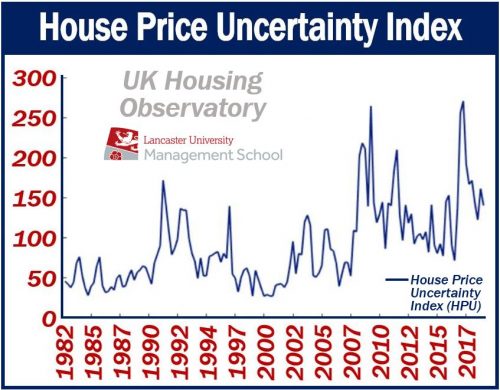

In the United Kingdom, the Brexit referendum pushed house price uncertainty to an all-time high. Researchers from Lancaster University Management School in England carried out a study using a new tool.

Professor Ivan Paya and colleagues say that UK house price uncertainty is far from over. The UK housing market’s potential risks are also far from over, they add.

Prof. Paya is one of the directors of the UK Housing Observatory at Lancaster University Management School (LUMS). The UK Housing Observatory is a project of LUMS’ Economics Department. It aims to improve our understanding of the British national and regional housing markets.

What is Brexit?

Brexit stands for BRitain EXITing the European Union. On 23rd June 2016, Britons voted in a referendum regarding staying in or leaving the European Union.

The Brexiteers got 51.9% of the vote while the Remainers got 48.1%. In other words, the British electorate narrowly voted for Brexit.

House Price Uncertainty tool

When the UK Housing Observatory members produced the latest quarterly analysis, they used the House Price Uncertainty tool. It was the first time they used the tool for this purpose.

The Observatory has been tracking house prices for the past few years. The latest release shows that, since the start of 2018, the UK’s property price growth rate has been falling. So far this year, the country has seen the lowest growth rate since 2013.

House prices this year in all UK regions have risen, except for Greater London. Greater London posted a decline of almost two percent over the last year.

Surprisingly, East Midlands (+4.4%), West Midlands (+4.2%), and Wales (+4%) had the highest growth in property prices. Scotland (+3.1%) has also experienced an increase.

House price uncertainty + cheap mortgages

Regarding house price uncertainty in the UK following the Brexit referendum, Prof. Paya said:

“The uncertainty in the housing market generated by Brexit, together with a continued subdued economic performance of the UK economy, are expected to put downside pressure on house prices.”

“On the other hand, very low real mortgage rates and restricted supply of new houses are the factors that will still keep UK house price growth on positive territory.”

Prof. Paya believes that house price growth will continue to decline during the rest of 2018. It will also fall during the first half of 2019, he adds, both across most regions and nationally.

By the Q2 2019, house prices will be rising by approximately 1.7%, members of the Observatory estimate.

It seems, therefore, that house price uncertainty and a sluggish market will continue as dominant features of the British real estate sector.

Greater London

Regarding Greater London, Prof. Paya said:

“Greater London is the only anomaly – as long as current economic trends continue, property prices will continue to decline in this region during 2018, and the first quarter of 2019, however prices will pick up towards the end of the following year.”

“The Price-to-Income Ratio continues to be high for historical standards, close to its all-time high in 2007. Despite the decrease in London house prices, the ratio has not declined substantially due to the fall in real income. This indicator, therefore, continues to be a source of concern as pressure on indebted households does not show signs of easing off.”