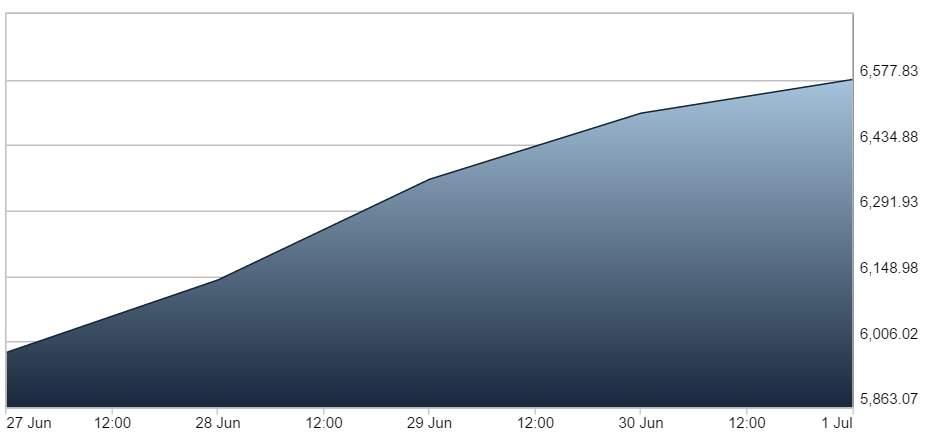

The FTSE 100 recorded its strongest weekly gain in five years, with the UK blue chip index recovering robustly from earlier Brexit losses.

The index surged 7.2 percent, up 73.5 points in Friday closing at a ten-month high of 6,577.83.

One of the main reasons for the buying frenzy is that the formal process to leave the EU, which starts when article 50 is triggered, won’t begin for another few months.

However, in US dollar terms, the FTSE 100 is down 7 percent since the result of the EU referendum. The FTSE 250 increased 2.4 percent last week, but in dollar terms has fallen in value by almost 15 percent since the Brexit vote.

Richard Turnill, of BlackRock, was quoted by The Financial Times as saying that last week’s rally was mainly due to investors rebalancing their portfolios for the fall in the value of the pound and cheaper share prices.

“It is a technical issue rather than a signal of any confidence in domestic UK stocks,” he said.

The biggest gainers of the week were Fresnillo, up 42.1 percent to £17.60, and Randgold posting a 35.9 percent increase to £87.75 per share. Other companies that performed well include: AstraZeneca +15.5%, Shire +15.4%, BP +15%, Diageo +14.9%, Mediclinic +14.9%, and British American Tobacco +14.5%.

Firms in mining and healthcare were the best performers.

Jason Hollands, managing director at Bestinvest, told This is Money: ‘I would still be cautious towards companies in areas that are very sensitive to the UK economic outlook or which are heavily dependent on cross-border trade with the EU until the dust settles.

‘Instead, focus on companies that do business beyond the UK or which provide services we are likely to keep on using through tough times as well as good ones.’

It should be noted that while a drop in the value of the pound is bad for holidaymakers, it makes it cheaper for overseas customers to buy goods produced in the UK – boosting sales and profits.