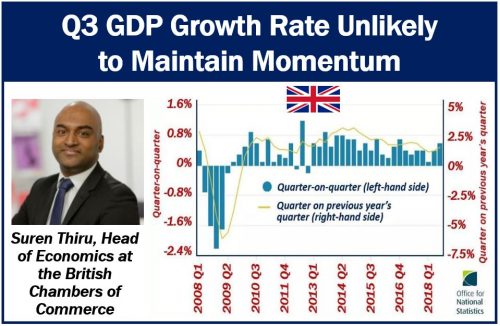

Head of Economics at the British Chambers of Commerce, Suren Thiru, says that the UK’s third quarter GDP growth rate is not likely to continue. Although Thiru welcomes the pick-up in GDP growth in the third quarter, the stronger headline figure masks a momentum loss. While July saw strong growth, there was no growth at all in August and September.

In Q3 2018, UK GDP’s growth rate stood at 0.6%, which was the fastest expansion in nearly two years. According to the ONS, the high growth rate was due to the warm weather. ONS stands for the Office for National Statistics, a non-ministerial department which reports directly to Parliament.

Regarding the pick-up in the third quarter, Thiru said:

“While the pick-up in GDP growth in the third quarter is welcome, the stronger headline figure masks a loss of momentum through the quarter from the particularly strong July outturn, when a number of temporary factors, including the heatwave and the World Cup, boosted activity.”

What is GDP growth rate?

GDP stands for gross domestic product. It is a measure of production that equals all the goods and services that an economy produces.

The GDP growth rate, therefore, refers to the rate by which the production of all goods and services have risen or declined.

GDP growth rate – good and bad news

The services and construction sectors got a strong boost from the exceptionally hot summer. The two sectors were the strongest contributors to the pick-up in the GDP growth rate.

However, economists voiced concern regarding the decline in business investment. When business investment goes down, productivity and growth subsequently suffer. In other words, the GDP growth slows down.

The increase in the Annual Investment Allowance that the Chancellor announced in the budget should help lift investment. However, it will only serve as a short-term boost.

Thiru added:

“It remains likely that the stronger growth recorded in the third quarter is a one-off for the UK economy, with persistent Brexit uncertainty and the financial squeeze on consumers and businesses likely to weigh increasingly on economic activity in the coming quarters.”

“Against this backdrop, the Bank of England’s recent hawkish rhetoric looks a little misguided and risks a further weakening in business and consumer confidence. With inflation on a downward trajectory and the UK’s growth outlook subdued, there remains sufficient scope for the central bank to keep interest rates on hold for some time yet.”

“To ease the extent of current uncertainty, the government must deliver a comprehensive Brexit deal that gives firms the clarity and precision they need.”