This Market Business News article provides detailed information on the pharmaceutical company GlaxoSmithKline PLC (GSK).

GlaxoSmithKline is one of the world’s leading pharmaceutical companies (in terms of revenue).

It manufactures drugs and vaccines for a range of medical conditions (such as asthma, cancer, infections, diabetes, and psychiatric conditions), in addition to producing personal healthcare products and nutritional products.

It is based in Brentford, London, UK.

The company is publicly listed on the London Stock Exchange (LSE) under the stock ticker symbol ‘GSK’ and is a constituent of the FTSE 100 Index, with a secondary listing on the New York Stock Exchange (NYSE).

GlaxoSmithKline operates commercial business across over 150 countries, with a network of 86 manufacturing sites in 36 countries and R&D centers in Europe, North America, and Asia.

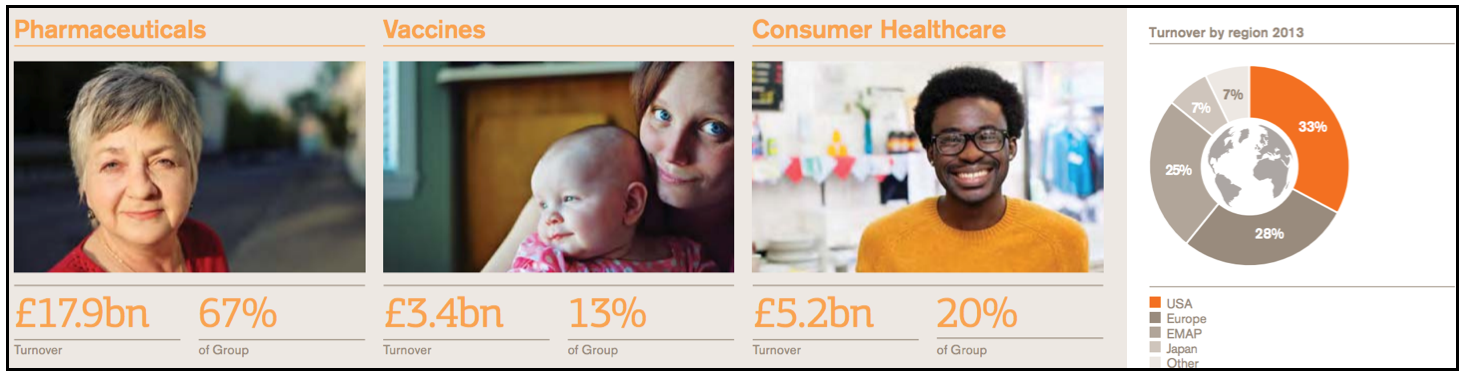

The company has three primary product areas:

Pharmaceuticals – develops and makes medicines to treat a broad range of acute and chronic diseases.

Vaccines – one of the world’s leading providers of paediatric and adult vaccines against a number of infectious diseases – in 2013 the company distributed approximately 860 million doses to 170 countries.

Consumer Healthcare – with brands in four main categories: Total Wellness, Oral Care, Nutrition and Skin Health.

GlaxoSmithKline’s best selling drugs in 2013 were: Augmentin (an antibiotic for the treatment of a number of bacterial infections), Avodart (used for benign prostatic hyperplasia), Lamictal (an anticonvulsant drug used in the treatment of epilepsy and bipolar disorder), Advair (used for the treatment of asthma and chronic obstructive pulmonary disease), Lovaza (treatment for patients with very high levels of triglycerides), and Flovent. (used to treat asthma, allergic rhinitis, and various skin disorders).

GlaxoSmithKline was created on 1 January 2001 after GlaxoWellcome plc merged with SmithKline Beecham plc.

These two companies (GlaxoWellcome and SmithKline Beecham) has significant influence in the pharmaceutical industry (prior to the merger):

GlaxoWellcome, a company founded in 1904 that originally manufactured baby food, was the world’s third-largest pharmaceutical company by revenue in 1999.

Beecham Research Laboratories, founded in 1859, became very well known for discovering Amoxycillin in 1972 (a very widely used antibiotic).

GlaxoSmithKline – COverview

- Chief Executive: Andrew Witty

- Chairman: Chris Gent

- Type: Public

- Industry: Pharmaceutical

- Founded: 2000

- Listed publicly on the LSE and NYSE

- LSE stock ticker symbol: GSK

- NYSE stock ticker symbol: GSK

- Assets: £42.086 billion GBP (2013)

- Revenue: £26.505 billion GBP (2013)

- Earnings per share: 112.5 pence (2013)

- Profit: £5.436 billion GBP (2013)

- R&D expenditure: £3.923 billion GBP (2013)

- Employees: 99,000+ (2013)

- UK company head office: 980 Great West Road, Brentford, Middlesex, TW8 9GS, England, +44 (0)20 8047 5000

- US company head office: 5 Crescent Drive, Philadelphia, PA 19112, +1 888 825 5249

