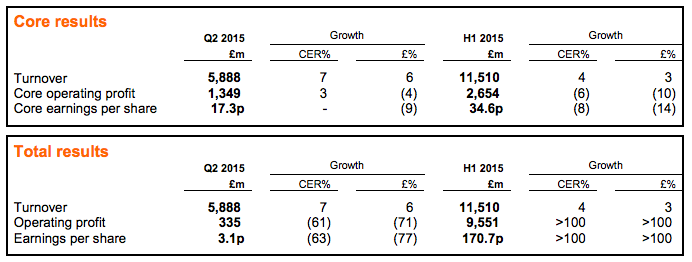

London-based multinational pharmaceutical giant GlaxoSmithKline (GSK) posted a six percent increase in second-quarter revenue to £5.89 billion ($9.19 billion).

It is the first full quarter for GSK after the $20 billion asset swap with Novartis, which brought in new vaccines and consumer health-care products.

Last year GSK sold its oncology business to Novartis for $16 billion. In return the company acquired the Swiss group’s vaccines division. The deal was completed in the first quarter of this year.

GSK Q2 Financial Results

Source: GSK

“This is our first full quarter of performance since completion of the transaction with Novartis and it is encouraging,” said Chief Executive Andrew Witty.

“Our integration and restructuring plans are on track and we remain confident that we can achieve our targets for this year and return the group to earnings growth in 2016.”

Witty noted that GSK’s HIV business performed particularly well.

“New product performance was positive in all three of GSK’s businesses, with the standout performance for the quarter coming from our new HIV drugs, Tivicay and Triumeq.”

Core operating profit dropped 4% to £1.35 billion, but beat analysts’ forecasts of £1.34 billion.

The group said its performance reflected “the disposal of GSK’s higher margin oncology business and the acquisition of lower margin vaccines and consumer healthcare businesses from Novartis”.

The company also said that core earnings per share for 2015 is expected to drop at a percentage rate in the high teens because of continued pricing pressure on Seretide/Advair in US/Europe, the dilutive effect of the Novartis transaction and the inherited cost base of the Novartis businesses.

Witty added:

“We will be showcasing further product innovation at our event for investors in November at which we expect to review new data and prospects for advanced and early-stage development projects in HIV, Oncology, Vaccines, Cardiovascular, Immuno-inflammation and Respiratory diseases.”

Shares of Glaxo rose around 3% after the results were released.