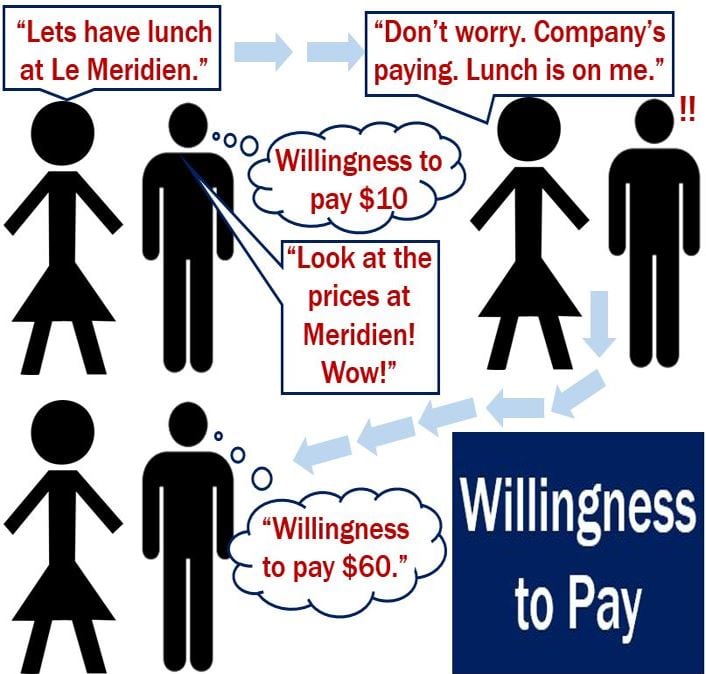

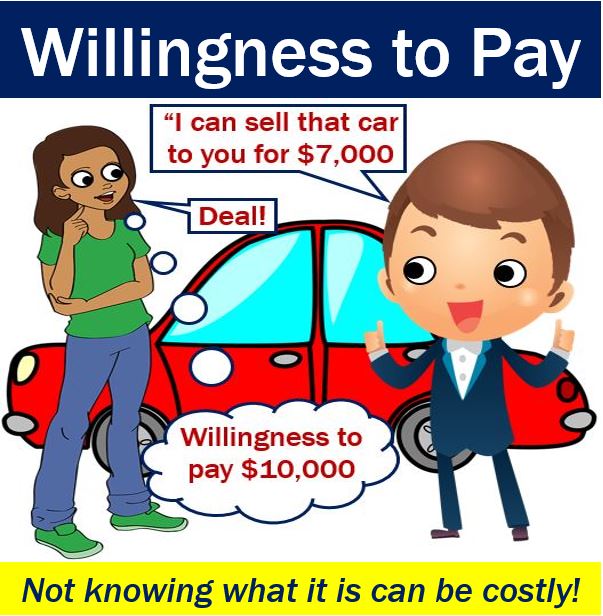

Willingness to pay, or WTP, is the most a consumer will spend on one unit of a good or service. Some economic researchers see willingness to pay as the reservation price – the limit on the price of a product or service. Others conceptualize WTP as a range – a product’s price may range from a specific amount up to the willingness to pay level.

Conversely, willingness to accept, or WTA, is the minimum price that an individual is willing to accept to abandon a product or put up with something undesirable, such as noise or traffic pollution. In the world of commerce, willingness to accept is the lowest price a seller will sell something for.

During the 1980s, several countries’ governments and international organizations began to carefully study people’s willingness to pay, specifically regarding the prices that they would accept in order to avoid losing a service, or gaining a new one.

The Organization for Economic Co-operation and Development (OECD), a forum of countries dedicated to the market economy and democracy, defined willingness to pay as: “The stated price that an individual would accept to pay for avoiding the loss or the diminution of an environmental service.”

Willingness to pay varies

Imagine you live in a country called Fantasyland. Fantasyland has the lowest crime rate in the world. Nobody is ever scared when they go out at night on their own. You can leave your home’s front door open, knowing that the chances of being burgled are virtually zero.

If the government proposed raising taxes to increase the number of police officers, most people would be against the idea.

Now, imagine you live in Muggolandia, which has the world’s highest crime rate. Nobody ever goes out at night, not even in groups. If you have to drive your car after dark, you do not stop at the red traffic light for fear of being assaulted.

Muggolanders’ willingness to pay for more security would be considerably higher than for Fantasylanders. Even if it meant raising income tax from its current 30% to 40%, Muggolanders would go along with the proposition if it meant having better public safety.

Willingness to pay varies, depending on people’s circumstances. Citizens of Saudi Arabia’s willingness to pay for potable (drinkable) tap-water is significantly greater than for Britons, where there are lots of rivers, lakes, and regular rainfall.

The willingness to pay for a pair of designer trainers is in the hundreds of dollars for a young adult, and probably no more than $50 for a senior (aged 65+).

Measuring willingness to pay

Being able to accurately know how much consumers are willing to pay for something is crucial for formulating competitive strategies, developing new products, and conducting value audits.

Gauging people’s willingness to pay is important for targeted promotions, one-to-one pricing, nonlinear pricing, and many other pricing tactics.

Price is an important variable in marketing, both in consumer purchasing decisions and corporate practices. It contributes to margins, product positioning, and sales volumes. Accurately assessing consumer perceptions of prices is extremely important.

In a 2009 article published in Recherche et Applications en Marketing (French Edition), SAGE Publications, titled – ‘Definition, Measurement and Determinants of the Consumer’s Willingness to Pay: a Critical Synthesis and Directions for Further Research’ – Marine Le Gall-Ely, Associate Professor of Management Sciences, Marketing and Consumer Behavior, at the University of Western Brittany in France, wrote:

“Ability to measure WTP enables calculation of the demand curve according to price and to set a price that offers the best possible margin. When prices can be customized, knowing the WTP could enable optimization of both sales volumes and margins.”

“Understanding the factors that influence WTP allows it to be raised and offers the opportunity of increasing sales volumes for a given price or, when possible, to customize prices.”

Opportunity cost

Marketing executives need to know what consumers’ willingness to pay is, as well as their perceived opportunity cost.

Opportunity cost refers to what you have to give up when you choose to purchase something. When consumers have to choose between two things they like, because there is not enough money for both of them, they will have to give up on one.

Imagine you only have $15. You love pizza and see one on sale for $14. However, you also like comics, but they cost $4 each.

If you buy the pizza, you give up the value you would have placed on the comic – the enjoyment you would have experienced reading it, finding out what happened following last week’s issue, etc. In economics this is called the opportunity cost.