The Consumer Confidence Index (CCI) is a widely regarded economic indicator that measures the degree of optimism or pessimism consumers feel about both the overall state of the economy and their personal financial situation.

By evaluating broader economic conditions alongside individual financial outlooks, the CCI offers valuable insights into consumer sentiment, which plays a critical role in shaping economic behavior.

It reflects consumer confidence in areas such as job security, income stability, and future financial prospects, offering a comprehensive picture of how individuals perceive the economy.

This information is essential for businesses, governments, economists, and policymakers to gauge future spending patterns and savings behavior, helping them anticipate economic trends.

As the OECD Library explains, the Consumer Confidence Index serves as an early indicator of how households might adjust their spending and saving habits. It gathers insights from people’s expectations about their personal financial situations, the overall economic climate, unemployment, and their ability to save, offering a glimpse into future consumer behavior.

What Does the Consumer Confidence Index Measure?

The CCI surveys consumers about several key economic factors that influence their confidence and spending behavior. Here are the key economic factors that are typically included:

Current Business Conditions

Consumers are asked how they perceive the present economic situation, specifically whether business conditions are good or poor.

Future Business Conditions

Consumers give their expectations on whether business conditions will improve, worsen, or remain the same in the next six months.

Current Employment Conditions

This measures how consumers feel about job availability and the state of the labor market—whether jobs are plentiful or hard to find.

Future Employment Conditions

Consumers share their outlook on job availability in the next six months, indicating if they expect employment conditions to improve or deteriorate.

Current Personal Financial Situation

Consumers assess their own financial health, considering factors such as income, savings, and whether they are better or worse off than a year ago.

Expected Personal Financial Situation

This evaluates consumers’ expectations regarding their personal finances over the next six months—whether they foresee an improvement, decline, or no change in their financial status.

Total Family Income for the Next Six Months

Respondents give their predictions on their household’s income level in the near future, which affects their spending and saving plans.

