The word warrant has several different meanings. In the world of markets and finance, it is a long-term security that entitles the holder to purchase the shares of the issuing company at an exercise price – a fixed price – until the expiry date.

In legal English, a search warrant is a writ (authorization) issued by a court to search a premises and seize specified items if they are found there. An arrest warrant authorizes the arrest or detention of a person or people.

A warrant might be an instrument (document) that authorizes somebody or some entity to do something that is otherwise illegal.

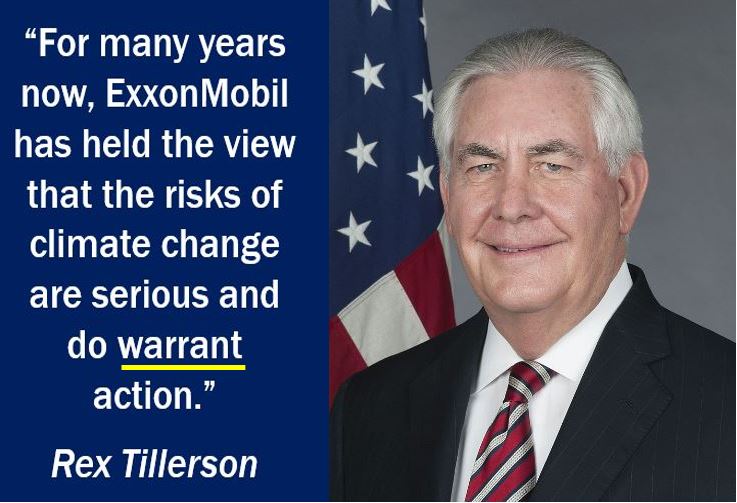

In philosophy, a warrant is a proper justification for holding a belief, as in: “There is no warrant for this assumption.”

In military English, a warrant is a certificate of appointment that is issued to a non-commissioned officer.

This article focuses on the financial meaning of the word.

Warrant in finance

In the world of finance, warrants are securities that entitle their holders to purchase a commercial entity’s stock at a specific price (exercise price) up to a certain date.

Warrants are similar to options – the two are contractual financial documents that allow the holder special rights to purchase securities. They both have expiry dates and are discretionary.

The term ‘warrant’ means to ‘endow with the right’, which is only marginally different from what ‘option’ means.

Warrants are commonly attached to preferred stock or bonds as a sweetener, allowing the issuer to pay smaller dividends and lower interest rates. Warrants may be used to enhance a bond’s yield and make it more enticing for potential purchasers.

Warrants may also be found in private equity deals. They are usually detachable and can be sold independently of a stock or bond.

When warrants are attached to preferred stocks, shareholders may have to detach and sell them before receiving dividend payments. That is why it is often advantageous to detach and sell a warrant as soon as you can so that you can start earning dividends.

In the Hong Kong Stock Exchange and Deutsche Börse (German Stock Exchange), warrants are actively exchanged. Approximately 11.7% of turnover in the first quarter of 2009 in the Hong Kong Stock Exchange consisted of warrant trading.

Warrant types in finance

There are many different types in finance. People purchase and sell them for variety of reasons. Below is a list of some types of warrants:

– Callable Warrants: this type of warrant offers investors the right to purchase a firm’s shares from that firm at a specific price up to a future date.

– Puttable Warrants: investors have the right to sell a company’s shares back to that company by a certain date and at a specific price.

– Equity Warrants: these may be call and put warrants.

– Covered Warrants: this warrant has some underlying backing. Perhaps, for example, the issuer will buy the stock beforehand or will use another instrument to cover an option.

– Index Warrants: an index is used as the underlying asset. The investor’s risk is dispersed – using index put and index call warrants – as occurs with regular equity indexes.

– Naked Warrants: these have no accompanying bond when they are issued, and like conventional warrants, they are traded on the stock exchange.

– Cash or Share Warrants: the settlement may be either through the physical delivery of the shares or in cash.

– Basket Warrants: these can be classified at an industry level, as is the case with a regular equity index. They mirror the performance of each industry.

– Wedding Warrants these are attached to the host debentures, and may only be exercised when the host debentures are surrendered.

– Detachable Warrants: the security’s warrant portion can be detached from the debenture and sold or bought separately.