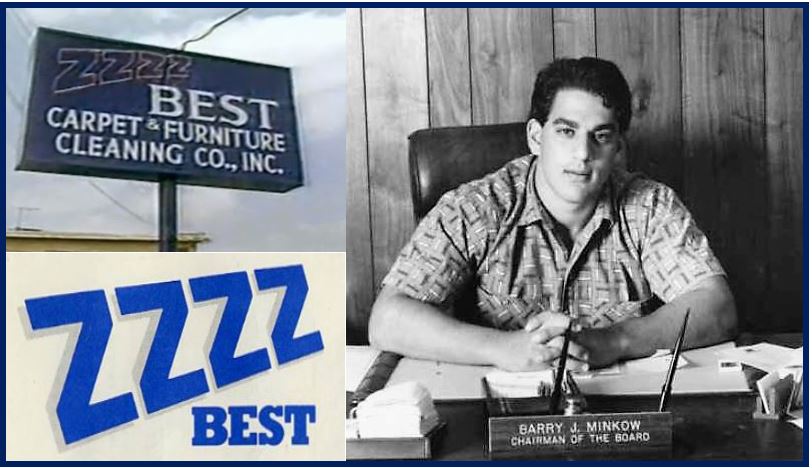

ZZZZ Best (pronounced: zee best) was a carpet cleaning and restoration company that was created in Inglewood, California in 1982 by Barry Minkow. Minkow was sixteen and still at school when he founded the company. The company was involved in huge amounts of fraud. It was a front for a Ponzi scheme.

Fraud occurs when a person uses dishonesty, tricks, or deception to gain money or property illegally. The person who does this is a fraudster.

The business, on the surface, looked extremely successful. However, the majority of its profits came from either organized crime syndicates or they had been made up.

In December 1986, ZZZZ Best went public and was valued at more than $300 million. Within seven months of its IPO, it filed for bankruptcy. Its were worth a fraction of the initial $300 million valuation when they were auctioned (just $64,000).

ZZZZ Officials sued

ZZZZ Best officials sued Mr. Minkow. They accused him of misappropriating over $23 million of the company’s money.

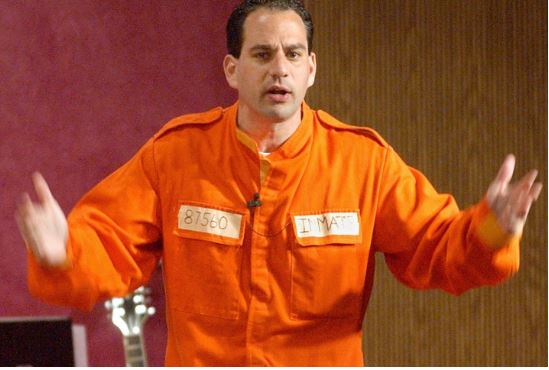

Minkow was found guilty and received a 25-year jail sentence.

Minkow engage in credit-card fraud, stole money from relatives, and staged burglaries so that he could claim the insurance.

A takeover that nearly took place

Regarding Minkow’s carpet restoration company, Dr. Matthew Partridge wrote the following in Money Week:

“The restoration service was completely invented. Minkow created a fake firm, Interstate Appraisal Services, which posed as ZZZZ Best’s client. To keep the business running, Minkow took loans from various dubious figures, and shuttled money between bank accounts, in a Ponzi-style scheme.”

Minkow even managed to convince banks to finance the acquisition of KeyServ, a competitor. The acquisition did not occur.

In May 1987, one day before the takeover, an article appeared in the Los Angeles Times detailing how Minkow had previously been involved in fraudulent charges to the tune of $72,000. The article added that Minkow still had not paid some victims back. After the article was published, the banks immediately pulled their credit lines and the takeover was postponed.

It soon became apparent that several important restoration contracts that ZZZZ Best claimed it had did not exist; Minkow had made them up. In July 1987, Minkow, who was CEO of the company, had to resign. A year later he was jailed for several counts of fraud.

Investors ignored many warning signs

ZZZZ Best shareholders had to share a settlement that was worth just $35 million.

Investors should have noticed that something was not right when Minkpow employed convicted criminals as directors.

Even after serving a jail sentence, Minkow did not learn his lesson. In 2011, he was jailed again for insider trading.