- Website: http://www.gsk.com/

| Income data (in £ millions) | 2013 | 2012 |

| Revenue | £26,505 | £26,431 |

| Cost of sales | £(8,585) | £(7,925) |

| Gross profit | £17,920 | £18,506 |

| Selling, general and administration | £(8,480) | £(8,789) |

| Research and development | £(3,923) | £(3,979) |

| Royalty income | £387 | £306 |

| Other operating income | £1,124 | £1,256 |

| Operating profit | £7,028 | £7,300 |

| Finance income | £61 | £79 |

| Finance expense | £(767) | £(808) |

| Profit on disposal of interest in associates | £282 | – |

| Share of after tax profits of associates and joint ventures | £43 | £29 |

| Profit before taxation | £6,647 | £6,600 |

| Taxation | £(1,019) | £(1,922) |

| Profit after taxation for the year | £5,628 | £4,678 |

| Profit attributable to non-controlling interests | £192 | £179 |

| Profit attributable to shareholders | £5,436 | £4,499 |

| Total comprehensive income for the year | £6,215 | £4,014 |

| Balance sheet data (in £ millions) | ||

| Total assets | £42,086 | £41,481 |

| Total liabilities | £(34,274) | £(34,744) |

| Total equity | £7,812 | £6,737 |

| Cash flow data (in £ millions) | ||

| Net cash inflow from operating activities | $7,222 | $4,375 |

| Net cash inflow/(outflow) from investing activities | $524 | $(2,631) |

| Net cash outflow from financing activities | $(6,273) | $(3,351) |

| Increase/(decrease) in cash and bank overdrafts | $1,473 | $(1,607) |

| Cash and bank overdrafts at end of year | $5,231 | $3,906 |

| Cash and cash equivalents at end of year | $5,534 | $4,184 |

| Overdrafts | $(303) | $(278) |

| Common share data (in pence) | ||

| Earnings per Common Share – Basic | 112.5p | 91.6p |

| Earnings per Common Share – Diluted | 110.5p | 90.2p |

Source: “GlaxoSmithKline plc 2013 Financial Statements”

Source: “GlaxoSmithKline plc 2013 Strategic Report”

Sir Andrew Witty, Chief Executive Officer, commented on the results:

“GSK’s performance in 2013 represented further strong delivery for the Group. We met our guidance with core EPS growth of 4% and sales growth of 1% (+3% ex-divestments) and returned £5.2 billion to shareholders via further growth in the dividend and our continuing share buy-back programme. We also delivered the most productive period of R&D output in the Company’s history and led the sector for new medicine approvals.”

He concluded:

“Looking further ahead, we continue to make fundamental changes to our business, including how we interact with our customers; investments in technologies to support research and manufacturing; new policies to determine the pricing and value of our products, and in the culture of our organisation. We believe these changes are vital in an industry with a 20-year business cycle and which operates in an environment as dynamic and as challenging as global healthcare.”

Read GlaxoSmithKline’s “Results Announcement for the year ended 31 December 2013”.

GlaxoSmithKline’s new compensation scheme

In December 2013, GSK said it planned to stop paying doctors for promoting its drugs. A bribery scandal in China, in which the company allegedly transferred $489 million to travel agencies and consultancies to bribe doctors resulted in a decline in sales in the country by 61% in the 3rd quarter of 2013.

Glaxo sales reps are no longer set individual sales targets. A rep working directly with doctors and hospitals will be assessed and rewarded according to his or her technical knowledge, the quality of service provided to enhance patient care “and the overall performance of GSK’s business,” the company said.

The new sales personnel compensation scheme will be implemented by the beginning of 2015.

News

July 24, 2014: Second quarter sales fell 23% to £986 million ($1.678 billion), mainly due to a poor performance in China and the US, and a strong pound. Two new respiratory drugs are taking longer-than-expected to sell well, consumer healthcare has supply chain problems, and a new HIV drug shows promise. Medication and vaccine sales in the US declined by 10%.

June 30, 2014: GSK has confirmed it received sex tapes of Mark Reilly, its former head of China, and his Chinese girlfriend at his apartment in Shanghai. Earlier this year secretly-filmed video had been sent by email to several Glaxo senior executives, including Sir Andrew Witty, the company’s CEO. Mr. Reilly has been charged with corruption by the Chinese police and may be facing a long prison sentence.

June 5th, 2014: GSK and 44 US states including the District of Columbia have agreed on a $105 million settlement for misrepresenting 3 of its drugs – asthma medication Advair and two anti-depressants Paxil and Wellbutrin. Although GSK agreed to the settlement, it has not admitted to any wrongdoing.

May 28th, 2014: The UK’s Serious Fraud Office says an investigation is underway into GlaxoSmithKline’s commercial practices. No details were given by either GSK or the SFO whether the probe involves one or a number of incidents. GSK wrote in a press release: “GlaxoSmithKline plc has today been informed by the UK’s Serious Fraud Office that it has opened a formal criminal investigation into the Group’s commercial practices.”

April 22, 2014: GSK and Novartis announce a deal in which their consumer healthcare divisions merge, GSK buys Novartis’ vaccines (exc. flu) unit and Novartis buys GSK’s cancer drugs division.