In finance volatility is a measurement of the fluctuations of the price of a security.

It is essentially an analysis of the changes in the value of a security. It is one of the most key measures in quantifying risk.

A measurement of historic volatility looks at a security’s past market prices. Implied volatility is determined using the price of a market traded derivative.

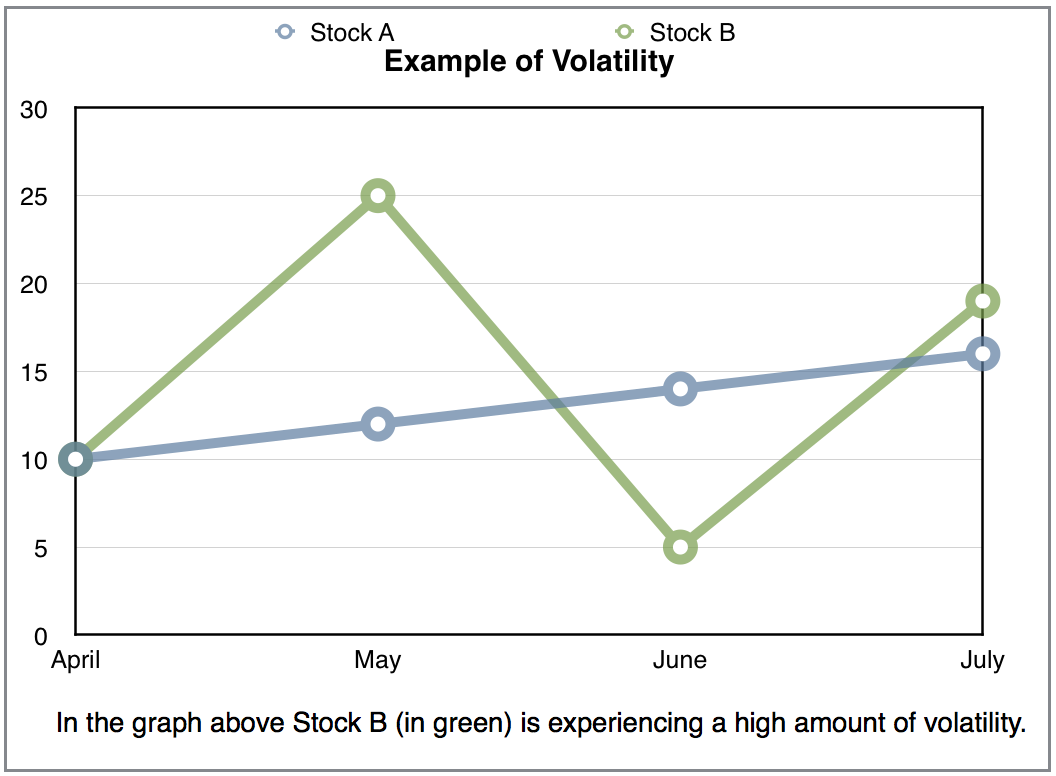

A security with high volatility means that its price can fluctuate considerably over a very short period (either up or down). In contrast, a low volatility means that the price of a security will not change dramatically in short periods of time.

In business and finance, the term ‘volatility’ can also refer to fluctuations in interest rates, the value of a currency, market confidence, etc.

According to nasdaq.com, volatility is:

“A measure of risk based on the standard deviation of the asset return. Volatility is a variable that appears in option pricing formulas, where it denotes the volatility of the underlying asset return from now to the expiration of the option. There are volatility indexes. Such as a scale of 1-9; a higher rating means higher risk.”

How is volatility calculated?

It is the standard deviation from a specific continual compounded return over a certain period, or it is calculated as the difference between returns from the same financial instrument.

A common method of calculating the relative volatility of a security to the market is its beta. A beta determines the volatility of a security’s returns against the returns of a benchmark (typically an index such as the the S&P 500).

For example, if there is a stock with a beta of 1.2, this means that it has historically shifted 120% for every 100% change in the benchmark. Similarly, a stock with a beta of .6 has historically shifted 60% for every 100% change in the underlying index.

The volatility of a financial instrument can be determined by a number of different ways, and there are different types that investors commonly analyze.

Over a period of one year, Company A’s shares were considerably more volatile than Company B’s.

Over a period of one year, Company A’s shares were considerably more volatile than Company B’s.

The five main types are:

- actual historical volatility – measured over a specific period of time with the last observation date being in the past.

- actual future volatility – measured over a period beginning in the present and typically ending at the expiration date of the security.

- historical implied volatility – uses the security’s historical prices.

- current implied volatility – uses a security’s current prices.

- future implied volatility – uses the future prices of the security.

Many experts say that today, with the explosion in information technology, volatility has become the norm. Former New York Times reporter and author of several books, once said:

“Volatility may be rising simply because investors must digest more information every day.”

Christine Lagarde, Managing Director of the International Monetary Fund said “Markets love volatility.”

Non financial or non-business meanings

Science – evaporating rapidly, as in “acetone is a volatile solvent.” A group of compounds with low boiling points.

Sociology – threatening to turn into a violent or explosive situation, as in “the volatile political situation in Syria has everybody worried.”

Psychology – moody, changeable, or flighty, as in “be careful what you say to John, he has a volatile disposition.”

It can also mean transient or fleeting, as in “volatile beauty.”

Video – Volatility