Over the past few decades, e-Commerce has become an integral part of the retail sector and online shopping. It has entered the daily lives of most consumers around the world. Digital payment trends have also changed.

Serious business take place without electronic support in the form of online stores or selling sites. Some merchants are completely switching to a more economical and convenient virtual format.

To organize online trading, you need tools that allow you to pay for the purchased product online, thereby making the whole process as simple and straightforward as possible for both the client and the seller. For this purpose, electronic payment systems have been created, which allow payments to be carried out on the site with just a few clicks.

Thanks to payment services, the buyer has the opportunity to immediately pay for the purchased product, without looking up from the monitor. The seller is paid rapidly, in most cases as soon as the purchase takes place.

Modern electronic service is a complex product based on a set of technical infrastructure and operations.

Generated into a single integrated system, these elements provide the ability to transfer funds from one entity to another in a non-cash format. In this case, online payment transactions go through the Internet. Such payment systems allow you to make online purchases and pay for goods and services using bank cards. How do payments work? Here are some features.

Card Authorization

Checking the validity of the card and its owner is carried out in many ways. For example, by entering a pin code during online authorization or contacting the bank and verifying the signature. There are many ways and not all of them are “online” and “offline”. For example, authorization using contactless payment technology can only be made using the card data. In some cases, with small amounts, an authorization may not be performed at all.

The terminal records the authorization information of the card and without contacting the bank gives the go-ahead for the operation. This is also because cards equipped with a chip and a contactless payment module can contain both an offline PIN verification module and store the amount of the client’s available funds.

Checking the availability of an amount is also not always used. Some companies can carry out the operation without verification. This often happens in situations where online checking of the availability of the amount is simply impossible.

Transaction Settlement

An acquiring bank, that is, a bank serving a point of sale or an ATM, or the very processing on the Internet site receives documents on the operation. These documents can be both electronic statements or unloading of an ATM operating statement, and paper documents. There are also very exotic methods, for example, copies of checks for operations carried out by “voice”, but they are extremely rare. Having received the documents, the bank generates clearing files.

These files are a spreadsheet of a certain format transmitted by the IPS through online systems and signed by the bank’s electronic signature. The IPS, in turn, generates clearing files for issuing banks, that is, banks that issued your card. Further, the issuing bank receives its clearing file, often several times a day, and carries out an operation to transfer funds in favor of the acquiring bank. At this moment, the money is debited from the card account, what is called a transaction happens. The blocking of funds, if any, is replaced with a real write-off.

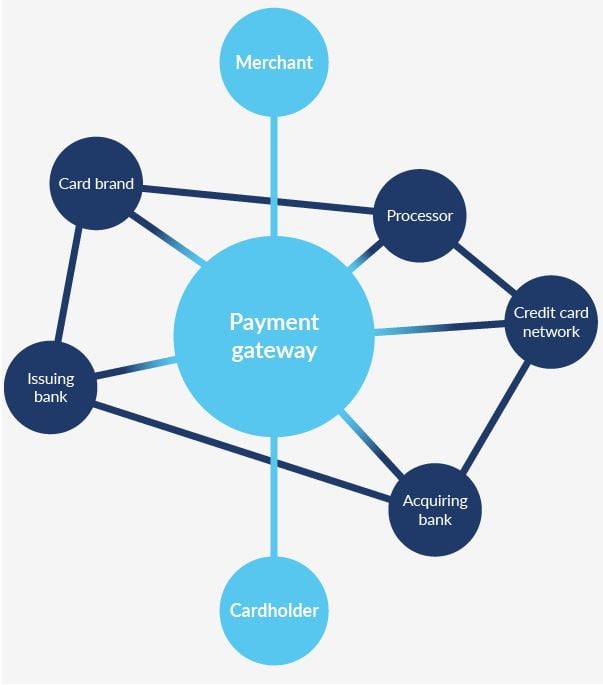

Payment gateway

In most modern online stores, it is almost impossible to process payments manually. The volumes are such that the user would rather leave than wait for the order. The use of payment gateways (Payment Gateway) reduces the time for processing payments, to put them on stream. The payment system is usually involved in the development of such tools, the seller only has to integrate the working script.

A payment gateway is a modern solution that allows online store owners to accept funds using bank cards. The system provides verification of information from the client. It acts as a guarantor of the security of the translation for the seller and the buyer.

Payment processor

It is a financial settlement transaction. It”s technically reversible currency exchange designated by a merchant to process transactions through various channels. Mostly these are credit cards and debit cards, for acquiring banks.

Merchant account

A merchant account is a special merchant account, the owner of which can accept payment cards VISA, MasterCard and others. it can receive payments from clients’ bank accounts. This is a convenient function. It ensures that payments are accepted around the clock, regardless of the bank’s or merchant’s working hours.

In addition, the merchant account allows you to accept payments from different countries. It makes it much easier to expand your activities outside your home jurisdiction. At the same time, merchants work with many currencies, which are often not available with “classic” banking.

Specialists of our company https://www.dataart.com/industry/financial-software are ready to offer useful solutions.

Interesting related article: “What is a Digital Wallet or e-Wallet?“