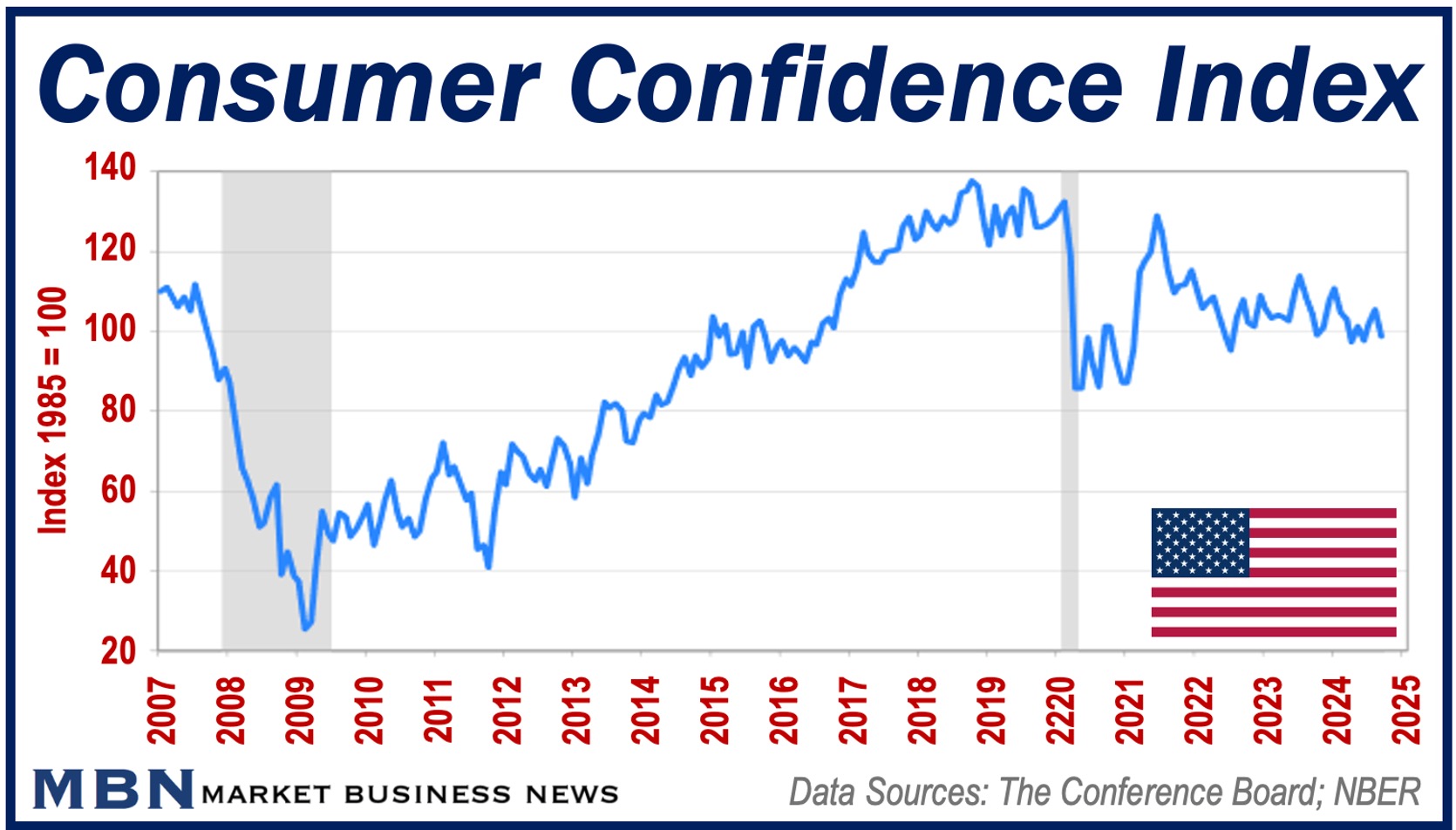

Once the data from these surveys is gathered, it is converted into an index, where a value of 100 represents the baseline set in 1985.

If the index is above 100, it indicates that consumers are more optimistic than they were in 1985, while an index below 100 signifies pessimism.

Why is the Consumer Confidence Index Important?

The significance of consumer confidence lies in its ability to predict economic activity.

High consumer confidence typically indicates that people feel secure about their financial future, leading to higher spending and, consequently, economic growth.

Conversely, low consumer confidence suggests that people are more likely to save rather than spend, potentially signaling a slowdown in economic activity.

Changes in consumer confidence can have a direct impact on major economic indicators such as retail sales, housing markets, and overall consumer spending.

For example, when consumer confidence is high, people are more likely to make large purchases such as homes, cars, or appliances. This increase in spending can boost the economy, leading to higher production, more jobs, and stronger growth.

On the other hand, when consumer confidence declines, it can have the opposite effect. People become more cautious about their spending, which can lead to reduced demand for goods and services.

This reduction in consumer spending can trigger a slowdown in production, layoffs, and even recessionary pressures.

The Role of the CCI in Economic Decision-Making

The CCI is closely monitored by a variety of stakeholders including manufacturers, investors, market analysts, central banks, retailers, financial institutions, government agencies, and economists.

Each of these groups uses the CCI to predict future economic activity, plan investment strategies, and adjust policies based on expected consumer spending and saving behaviors.

Here is how some sectors of the economy and government rely on CCI data:

Businesses

Manufacturers and retailers rely on CCI data to anticipate demand for their products. When the CCI indicates growing consumer confidence, businesses may increase production, expand inventories, and hire more workers.

Conversely, a drop in consumer confidence may prompt companies to reduce production, cut back on staff, and delay investments.

Banks

Financial institutions use CCI data to gauge consumer sentiment and its impact on borrowing and lending.

A higher index may suggest an increase in loan applications for mortgages, car loans, and credit cards, while a declining CCI may lead banks to tighten their lending criteria as demand for credit drops.

Government

Policymakers monitor the CCI to assess the overall economic mood and make decisions about fiscal and monetary policy.

A sustained drop in consumer confidence might prompt the government to introduce stimulus measures, such as tax cuts or increased public spending, to revive the economy.

Similarly, a rising CCI can lead to policies aimed at controlling inflation or managing economic growth.

Calculating the Consumer Confidence Index

In the United States, the Consumer Confidence Index is produced by The Conference Board, an independent economic research organization.

The index is based on monthly surveys conducted among 5,000 households, focusing on five key questions related to the current and expected future economic conditions:

- Appraisal of present business conditions.

- Appraisal of present employment conditions.

- Expectations for business conditions six months ahead.

- Expectations for employment conditions six months ahead.

- Expectations for total family income over the next six months.

Statisticians then aggregate the responses to these questions and calculate an index value.

The CCI is weighted to reflect both current economic conditions (40% of the index) and future expectations (60%).

The resulting figure provides a snapshot of consumer sentiment across the nation. A higher CCI reading suggests increased confidence, while a lower reading signals growing concern among consumers.

Global Usage of the CCI

United States

While the Consumer Confidence Index originated in the United States, many countries around the world have adopted similar measures to gauge consumer sentiment.

Canada & European Union

In Canada, for example, the Conference Board of Canada has been publishing its own CCI since 1980, and in the European Union, member countries monitor consumer confidence through the European Commission’s standardized surveys.

