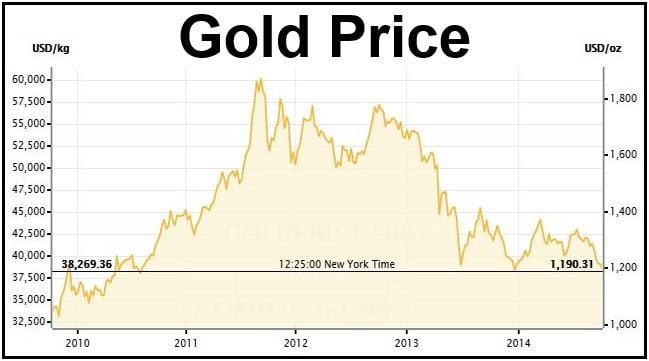

Gold fell on Friday following the release of US non-farm payrolls and unemployment figures for September, which exceeded expectations. Gold’s spot price slid below $1,200 to a ten-month low.

In September, unemployment fell by 0.2 of a percentage point compared to August, while the number of new jobs created by the private sector reached 248,000. Good economic news tends to be the kiss of death for safe haven trades.

As soon as the strong figures were released, the dollar continued upward as analysts speculated that the Fed was more likely to consider raising interest rates sooner than the second half of 2015.

Gold, which typically moves in the opposite direction to the dollar, fell. Since March 2014, gold has fallen by 13%. Import controls and tariffs in India have not helped.

With euro interest rates likely to fall, while the opposite is going to occur in the United States, the dollar reached a two-year high against the European currency. Experts in Europe are saying the dollar will carry on rising for at least two years.

(Photo: Goldprice.org)

The Diwali Festival, also known as the ‘Festival of Lights’, which starts on October 22, will boost gold sales slightly. However, most experts do not expect the impact on prices to be statistically significant. Diwali is one of the largest shopping seasons in India, when people buy new clothes, gifts, cars, gold jewelry and other items.

The Chinese national holiday in Hong Kong, another time when purchases of gold may peak, have been undermined by the street protests.

There are rumors that China will increase its gold reserves as part of its quest to become the world’s largest holder of the precious metal.

The United States, with 8,500 tonnes, has the largest stockpile of gold. Nobody outside the government’s inner circle of supremos has any idea of how much China may hold.

In after-hours trading on Wall Street, gold was selling $20 down at $1,193, which is a 12-month low. At the time of writing (Sunday October 5, 16.22 GMT), Goldprices.org quotes the precious meal at $1,190.31.

Many factors affecting gold, says HSBC

HSBC has revised down its gold and silver price forecast. The HSBC team believe and expected the dollar rally will run well into 2015 and will keep the two precious metals down.

Analyst James Steel, part of the HSBC team, said that the strengthening dollar due to expectations of higher interest rates may be a key factor on pushing down gold prices, but it is not the only one.

Mr. Steel said:

“Many of the factors associated with a stronger USD are inherently gold-bearish. Gold’s decline cannot therefore entirely be blamed on a stronger USD.”

The gradual tapering of the stimulus program by the Fed is pushing investors towards higher-yielding assets. When inflation is low, and it is ultra-low at the moment, inflation-hedge gold buying declines.

Add to this rising stock markets over the past few months and one can see there are several factors bearing down on gold prices.

However, HSBC does not see gold falling much below $1,200 per ounce. The team is more optimistic about silver.

Video – Gold dips below $1,200

Trader Bill Baruch joins Daniela Cambone at Kitco News to help make sense of what happened to gold prices on Friday.