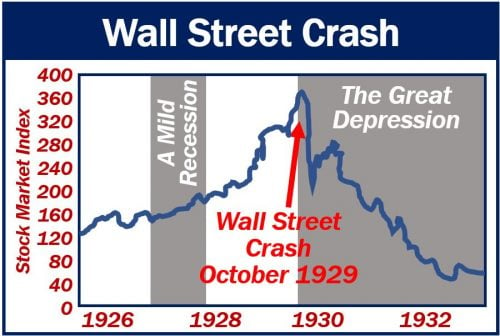

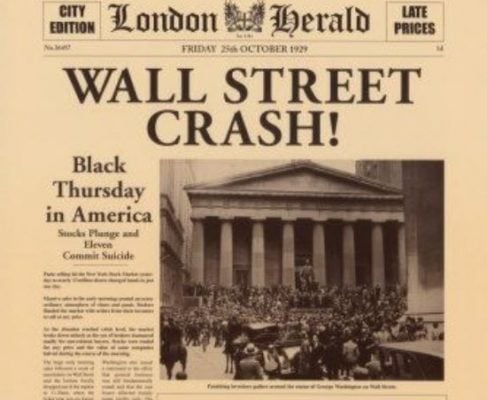

The Wall Street Crash was the most severe stock market crash in American history. It occurred in late October 1929. People also refer to it as Black Tuesday, the Great Crash, or the Crash of ’29. There was also a Black Thursday and a Black Monday. The Wall Street Crash preceded the Great Depression, which lasted well into the late 1930s. It was not until 1954 that stock market prices reached their pre-Crash levels.

Some financial experts had warned that the American economy was losing steam. In September 1929, investors began selling shares in large numbers. Other investors became nervous and soon there was a panic. More and more people rushed to sell their shares.

On Thursday, October 24th, 1929, investors sold 12.8 million shares. On Tuesday, October 29th, sixteen million shares were sold at significantly low prices. New York’s Stock Market collapsed in what we call today the Wall Street Crash.

We refer to the 24th and 29th of October as Black Thursday and Black Tuesday. Some selling also occurred on Monday, October 28th; hence, the term Black Monday also exists.

Wall Street Crash – Great Depression

Thousands of investors lost their money in the Wall Street Crash. From one week to the next they lost everything and could not pay their debts.

Banks closed down all over the country, and ordinary Americans lost all their savings. Consumer spending dried up.

When consumers stopped spending companies sold less, so they had to lay off workers or close down. Subsequently, unemployment rose rapidly. The Great Depression had begun.

The Great Depression

It was America’s most severe economic downturn in modern history. The Great Depression also affected dozens of countries around the world.

In the US, the Great Depression lasted a decade – from 1929 to 1939. In other words, from the Wall Street Crash to the beginning of World War II when Britain and France declared war on Germany.

By 1933, half of America’s banks had shut down and unemployment had reached 15 million.

The Great Depression was much more severe than the Great Recession of 2007/9 to 2009/10.

During the Great Depression, global GDP shrank by 15%. Global GDP during the Great Recession, on the other hand, declined by just 1%. GDP stands for gross domestic product.

Causes of the Wall Street Crash

The Wall Street Crash occurred for many reasons. The rise of American consumerism during the roaring ’20s led to the overproduction of goods. People acquired many of these goods with borrowed money. There were many easy credit schemes.

There was lots of borrowing in the 1920s because the authorities kept interest rates too low. Economists refer to the easy access to credit as ‘loose money.’

During the months and years leading up to the Wall Street Crash, there had been an unsustainable boom in the prices of stocks. In this context, the word ‘stocks‘ means the same as ‘shares.’ Hence the terms ‘stocks and shares’ and ‘stock market.’

Encouraged by the apparent strength of the American economy and easy access to credit, many consumers borrowed to buy shares. Also, companies took out huge loans for expansion.

As their indebtedness grew, consumers and businesses also became more susceptible to changes in confidence.

Regarding that susceptibility, Economics Help states:

“When that change of confidence came in 1929, those who had borrowed were particularly exposed and joined the rush to sell shares and try and redeem their debts.”

Wall Street Crash – investment bubble

The Wall Street Crash was not the first investment bubble ever to occur. There had been many before. There have also been a few since. More recently, we witnessed the ‘dot.com bubble‘ at the end of the last century.

The New York Times made the following comment about the Wall Street Crash:

“It came with a speed and ferocity that left men dazed. The bottom, simply fell out of the market….. The streets were crammed with a mixed crowd — agonized little speculators,… sold-out traders,… inquisitive individuals and tourists seeking … a closer view of the national catastrophe….. Where was it going to end?”

Some people predicted that something like the Wall Street Crash would happen soon. In a Guardian article, Larry Elliott quotes Roger Babson, an investment adviser, who one month before the crash said:

“Factories will shut down. Men will be thrown out of work. The vicious cycle will get in, and the result will be a serious business depression.”

F Scott Fitzgerald (1896-1940) said that the Wall Street Crash was the moment when the “jazz age dived to its death.” Fitzgerald was an American fiction writer whose works illustrate the Jazz Age.