What is face value? Definition and meaning

The term face value represents the value of a tradable asset that is stated by the institution that issues it, i.e. its value when it was issued. In the context of coins, stamps or paper money, it refers to their true value (nominal value).

Sometimes the face value is just symbolic and is completely different from what people will pay. For example, a one troy once American Gold Eagle bullion coin, with a face value of $50, was worth and sold for $1,200 in November 2009.

In finance, face value is a term that is frequently used to represent what a financial instrument or security is worth or used as a means of determining interest payments.

The face value of a bond is the price at which it was issued.

The face value of a bond is the price at which it was issued.

According to ft.com/lexicon, face value is:

“The value on the face of a certificate conferring possession of a bond, note or other instrument, and in the case of a debt instrument, the amount to be redeemed at maturity. Also called nominal value or par value.”

Face value – stocks

The face value of a stock is the original cost of the stock that is shown on the certificate. Dividends of preferred stock are often expressed as a percentage of its face value. In this context the term is also known as ‘par value’.

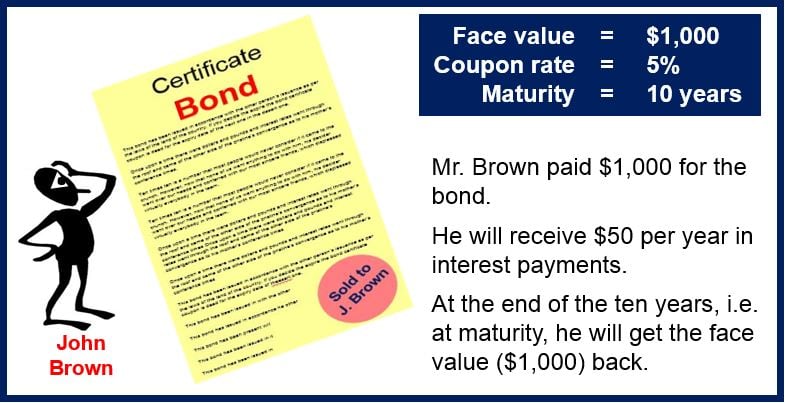

Face value, coupon rate & maturity of bonds

The face value of a bond is the price at which it is issued. This is the amount the bond issuer owes the investor at the time of maturity.

Most bonds make periodic interest payments to the investor. The coupon rate is the rate of interest offered by the company issuing the bond. This is calculated as a percentage of the bond’s face value.

The maturity of the bond refers to the date when the bond issuer repays the investor the principal amount – it is the end of the bond’s life; periodic interest payments stop at maturity.

In the case of bonds the face value is the same as the principal or redemption value. However, despite the face value remaining constant, the actual value of a bond may change because of factors such as fluctuations in interest rate and the risk of default.

If interest rates change to a value above a bond’s coupon rate then it is sold at a discount (below par). In a similar manner, if interest rates fall below the bond’s coupon rate then it is sold at a premium (above par).

In this context the term is also known as ‘maturity value’.

In a life insurance policy, the face value is the death benefit. In so-called ‘double-indemnity’ life insurance policies, the beneficiary gets double the face value if the death was accidental.

In a non-financial context, ‘face value’ means the apparent merits of an idea, before it has been put to the test – a bit like a ‘first impression’.