Goldman Sachs announced that it has cut its price outlook for oil next year.

Goldman Sachs announced that it has cut its price outlook for oil next year.

The investment bank cited oversupply and the effects of a slowing Chinese economy as the two primary reasons for the slash in its price outlook.

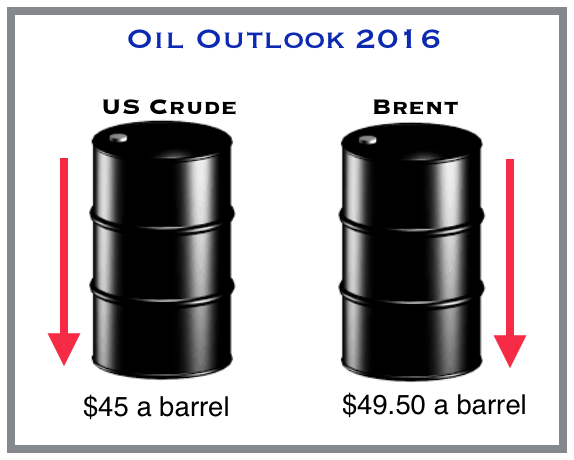

Goldman cut its 2016 forecast for US crude from $57 per barrel down to just $45. It also lowered its Brent forecast from $62 down to $49.50.

In addition, the bank said that the risks of a collapse to $20 is growing.

Goldman said in a note entitled “Lower for even longer”:

“The oil market is even more oversupplied than we had expected and we forecast this surplus to persist in 2016,”

“Despite the fiscal challenge that low oil prices create for OPEC producers, the alternative of reducing production would similarly undermine long-term revenues,” it added.

The bank said that crude could possibly plummet to the $20 per barrel level.

“While not our base case, the potential for oil prices to fall to such levels … is becoming greater as storage continues to fill.”

Growth in global demand is expected to decline next year because of the Chinese economic slowdown, which is will hit nations that rely heavily on commodity exports.

“Not only is emerging market growth slowing, but the benefits from lower prices are most likely behind us, as our … modeling shows that they typically last 9-12 months,” Goldman Sachs noted.

On top of that OPEC is expected to pump even more oil next year.

“Despite the fiscal challenge that low oil prices create for OPEC producers, the alternative of reducing production would similarly undermine long-term revenues,” it noted.

What this essentially means is that oil prices would have to drop by a really significant amount for OPEC to react and begin cutting output.

The reality is that demand isn’t going to surge anytime soon and major OPEC members are unlikely going to cut back output, which indicates that oil may very well tumble for a while longer.