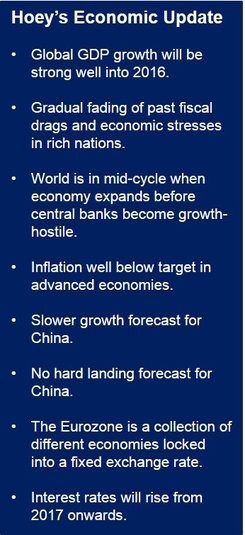

BNY Mellon’s global economic forecast predicts faster growth this year, in 2015 and 2016.

The author of the most recent Economic Update, Richard Hoey, BNY Mellon’s Chief Economist, says the accelerated growth will be due to the gradual fading of past fiscal drags and economic stresses in Europe, the US and UK.

Fiscal drag occurs when earnings growth and rising prices push more people into higher tax brackets. If their tax burdens rise, their spending declines.

Mr. Hoey said:

“The mid-cycle phase of economic expansion tends to occur after much of the financial hangover from the prior crisis has faded but before central banks are motivated to restrain economic expansion in order to suppress excessive inflation.”

“Many central banks in advanced countries are indeed worried about inflation today, but they are worried that inflation is too low rather than that inflation is too high. This is having a profound impact on monetary policy.”

Most central banks pushing for growth

Monetary policy in most advanced economies is aggressively stimulative, which is only partly offset by “growth-hostile regulation,” Hoey added.

Most advanced economies’ central banks will be supportive of economic expansion for some time to come, given that their core inflation rates are well below target. The annual inflation target rates in the European Union (EU), the US and Japan are the same – 2%.

- US March inflation was 1.5% (annualized), according to a report published by the US Bureau of Labor Statistics.

- Inflation in the Eurozone dropped to 0.5% (annualized) in March, versus 0.7% in February, according to the statistical office of the EU, Eurostat.

- Japan’s inflation rate declined to 1.6% (annualized) in January compared to 1.9% the month before.

Hoey said: “Within the advanced countries, the financial hangover of the last crisis is fading.” The financial costs for the peripheral Eurozone governments, as well as for high-risk borrowers in Europe, the UK and US have fallen steeply.

Hoey’s global economic forecast also predicts:

China slower growth – growth in China should slow to about 7% near term and 6% long term, mainly due to the “sluggish outlook for Chinese real estate.” Hoey says China is unlikely to come down with a bump.

The euro – although the Eurozone is known as a group of countries with one currency, it should be seen as 18 different nations “locked together at a fixed exchange rate,” Hoey notes. A fixed exchange rate is one in which a country’s currency is pegged to another currency or a basked of currencies.

US wage inflation – the labor share of national income in the United States is the lowest in several decades. Increased wage inflation will probably be welcomed by both the Obama administration and the American people, Hoey believes. “And first welcomed and then later tolerated by the Federal Reserve.”

Hoey concludes:

“A well-tolerated gradual upward drift in wage inflation would be consistent both with our expectation of about 3% real GDP growth for the three years 2014, 2015 and 2016 and with the likelihood of an upward spike in interest rates in 2017 and 2018.”