Zero-based budgeting, or a zero-base budget, requires that all managers’ budgeted expenditures are justified, as opposed to requiring justification just for increases to previous year’s budget, which is the more common approach.

Zero-based budgeting is a method for preparing operating plans and cash flow budgets which must start from scratch each year, without any pre-authorized funds.

With traditional budgeting, past sales and expenditure trends are taken as given – assumed to continue.

With zero-based budgeting (ZBB), every single activity has to be justified on the basis of cost-benefit analysis. When the ZBB accounting method is used, it is assumed that no current commitment exists – there is no balance that should be carried forward.

At the beginning of each period, a manager is theoretically assumed to have a base line, as far as expenditure is concerned, of zero – hence the name ‘zero-based budgeting’.

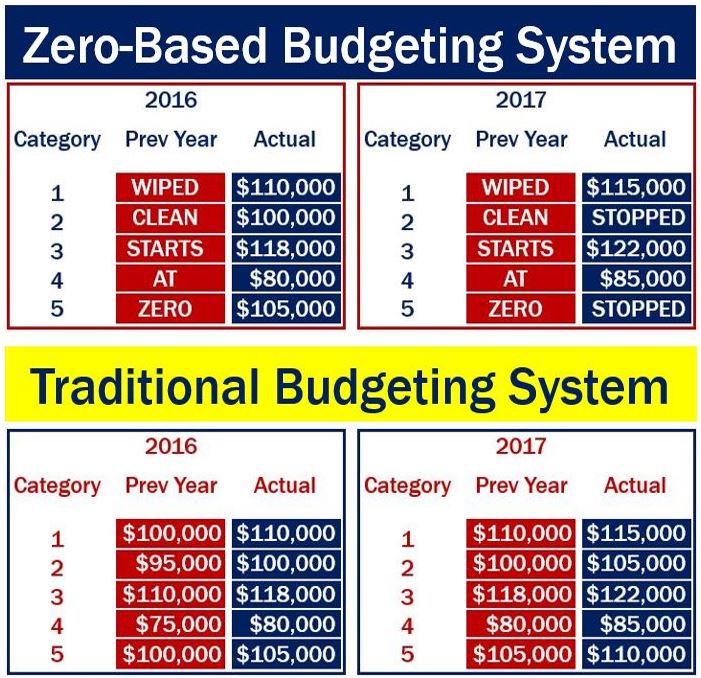

With a traditional budgeting system, you carry forward the previous periods’ numbers, and only negotiate if you want that amount changed. With a zero-based budgeting system, every accounting period starts with zero – all numbers are wiped clean. So each expenditure has to be completely assessed from scratch.

With a traditional budgeting system, you carry forward the previous periods’ numbers, and only negotiate if you want that amount changed. With a zero-based budgeting system, every accounting period starts with zero – all numbers are wiped clean. So each expenditure has to be completely assessed from scratch.

Focusing on key business objectives

The aim of ZBB is to continually refocus funding on key business objectives, and scale back or cancel any activities which are not related to those objectives.

According to McKinsey & Company, a multinational management consulting firm:

“Zero-based budgeting is a repeatable process that organizations use to rigorously review every dollar in the annual budget, manage financial performance on a monthly basis, and build a culture of cost management among all employees.”

“A world-class ZBB process is based on developing deep visibility into cost drivers and using that visibility to set aggressive yet credible budget targets.”

AccountingTools.com says that in a zero-based budgeting system, the basic process flow is to:

– Prioritize business objectives.

– Create, assess, and evaluate alternative methods for reaching each objective.

– Examine alternative funding levels, depending on planned performance levels.

Bain & Company, an American global management consulting firm , writes: “In our experience, zero-based budgeting (ZBB) provides a practical way for companies to radically redesign their cost structures, cutting as much as 25% of spending on overhead and support functions, while boosting efficiency and competitiveness.” (Image: adapted from bain.com)

Bain & Company, an American global management consulting firm , writes: “In our experience, zero-based budgeting (ZBB) provides a practical way for companies to radically redesign their cost structures, cutting as much as 25% of spending on overhead and support functions, while boosting efficiency and competitiveness.” (Image: adapted from bain.com)

Zero-based budgeting and recession threat

For many companies, the idea of rebuilding the budget from scratch may be seen as a nightmare – wiping the budget slate clean and starting from the ground up is a worst-case, last resort thing to do; never something any senior manager would ever consider doing under normal circumstances.

However, beginning in 2008, a growing number of commercial enterprises, opted to do just that. Faced with the Great Recession, corporations started to turn towards zero-based budgeting.

The zero-based budgeting process is one that allocates funding, not according to budget history, but based on program efficiency and necessity.

Budgeters review every single program and expenditure at the beginning of each financial period. Each line item must be justified in order to approve funding for it.

ZBB may be applied to any kind of cost, including operating expenses, sales, capital expenditure, marketing, variable distribution, or cost of goods sold.

Deloitte Touche Tohmatsu Limited (Deloitte), a UK-incorporated multinational professional services firm, writes:

“When successful, ZBB produces radical savings and liberates organizations from entrenched departments and methodologies. When unsuccessful, the costs to an organization can be considerable.”

Zero-based budgeting in the 1970s

Zero-based budgeting initially rose to prominence in the public sector in the financial crisis of the 1970s. As public pressure grew, US President Jimmy Carter promised to reform the federal budgeting system and balance the federal budget using ZBB. When he was Governor of Georgia, Carter had used ZBB.

Even though it was well received at first, ZBB proved not only time consuming and incredibly complicated, but also ineffective, because it was Congress and the executive branch that ultimately decided which programs were kept and which were eliminated.

President Carter’s budget office used a variant of ZBB, in which agencies had to rank their programs with funding limits. This forced them to assign priorities and identify targets for reductions. However, rather than starting from a true zero base, the agencies started from a ‘priority base’.

President Ronald Reagan abandoned the system soon after taking office in 1980. “Since then, ZBB’s use in both the public and private sectors has been limited due to its high level of complexity and large requisite investment that can hinder its execution,” Deloitte wrote.

Video explaining zero-based budgeting

This Stroud International video explains what zero-based budgeting is, a system that was created by Pete Pyhrr, from Texas Instruments, in the 1960s.