with their own money, but the firm’s money. The term may also refer to a company that invests in new business ventures.

Angel investors are venture capitalists who use their own, personal money or assets. Angel investors typically invest in exchange for part-ownership of a startup or convertible debt.

We refer to the money that venture capitalists invest as ‘venture capital‘ or ‘VC.’ VC is a type of private equity. Private equity refers to shares and debts of a private company, i.e., a company that is not listed on a stock exchange.

Venture capital not only injects financial resources into a startup but also often brings strategic guidance and networking opportunities that are crucial for innovation and scaling.

Cambridge Dictionary defines a venture capitalist as “a person or financial organization that invests in new businesses, especially ones that involve risk.”

Google Inc is a venture capitalist

The term does not only refer to people but also companies. Google Inc, for example, is a major venture capitalist. Its division, Google Ventures, focuses on venture capital.

Google Ventures also has a large European arm, which the company set up with an initial investment of $100 million. Europe, Google says, is teeming with good ideas and it would like to get in there to support interesting startups.

Many scientists and people with good ideas prefer to approach a venture capitalist than to work in a large company. If their idea becomes commercially viable, they make much more money if they had set up a startup.

What does a venture capitalist seek?

Venture capitalists might see hundreds of business plans and ideas each year. However, they end up choosing just a few of them.

They seek great people with expertise. They also look out for ventures that may bring an ‘unfair advantage.’ A business with an unfair advantage is more likely to outperform other companies.

A typical venture capitalist wants a higher rate of return than other investments, such as for example, the stock market.

Venture capitalists typically have an exit strategy, aiming to realize a return on investment through mechanisms like IPOs, mergers, or acquisitions within a few years.

They invest in promising startups or young companies that have a high potential for growth. However, they are also relatively high-risk investments.

Popular targets for venture capitalists today are IT and biopharmaceutical companies. Clean technologies and semiconductors are also popular sectors.

Video – What is a Venture Capitalist?

This video, from Marketing Business Network, our sister channel on YouTube, explains what a ‘Venture Capitalist’ is using easy-to-understand language and examples.