Wave damage insurance is insurance against the damage done by the action of waves and the tide to the insured property, as opposed to damage done by just the wind.

Policies covering wind damage generally exclude wave damage.

The policyholder needs to take out a wave damage insurance policy, or attach a clause to a policy, if he or she wants to include protection against the waves and tides.

According to California State University’s Insurance Dictionary, wave damage insurance is:

“Coverage against damage to property resulting from high waves or tides.”

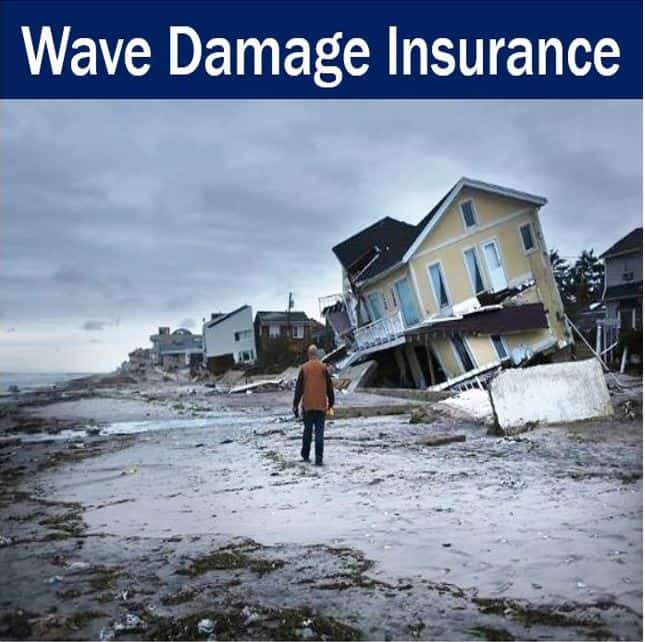

If your home is close to the sea, check your property insurance policy carefully. Many underwriters do not offer wave damage insurance. (Image: adapted from wnyc.org)

If your home is close to the sea, check your property insurance policy carefully. Many underwriters do not offer wave damage insurance. (Image: adapted from wnyc.org)

Why isn’t wave damage insurance included automatically?

In an article written by actuary Laurence H. Longley-Cook in 1962 – Actuarial Aspects of Industry Problems – he talked about the demand for wave damage insurance and the problems associated with offering such coverage routinely in insurance policies.

Some people had suggested that flood and wave damage coverage ought to be provided by means of an assigned risk plan or other compulsory machinery.

“However, such a plan would encourage the construction of dwellings and other buildings in areas where their frequent destruction by the elements would be a waste of the national wealth and would not be in the overall public interest,” Longley-Cook wrote.

Longley-Cook believed that a solution might lie in widening extended coverage to include a greater number of hazards that are currently difficult to insure.

Sea vessels are especially vulnerable to wave damage. (Images: Left – uk.pinterest.com. Right – marinebusiness.com.au)

Sea vessels are especially vulnerable to wave damage. (Images: Left – uk.pinterest.com. Right – marinebusiness.com.au)

Chad Edmonds, General Manager of the Sanibel Harbour Yacht Club in Fort Myers, Florida, wrote that marina insurance will generally cover most perils. However, he warns that many underwriters may not provide flood or wave damage insurance.

“Insurance coverage for damage associated with high winds and flooding may be only partially incorporated within flood insurance,” Edmonds wrote.

If you own a yacht, or any kind of vessel, check whether your insurance policy provides coverage against wave or tidal damage. If you are not sure what the policy specifies, check with a reputable insurance broker.