The wholesale price or trade price is the price of products when they are sold in bulk by wholesalers to retailers, hence the name. Wholesale prices are cheaper than retail prices. Retail means shops and stores – selling directly to the public.

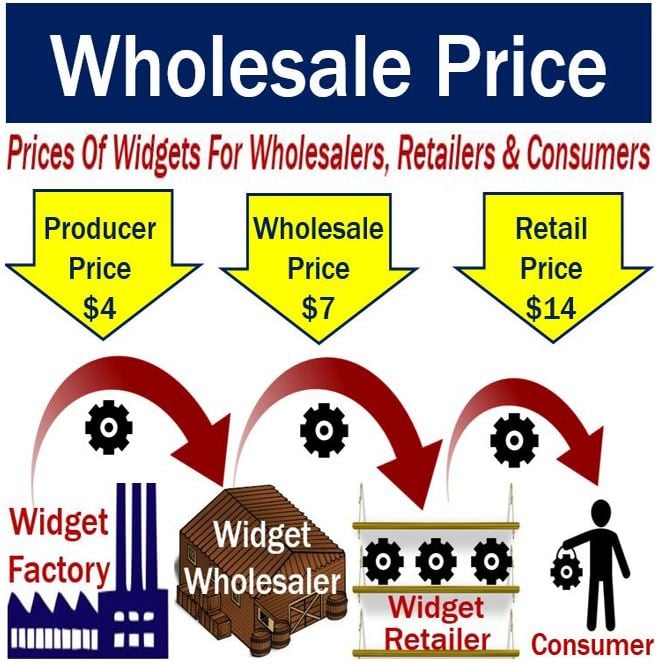

The producer sells goods at a certain price to the **wholesaler, who sells on those goods at a slightly higher price to the retailer, who then sells them at an even higher price to the consumer.

** The wholesaler is the ‘middle-man’, the ‘go-between’, between producer and retailer.

The wholesale price is always lower than the retail price. Sometimes a supermarket chain might sell a specific product at cost – the amount they bought them for – or even below cost in an attempt to attract customers, or in response to moves by other supermarket chains.

In the current supermarket price war in the United Kingdom, it is not uncommon for the retailer to refuse price increases from the wholesaler. In October 2016, Britain’s supermarket giant Tesco refused to accept higher wholesale prices from several Unilever products, including Persil, Flora, Berttolli, Marmite and Knorr.

Wholesale price allows for markups

The wholesale price is the producer’s price plus the margin (profit) that the wholesaler makes when selling on a product to the retailer.

When goods are sold at wholesale prices, they are sold in bulk – in large volumes – so that the wholesaler can make a profit on a small margin.

MSRP – Manufacturer’s Suggested Retail Price – is calculated so that there is room for both a wholesale and retail markup.

Wholesale price in investment markets

In the world of assets and markets, the wholesale price is the value of an asset in a market where the big players make transactions in that asset with other large professional participants.

Wholesale Price(s) Index

The Wholesale Price(s) Index (WPI) is an index that tracks and measures changes in the prices of products in the different stages before the end user (consumer) buys them in a shop. Some countries use the term Producer Price Index for the same thing.

The long form of WPI may be written in either the singular and plural form – ‘price’ or ‘prices’.

In most countries, the WPI is used as an important measure of inflation. Monetary and fiscal policy changes are in large part influenced by WPI changes.

The OECD has the following definition for the Wholesale Prices Index (OECD uses the plural form):

“A measure that reflects changes in the prices paid for goods at various stages of distribution up to the point of retail. It can include prices of raw materials for intermediate and final consumption, prices of intermediate or unfinished goods, and prices of finished goods. The goods are usually valued at purchasers’ prices.”