HSBC Holdings plc is a multinational banking and financial services company based in London, UK.

It is one of the largest banks in the world, operating around 7,200 offices across 85 countries and territories, with over 89 million customers.

HSBC is named after its founding member, The Hongkong and Shanghai Banking Corporation Limited, which was formed in 1865 by Scotsman Thomas Sutherland. His company focused on establishing local banking facilities in Hong Kong and on the China coast.

By the end of the 19th century The Hongkong and Shanghai Banking Corporation was the foremost financial institution in Asia.

In the 1970’s the bank aimed to expand its presence in the USA and the UK. The company acquired the US based Marine Midland Bank.

A new holding company, HSBC Holdings plc, was formed in 1991. HSBC went on to acquire the UK based Midland Bank and became headquartered in London.

The bank is primarily listed on both the Hong Kong Stock Exchange and London Stock Exchange (LSE). As of March, 5, 2013, HSBC is the second largest company on the LSE (after Royal Dutch Shell).

HSBC Holdings plc – Company Overview

CEO: Stuart Gulliver

CEO: Stuart Gulliver- Chairman: Douglas Flint

- Industry: Banking

- Type: Public limited company

- Listed on LSE, SEHK, and NYSE

- LSE stock symbol: HSBA

- SEHK stock symbol: 0005

- NYSE stock symbol: HSBC

- Profit for the year: $17,800 million USD (2013)

- Earnings per share: 0.84 USD (2013)

- Founder: Thomas Sutherland

- Founded: 1865 (The Hongkong and Shanghai Banking Corporation), 1991 (HSBC Holdings plc)

- Headquarters: 8 Canada Square, Canary Wharf, London, United Kingdom

- Employees: 254,000 (approximately)

- Website: http://www.hsbc.com/

- Investor relations contact number: +44(0) 870 702 0137

- Investor relations email: [email protected]

HSBC Holdings plc – Financial Results

| Key figures (in millions of USD except for share data) | 2013 | 2012 |

| Total operating income | $78,337 | $82,545 |

| Net operating income | $58,796 | $60,019 |

| Total operating expenses | ($38,556) | ($42,927) |

| Operating profit | $20,240 | $17,092 |

| Profit before tax | $22,565 | $20,649 |

| Profit for the year | $17,800 | $15,334 |

| Total assets | $2,671,318 | $2,692,538 |

| Shareholders’ equity | $181,871 | $175,242 |

| Cash and cash equivalents at 31 December | $346,281 | $315,308 |

| Earnings per share – basic (in USD) | $0.84 | $0.74 |

| Earnings per share – diluted (in USD) | $0.84 | $0.74 |

Source: “HSBC Holdings plc Annual Report and Accounts 2013”

Stuart Gulliver, Group Chief Executive, commented on the results:

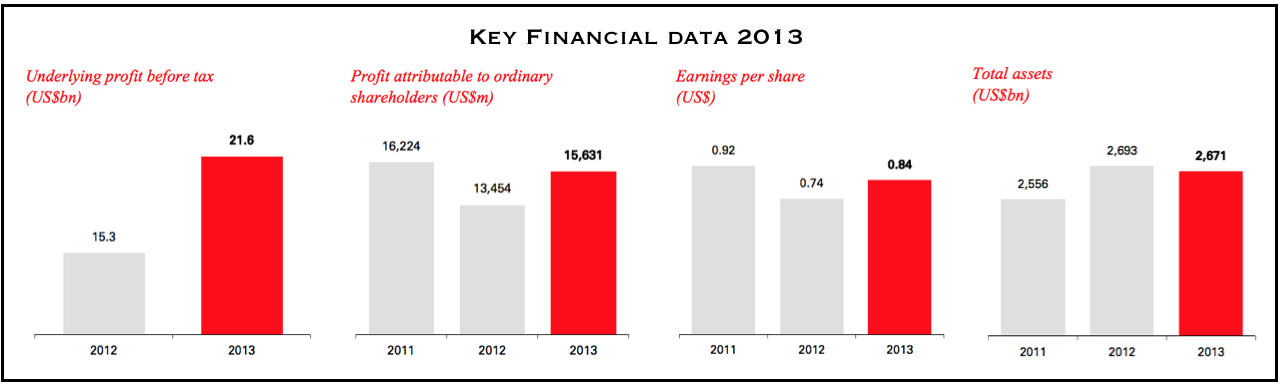

“Our performance in 2013 was influenced by the strategic measures that we have taken since the start of 2011. Reported profit before tax was US$22.6bn, US$1.9bn higher than 2012, and underlying profit before tax was US$21.6bn, US$6.3bn higher than last year. Underlying revenue grew 9% faster than costs in 2013.”

He added:

“Underlying profit before tax was higher in three out of our four global businesses and all of our regions, with the exception of Latin America where underlying profit before tax fell. Whilst our performance in Latin America was affected by slower economic growth and inflationary pressures, we made significant progress in repositioning our portfolios with a focus on our priority markets of Brazil, Mexico and Argentina.”

HSBC Holdings plc – Live Stock Market Data

HSBC Holdings plc – News Feed

[wp_rss_retriever url=”http://www.hsbc.com/rss-feed” excerpt=”100″ items=”5″ read_more=”false”]

News:

August 4, 2014: profit for the first half of 2014 declined by 12% to $12.34 billion from $14.07 billion during the same period last year. It was the steepest decline since 2009. Underlying revenue fell to $31,359 billion from $32,720 billion. The bank put aside $234 million to cover PPI and other possible settlements.