The IMF’s global growth forecast for 2014 improved to 3.6%, compared to 3% for 2013. The IMF (International Monetary Fund) predicts that global GDP growth will accelerate to 3.9% in 2015.

The IMF warned, however, that the changing external environment is posing new challenges to developing and emerging market economies.

The International Monetary Fund’s latest World Economic Outlook (WEO) welcomes the advanced economies’ accelerating recovery from the Great Recession, even though growth is still “subpar” and unevenly distributed across the world.

Economic recovery stronger and broader

The IMF’s Chief Economist Olivier Blanchard, said:

“The recovery which was starting to take hold in October is becoming not only stronger, but also broader. we are far short of a full recovery, the normalization of monetary policy—both conventional and unconventional—is now on the agenda.”

Although the acute risks to global economic growth have decreased considerably, they have not disappeared altogether, Blanchard cautioned. The world economy remains relatively fragile despite better prospects. The important risks, both the old and new ones, remain, he added.

Old risks include:

- Finalizing the financial sector reform agenda.

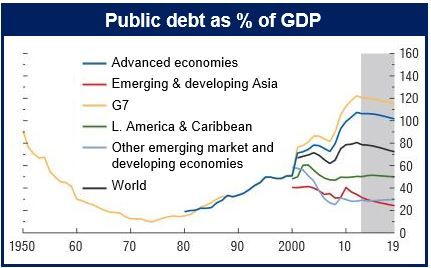

- High levels of debt in many nations.

- Persistently high unemployment levels.

- Concerns regarding emerging markets.

New looming worries include:

- Worryingly low inflation rates in the advanced economies, especially the Eurozone.

- A more pessimistic outlook for emerging markets compared to what economists had predicted during the second half of 2013.

- Recent geopolitical strains.

Stronger policy efforts are required, the report stresses, to completely restore confidence and make sure that the global recovery is durable and sustained.

In general the IMF’s global growth forecast is similar to the October 2013 WEO.

Advanced economies now in a stronger position

Economic growth in the United States has been a major driver in pushing forward global GDP growth. Annual growth for 2014 and 2015 in the US is forecast to be approximately 2.75%. WEO authors wrote “More moderate fiscal consolidation helps; support also comes from accommodative monetary conditions, a recovering real estate sector, and higher household wealth.”

The Eurozone is finally experiencing economic growth after years of recession. A strong reduction in the pace of fiscal tightening across the whole Eurozone is expected to help boost economic growth.

Within other areas of the European Union, outside the core euro area, net exports have helped accelerate growth, as has the stabilization of domestic demand. However, given the continued financial fragmentation, tight credit and a high corporate debt burden, demand growth is forecast to remain sluggish.

Underlying growth drivers are expected to boost economic activity in Japan, notably exports and private investment. April’s sales tax increase from 5% to 8% will probably slow economic growth moderately.

(Source: IMF)

Developing nations and emerging markets

More than two-thirds of global growth currently comes from developing economies and emerging markets. Their GDP growth is forecast to grow moderately to 4.9% in 2014 compared to 4.7% in 2013, and then by 5.3% in 2015.

The IMF wrote:

“The weaker momentum compared with advanced economies reflects in part the adjustment to a less favorable external financial environment and, in some cases, continued weak investment and other domestic structural constraints. Going forward, stronger exports to advanced economies are expected to underpin moderate increase in growth.”

China’s GDP is forecast to grow by 7.5% in 2014 and then by the same amount in 2015 as the Communist Party tries to put the economy on a more sustainable and balanced growth path.

Real GDP growth in India is expected to strengthen this year, partly thanks to government efforts to boost investment growth.

In Latin America some economies have recently faced strong market pressure. The region is forecast to have 2.5% GDP growth in 2014 and then 3% in 2015.

The sub-Saharan African economies continue growing at a strong pace. The IMF predicts 5.5% growth each year for 2014 and 2015. Higher growth will be boosted by commodity-related projects.

Conditions are challenging for many economies in the Middle East and North Africa, with only “moderate rises” predicted in 2014-2015. The IMF wrote “Most of the recovery is due to the oil-exporting economies, while many oil-importing economies continue to struggle with difficult sociopolitical and security conditions.”

The short-term prospects of the Russian Federation and other economies of the CIS (Commonwealth of Independent States) have been downgraded, “reflecting the fallout from the Ukraine crisis.”

Growth is expected to slow down in emerging and developing Europe in 2014, before rebounding slightly in 2015, “largely reflecting changing external financial conditions.”

Global growth forecast could be skewed by some hurdles

The WEO authors believe that the balance of risks to global growth has improved, but emphasize that there are still some hurdles, including:

Low inflation – a moderate risk exists on persistently low inflation in the advanced economies, especially in the Eurozone. Inflation rates in the US, the Eurozone and Japan are expected to remain well below their 2% annual targets for some time, “as growth is not expected to be high enough for economic slack to decline rapidly.”

The IMF wrote:

“Longer-term inflation expectations are then more likely to drift down in response, and risks of lower-than-expected inflation, or even deflation, will increase, because interest rates are already close to zero and only limited options remain for using monetary policy to respond.”

“The result would be premature increases in the cost of borrowing and higher real debt burden. The lingering danger is that the longer inflation remains weak, the more vulnerable the region is to damaging debt deflation in the event of adverse shocks to activity.”

Emerging market risk – the higher cost of capital resulting from tighter financial conditions could slow down investment and durables consumption more severely than forecast, which in turn would hinder growth.

Another concern is capital outflows – investors may move more of their money than expected from emerging to advanced economies.

The IMF wrote:

“There is a risk of renewed bouts of market volatility with the expected normalization to a more neutral monetary policy stance in the United States. In either case, the result could likely lead to financial turmoil and difficult adjustments in some emerging markets, with a risk of contagion.”

Recent developments in Ukraine increase the risk of trade wars and market volatility due to political brinkmanship.

Policy implications

Regarding policy implications for the advanced economies, the authors say governments need to avoid a hasty withdrawal of monetary accommodation, “given continued fiscal consolidation, still-large output gaps, and very low inflation. In the euro area, more monetary easing, including via unconventional measures, is recommended to sustain activity and help achieve the European Central Bank’s price stability objective. And in Japan, policymakers need to deliver on the ‘third’ arrow of Abenomics—structural reforms to lift potential growth.”

Regarding policy implications for the emerging market economies, “the appropriate policy measures will differ.” Authorities need to allow the exchange rates to respond to changing fundamentals. Some economies will require a new round of structural reforms to improve GDP growth potential. “These include investment in public infrastructure, removal of barriers to entry in product and services markets, and, in China, re-balancing growth away from investment toward consumption.”

Low-income economies must avoid an accumulation of public and external debt. Many low-income nations have managed to maintain strong economic growth, in part due to better macroeconomic policies, “but their external environment has also been changing.”