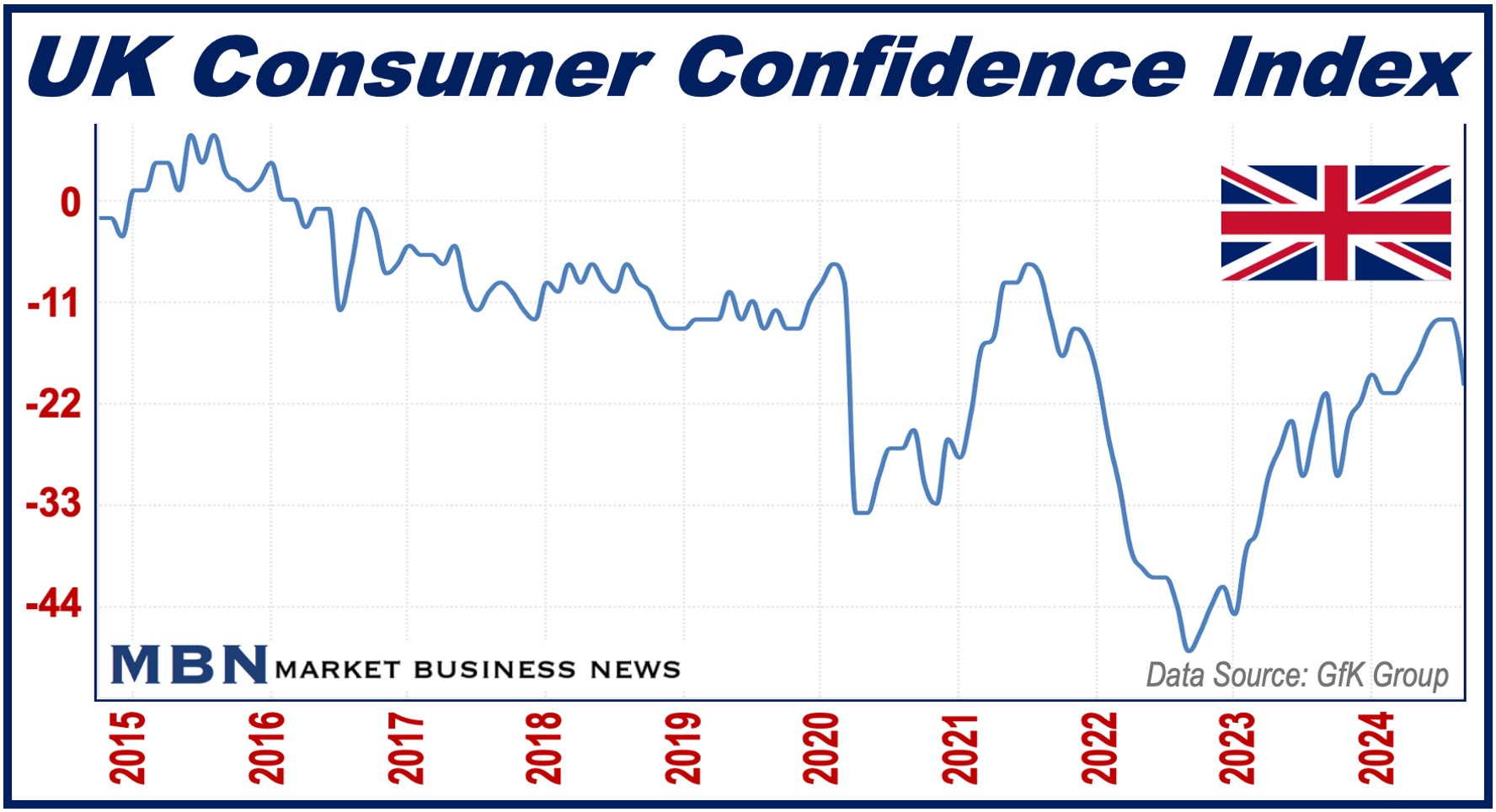

United Kingdom

In the United Kingdom, the GfK Consumer Confidence Barometer has been running since 1974.

It tracks consumer sentiment by surveying a representative sample of the population each month on key factors such as personal finances, general economic outlook, and buying intentions.

Emerging Economies

In developing economies like Indonesia and India, the CCI plays an increasingly important role in tracking consumer behavior, particularly as consumer spending becomes a more significant driver of economic growth.

These indices are adapted to local conditions but generally follow the same principles as the U.S. model, providing valuable insights into household spending and saving patterns.

Limitations and Criticisms of the CCI

Despite its widespread use, the Consumer Confidence Index is not without its critics.

Volatility

Some argue that consumer sentiment is too volatile and subjective to serve as a reliable predictor of future economic activity.

For example, sudden changes in political or global events can dramatically alter consumer perceptions, leading to short-term fluctuations in the index that may not accurately reflect longer-term economic trends.

Lack of Data

Furthermore, some critics point out that consumers may not have the necessary information to accurately assess the broader economic conditions.

Recent headlines or personal experiences may have shaped their views rather than a comprehensive understanding of economic fundamentals.

A Lagging Indicator

In addition, Some people criticize the CCI for being more of a lagging indicator than a leading one. In other words, it may simply reflect current economic conditions rather than predicting future changes.

However, supporters argue that the index provides a useful snapshot of consumer sentiment, which can influence future economic outcomes.

The Consumer Confidence Index is a crucial tool for understanding consumer sentiment and its impact on the economy.

By measuring how optimistic or pessimistic consumers feel about their financial future and the overall economy, the CCI offers valuable insights into potential shifts in consumer spending, saving, and borrowing behavior.

While it may have its limitations, the CCI remains an important gauge of economic health, influencing decisions made by businesses, financial institutions, and governments worldwide.