West Texas Intermediate (WTI) is a trading classification of crude oil and one of the most commonly used benchmarks in oil prices.

WTI is one of the most referenced benchmarks used in oil news reports on oil prices, along with the Brent price – which comes from the North Sea.

The oil is considered to be very light, with a low sulfur content – considerably lighter and sweeter than Brent Crude, Dubai, or Oman.

WTI only contains 0.24% sulfur and has an API gravity of approximately 39.6. The oil is primarily refined in the Gulf Coast and Midwest areas of the United States.

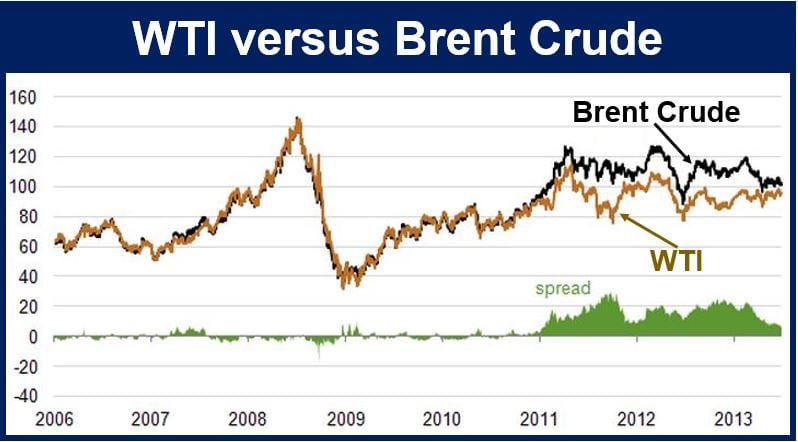

At the end of 2010 the price difference between the two benchmarks widened, and then narrowed at the end of 2013.

At the end of 2010 the price difference between the two benchmarks widened, and then narrowed at the end of 2013.

WTI is the underlying commodity of Chicago Mercantile Exchange’s oil futures contracts (legally binding agreements to buy/sell a commodity at a specific month at a pre-determined price).

The Nasdaq Business Glossary defines West Texas Intermediate as follows:

“A popular benchmark oil price. WTI is the underlying asset in the New York Mercantile Exchange’s oil futures contract.”

The main trading hub for crude oil is located in Cushing, Oklahoma, and has been the delivery point for crude contracts and is the price settlement point for West Texas Intermediate on the New York Mercantile Exchange.

Light Sweet Crude Oil futures and options, in particular West Texas Intermediate futures, are the most actively traded energy product in the world.

West Texas Intermediate plays an important role in managing risk in the energy sector worldwide as it has high liquidity, a large number of customers, and a lot of transparency.

Prices – WTI versus Brent Crude

If you compare WTI and Brent back in 2008/9, many producers (including OPEC) said they would take Brent as a global proxy benchmark. At that time, Brent’s popularity soared, partly because the disconnect between the US and global markets was slowly materializing as more shale oil and tight oil came onto the scene in North America.

From 2008/9 onwards, the disconnect between WTI and Brent started getting wider and wider, starting off at $5, then $10 and later $15. A couple of years ago Brent crude was selling at a premium of nearly $25 to light crude.

If you look at the disconnect between the two benchmarks now, and it has narrowed to about $3 – the market has levelled out. The disconnect became very stark at one point – when the US had a domestic glut – now that there is a global glut, there is a convergence of the two benchmarks.