Contents

- What is Forex Trading

- How Much Money Do You Need to Start with Trading

- Understanding the Risks

- Where to Learn Trading Strategies

- Why Do You Need a VPS (Virtual Private Server)?

- Choosing the Right Broker

- Let’s Start Trading

- Conclusion

1. What is Forex Trading

The development of the Internet, technologies, the availability of mobile devices and their spread around the world have led to an increase in the popularity of Forex trading and a large number of Forex brokers.

Trading platforms are translated into different languages, which makes Forex trading easy and accessible for everyone. Every day, the number of traders on the exchanges grows and the volume of trading increases. Forex offers great opportunities to earn money, but these opportunities are necessary to be used.

The most difficult moment for any beginner is to start trading Forex. There is so much information that is very difficult to navigate. Forex trading, like any other type of earnings, requires knowledge and a serious approach.

2. How Much Money Do You Need to Start with Trading

Like any type of business, Forex requires an initial investment. To start trading, you need a minimum deposit. There is a rule that you can lose no more than 2% of deposit for one trade, so opening an order, you must set a stop loss so that even in case of failure, the maximum loss is no more than 2%.

However, beginners are advised to reduce the maximum loss to 1%. In this case, if a novice makes 10 unsuccessful trades in a row, which sometimes happens with beginners, then his total loss will be 10%, and if a novice sets a stop loss with the possibility of losing 2%, then for 10 unsuccessful trades he will lose 20% of his deposit, which is very risky.

Emotional excitement often leads to new mistakes. It should be noted that a stop loss with the possibility of losing 1% of the transaction can only be placed on the most stable assets. If the currency pair is not stable and is subject to strong volatility the transaction can easily be closed with a stop loss and the trader will lose money.

Too small a deposit does not allow you to recover if several transactions were closed at a loss. For the same reason, beginners are not advised to have many open orders at once. In this case, they can quickly lose control of the situation. And strong excitement will make the situation even worse.

3. Understanding the Risks

Trading on an exchange, you should be aware that Forex trading carries risks. With the right and competent approach, you can constantly and steadily earn money, but trading errors can cost a lot.

Therefore, the task of traders is to minimize the risk of errors. Each strategy used by a trader requires its own approach.

To reduce risks, some Forex brokers offer demo accounts, where you can try out any strategy without risking money, and at the same time determine the size of the deposit to start.

At the first stages, you need to trade as conservatively as possible in order to reduce your risks.

4. Where to Learn Trading Strategies

Before you start trading, you need to familiarize yourself with the trading platform and study the material that is presented on the platform. Brokers working in the Forex market for a long time usually have enough training material to start working on the exchange.

In addition, exchanges provide news materials explaining how this or that news affects the price of an asset.

You should start with the simplest and most understandable strategies. It is better to test these strategies on demo accounts beforehand. Therefore, choosing an exchange, it is very important that the broker has a demo account. You’d be surprised to know things you wouldn’t ever have thought possible, such as the ability to scan for unusual options activity or see indicators of volatility before major price swings.

5. Why Do You Need a VPS (Virtual Private Server)?

The forex VPS is provided to you for personal use. This is a separate virtual computer that allows you to conduct round-the-clock automated trading, even when you are asleep, at work or on vacation, which significantly increases your income from trading.

Access to the virtual computer can be obtained from any device, which is very convenient when you are on vacation or at work.

We recommend forex hosting from FXopen.

6. Choosing the Right Broker

For a beginner, it is very important to choose the right broker. There are a huge number of brokers, so without trading experience, it is difficult to find the most suitable broker.

Traders trust their money to a broker, so reliability is an important criterion for any broker. It is also important how many years the broker has been working, and what reviews there are about the broker on the Internet.

The broker’s activities must be regulated. This ensures that the broker will protect the rights of traders, as the regulator controls the broker’s activities.

It is also important to have a demo account and training and reference materials. In this case, the novice will not need to search for the necessary information on the Internet. Serious and proven Forex brokers have a large database of training material specially adapted for the Forex broker’s platform and for the accounts and tools that it offers. An additional advantage is market news and Analytics.

It is important to have representative offices all over the world, that the broker’s platform is translated into different languages. It is necessary to have support in your native language. This will help you quickly and correctly solve all the issues that arise when working with a broker.

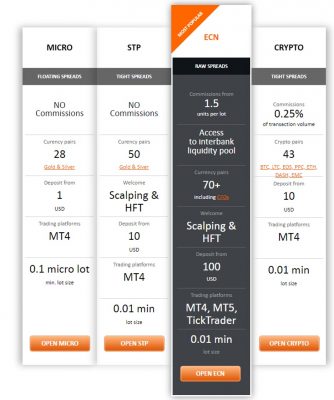

The size of the deposit also matters, and for experienced traders, the amount of leverage is also important. Although beginners should not use a large leverage.

You should also pay attention to the deposit and withdrawal methods.

7. Let’s Start Trading

After selecting a suitable broker, you need to register on the platform and install the platform for trading. If you have any questions, please ask support or get acquainted with the training materials provided on the platform.

If the broker is regulated, you will also need to verify your identity. In order to avoid problems working with the broker in the future, it is better to ask for support about verification, deposit replenishment, and withdrawal of funds.

Before you start working with a broker, we recommend you to try trading on a demo account.

Conclusion

Forex trading is available to everyone. Choosing the right and reliable broker will make it much easier for you to start trading.

If you have any questions on trade it is better to ask your questions to the Forex broker. Before trading, you need to test your strategy on a demo account. This way you will get the skills and experience you need without losing money.

Interesting Related Article: “Forex Trading Basics for Beginners“