Windfall profits are massive profits that companies make unexpectedly due to unusually favorable circumstances. To be a windfall profit, it must be much greater than the historical norm and usually temporary in nature (not always). In most cases, windfall profits are experienced by all the companies within one industry – in rarer cases just one firm is the lucky one.

The concept of windfall profits is a controversial one, and is frequently used by lawmakers to justify imposing a windfall profit tax, i.e. a tax on money that is earned unexpectedly through circumstances that the commercial enterprise had no control over.

The term may also refer to an individual rather than a company. For example, when the price of real estate goes up significantly, owners can make huge profits by selling their properties. This unexpected and sudden increase in income is a windfall profit.

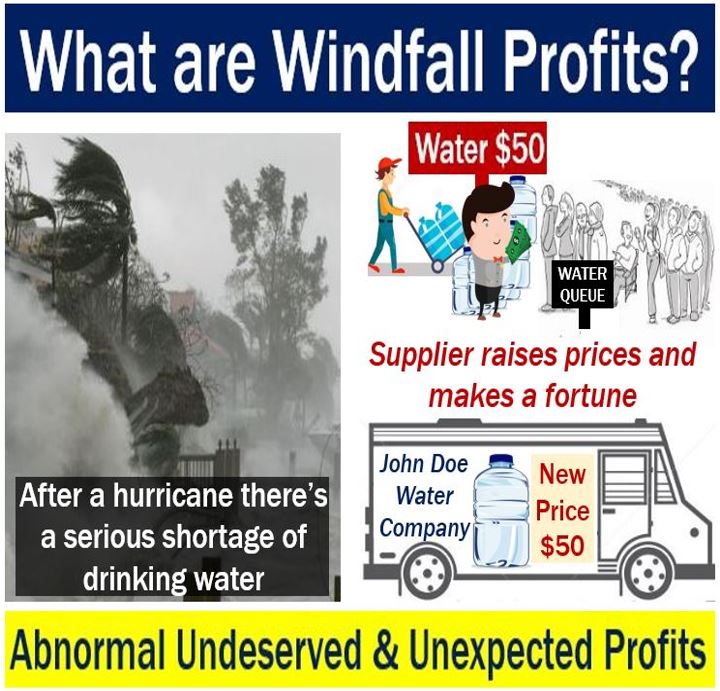

Windfall profits may be the excessive profits made by some people or companies following a natural disaster, when there are shortages of essential items. When suppliers raise the prices of goods and services during a state of emergency, they are said to be guilty of ‘price gouging’.

Windfall profits may be the excessive profits made by some people or companies following a natural disaster, when there are shortages of essential items. When suppliers raise the prices of goods and services during a state of emergency, they are said to be guilty of ‘price gouging’.

Politicians argue that if the giant profits were neither expected nor the result of efforts by a company’s senior management and other employees – if they are ‘undeserved’ – taxing them should not undermine the firm’s incentives to make maximum profits in future.

However, the whole thing becomes a serious problem when politicians begin classing deserved and expected profits as windfall profits. The message to the industry is that there is no point in trying to increase profits, because businesses will be penalized with additional taxes. In other words, companies complain that windfall profit tax kills growth.

Causes of windfall profits

A windfall profit emerges when there is a big gap between sourcing prices and selling prices. It might be the result of a rapid increase of prices in a sector, where production capacity and assets are fixed and already financed.

A new tariff system or some other type of regulation can also lead to abnormal profits.

Most politicians say that windfall profit should have a special tax. Unsurprisingly, the business community disagrees.

When crude oil prices surge, energy companies make huge profits, which always leads to demands by politicians to class them as windfall profits that should be taxed as such.

In a 2013 Guardian article – Airlines ‘made billions in windfall profits’ from EU carbon tax, Suzanne Goldenberg wrote that airlines made windfall profits of up to $1.81 billion in 2012 from a European Union (EU) carbon tax, which they had claimed would impose crippling costs on the air passenger transport industry.

Ms. Goldenberg wrote:

“In terms of individual carriers, Lufthansa made as much as €53.6m in windfall profits, followed by Air France with €51.5m, and British Airways at €44.1m.”

“Delta was estimated to have made €29.7m and United Airlines €29.2m, with American Airlines in line for €175m in windfall profits.”

Windfall profits are common after a disaster, when there are shortages. In such cases, those making huge profits are said to be price gouging.

Windfall profits vs. windfall gains

All windfall profits are windfall gains but not vice-versa, just like all bananas are fruits but not the other way round.

Examples of windfall gains are winning the lottery or inheriting a lot of money. In all cases of windfall gains, the recipient did not expect it and had no control over the event.

Windfall profits are a type of windfall gain, but only when something was bought and then sold, i.e. when commercial activities were performed.

For example, if I bought a house for $100,000 last year, and sold it today for a surprising $200,000, that is a windfall profit (or a windfall gain). However, if I inherit $10 million, that is only a windfall gain, not a windfall profit – inheriting money is not a business activity, the receiver did not buy and then sell anything.

In this Liberty Pen video, American economist Walter E. Williams, the John M. Olin Distinguished Professor of Economics at George Mason University in Fairfax County, Virginia, USA, explains that windfall profits serve a vital social function. “They serve as a signal that there are unmet human wants,” he explains.