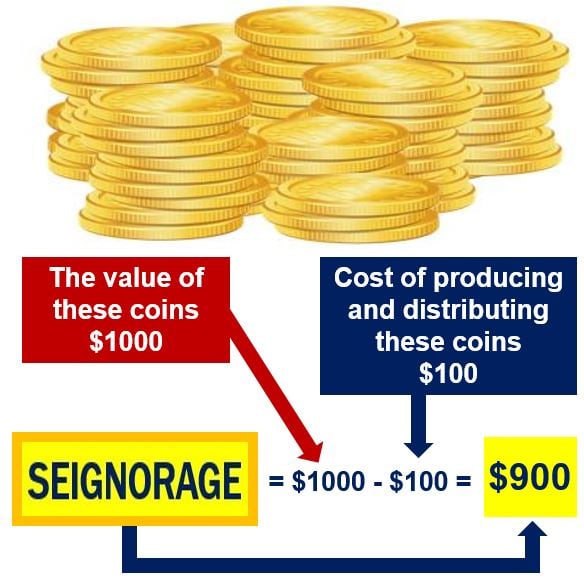

Seigniorage is the difference between the cost of producing and distributing paper, metal and electronic money, and its value.

Traditionally, seigniorage referred to the profit that rulers made from permitting metals to be converted into coins. Today, it may also refer to the power of a nation whose banknotes and coins are held as a reserve currency by other countries.

The term ‘seigniorage’ comes from the Old French word ‘Seigneuriage’, meaning ‘right of the lord (seigneur) to mint money’. The word can also be spelled ‘seignorage’ or ‘seigneurage’.

Today, the term has two main meanings:

– A tax that is added to the total price of a coin – production and metal costs – that a client has to pay the mint, and that was sent to the sovereign of the political area. A mint is an industrial facility that manufactures coins that are used in an economy’s currency.

– The difference between the interest earned on a security acquired in exchange for bank notes and the cost of making and distributing those notes.

Seigniorage – government revenue

Seigniorage is the revenue governments derive because the cost of minting coins or printing paper money is less than the market value of the money.

The basic idea behind seigniorage is that the government loses money if the cost of producing money in circulation is greater than its value, and makes money when its value exceeds its cost of production.

It is the value generated by the government by adding its stamp to an ordinary piece of metal or paper – plus all electronic bank entries today.

More often than not, seigniorage is a source of revenue rather than a loss-maker.

When the government earns revenue from seigniorage – when the money it creates is worth more than the cost of producing it – that income is used to finance some of its expenditure, i.e. the taxpayer’s bill is lower.

For example, if it costs the US government 5 cents to produce each paper dollar bill, the seigniorage is $0.95, i.e. $1 minus the $0.05 cost of producing it.

Sometimes the production of money can result in a loss rather than a gain for the government that is producing it. This is more common with the production of coins from metal.

Metals, such as silver, gold, copper or nickel, have their own inherent value, called the ‘melt value’.

A one-cent coin in the US – commonly known as a ‘penny’ – is made mostly of zinc. In 2014, the cost of making a 1 cent coin was 1.7 cents, because the melt value of zinc had risen.

Over time, the face value of many coins – especially silver or gold ones – may fall below their melt value.

Seigniorage and inflation

King Philip IV of France, in 1290, needed more money to finance his wars. So he started to debase the country’s currency by steeply raising the seigniorage he received from melting new coins.

The French currency – the franc – consequently devalued considerably. Hyperinflation ensued and virtually all silver and gold disappeared from his kingdom.

What Philip IV did was the equivalent of printing money today. If you increase the monetary base with less intrinsic value you get rising inflation. If there is more money about, but there is same amount of goods and services in the economy, the prices of those goods and services will rise to compensate.

Video – Child criticizes banks and seigniorage

In this video, a 12-year-old girl criticizes large banks and seigniorage.