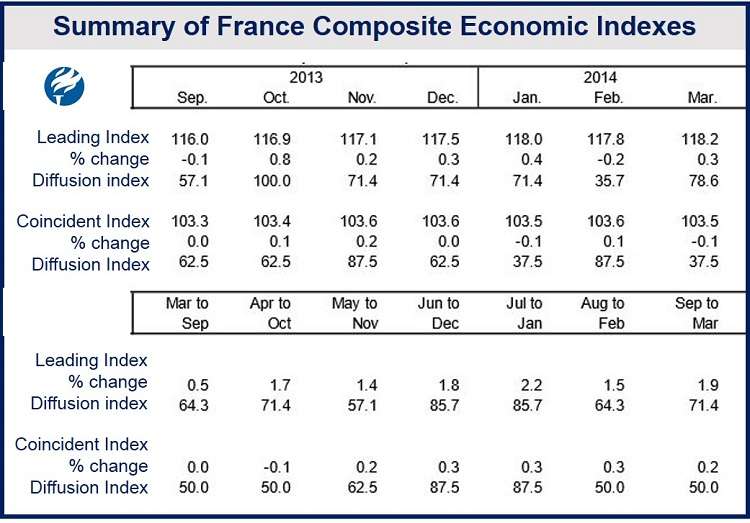

The French economic outlook is mixed, with its Leading Economic Indicator improving by 0.3% in March after a slight fall in February, but its measure of economic activity (CEI) declined by 0.1%, according to figures published by The Conference Board.

Leading Economic Index

Large positive contributions to the French LEI in March came primarily from residential building permits and the yield spread, which more than offset the negative contributions from new unemployment claims.

Over a six-month period ending on March 31st, 2013, the LEI improved by 1.9% (equivalent to about 3.8% annually), compared to a 0.5% increase during the previous six-month period.

According to The Conference Board, “the strengths among the leading indicators have remained more widespread than the weaknesses in recent months.”

In March 2014, of the seven components that make up the LEI, six increased.

The following contributed positive in March, in order of size:

- Residential building permits,

- The yield spread,

- Industrial new orders,

- Production expectations,

- The stock price index,

- The ratio of the deflator of manufacturing value added to unit labor cost in manufacturing.

The number of new unemployment claims contributed negatively to the LEI.

The LEI for March, after the 0.3% rise, stands at 118.2 (2004=100).

For the six-month period through March, the LEI rose 1.9%, with five of the seven components increasing.

(Source: The Conference Board)

Coincident Economic Index (CEI)

The CEI for France, which measures current economic activity, fell slightly in March, after falling in February and December.

The CEI during the September 2013 to March 2014 period rose by 0.2% (equivalent to approx. 0.4% annually), compared to zero growth during the previous six-month period.

Over the last six months, the strengths and weaknesses among the CEI indicators have remained balanced.

In Q1 2014, GDP grew by 0.1% (annualized rate), after 0.7% growth in Q4 2013.

The Conference Board wrote:

“Despite the recent decline, the LEI remains on an upward trend and its six-month growth rate has increased compared to six months ago. In addition, the strengths among the leading indicators remain widespread. Meanwhile, the CEI has been relatively flat for two years, and its six-month growth rate remains slightly positive. Taken together, the recent behavior of the composite indexes suggests that France’s economy is likely to continue improving moderately in the near term.”

Below is a list of how the four components contributed to the March CEI:

- Wage and salaries: increased,

- Industrial production: declined,

- Employment: declined,

- Personal consumption: declined.

After March’s 0.1% fall, the CEI now stands at 103.5 (2004=100).

Over the six-month period ending on March 31st, the CEI grew by 0.2%.