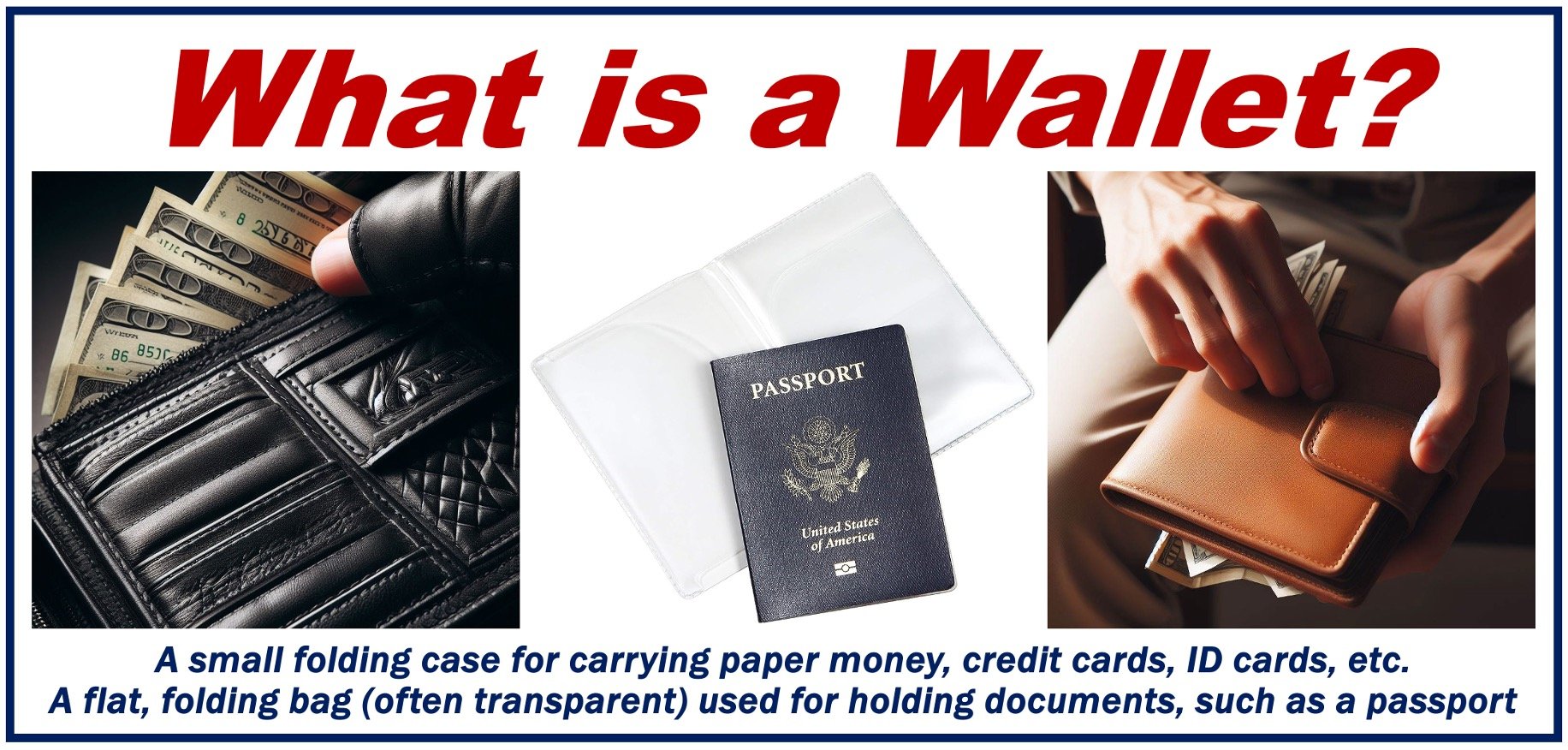

A Wallet is a small, flat case in which we keep money (banknotes), small documents, bank cards, loyalty cards, our driver’s license, and possibly some kind of photo ID.

They are typically made of fabric or leather, are pocket-sized, and usually (not always) foldable.

Traditional wallets have evolved in design over the years, ranging from simple cardholders to complex organizers with multiple compartments for cash, cards, and other essentials, reflecting changes in fashion and consumer needs.

Etymology of ‘wallet’

Etymology is the study of the origins of words and how they evolved over time.

According to the Online *Etymology Dictionary, the word ‘wallet’ first appeared in the English language in the late fourteenth century, with the meaning ‘bag, knapsack’.

Nobody is sure where that word came from – perhaps from an unrecorded Old North French Walet, meaning ‘knapsack, roll’.

With its modern meaning – ‘a flat case for carrying paper money’ – the word ‘wallet’ is believed to have emerged in American English in 1834.

Wallet for online transactions

Over the past couple of decades – since the emergence of the Internet and online shopping – the term has taken on a new meaning. Wallets, in the world of IT (information technology), are small software programs that are used for shopping online and other online transactions.

Online wallets are commonly referred to as E-Wallets.

An e-wallet is a web service or program that allows you to store and control your online shopping. It contains data such as passwords, logins, shipping address, billing address, and credit/debit card details – all in one central place. It provides a convenient and quick method for people to buy products from virtually any individual or business across the world. (Image: adapted from e2logy.com/blog)

An e-wallet is a web service or program that allows you to store and control your online shopping. It contains data such as passwords, logins, shipping address, billing address, and credit/debit card details – all in one central place. It provides a convenient and quick method for people to buy products from virtually any individual or business across the world. (Image: adapted from e2logy.com/blog)

-

Various payment forms

E-wallets today are typically integrated into e-commerce platforms and applications (apps), which simplifies the payment process at checkout. They support various payment forms, including bank transfers, loyalty points, and even cryptocurrencies.

-

Biometric verification

Many of them require biometric verification such as facial or voice recognition, or fingerprint or iris scanning for transaction authorization.

-

Used both online and offline

E-wallets are accepted for both online and in-store purchases. They are also used for peer-to-peer transfers and bill payments. The term ‘peer-to-peer transfers’ refers to electronic money transfers between individuals.

World’s major e-wallets

Usage of e-wallets is spreading rapidly across the world. Here are the 12 most widely used ones:

-

Apple Pay

Exclusive to Apple devices, facilitates contactless payments using NFC technology.

-

Cash App

Enables peer-to-peer money transfers and bill payments. It also allows investments in stocks and bitcoin.

-

Dwolla

A US-focused service offering low-fee bank transfers with a focus on security and automation.

-

Google Pay (formerly Android Pay)

An Android app that stores cards for contactless payments.

-

PayPal

Globally recognized for digital payments and money transfers.

-

Samsung Wallet

Combines Samsung Pay and Samsung Pass for managing digital keys, boarding passes, loyalty cards, passwords, and more.

-

Venmo

Owned by PayPal, offers social, easy-to-use mobile payments and purchases.

-

Zelle

Fast and secure money transfers between U.S. bank accounts.

-

Walmart Pay

Uses QR codes for payments, compatible with all smartphones.

-

Amazon Pay

Integrates with websites for secure purchases using Amazon accounts.

-

Alipay

Operated by Alibaba’s Ant Group, it’s one of the largest digital payment platforms in China.

-

WeChat Pay

Integrated into WeChat, China’s largest social media platform, widely used for various transactions.

3 Videos

These 3 interesting videos, from our YouTube partner channel – Marketing Business Network – explain what the terms ‘Wallet,’ ‘e-Wallet’, and ‘Digital Wallet’ mean, using simple and easy-to-understand language and examples.

-

What is a Wallet?

-

What is an e-Wallet?

-

What is a Digital Wallet?