A yield spread strategy is a method of taking advantage of the yield spread of a specific bond.

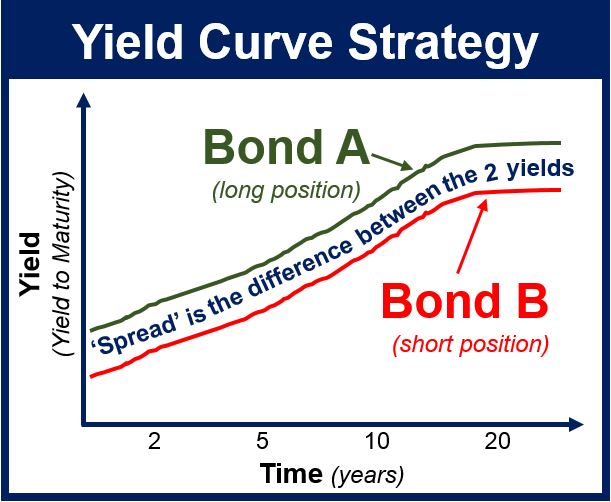

This trading strategy encourages placing a short position on a bond with a low yield, while at the same time placing a long position on a bond with a high yield.

A general rule of thumb is that the lower the credit rating of a government or company (issuing the bond) the higher the yield of the bond.

The investor takes a long position with the higher yielding bond and a short position with the low-yielding one.

The investor takes a long position with the higher yielding bond and a short position with the low-yielding one.

A yield investment strategy attempts to generate capital gain from high-yield bonds, that usually carry a rating below ‘BBB’ from S&P, and below ‘Baa’ from Moody’s, while mitigating risk by also placing positions on bonds with better ratings.

The yield curve plots the yields or interest rates for a certain debt contract with different maturity dates.