IBM reported a mixed third-quarter earnings report on Wednesday, with an increase in revenue but a net loss of $330 million.

The net loss was due to a one-time, non-cash pension settlement charge of $2.7 billion. On an adjusted basis, excluding the charge, IBM reported earnings of $2.30 per share (up 5% from the same period last year).

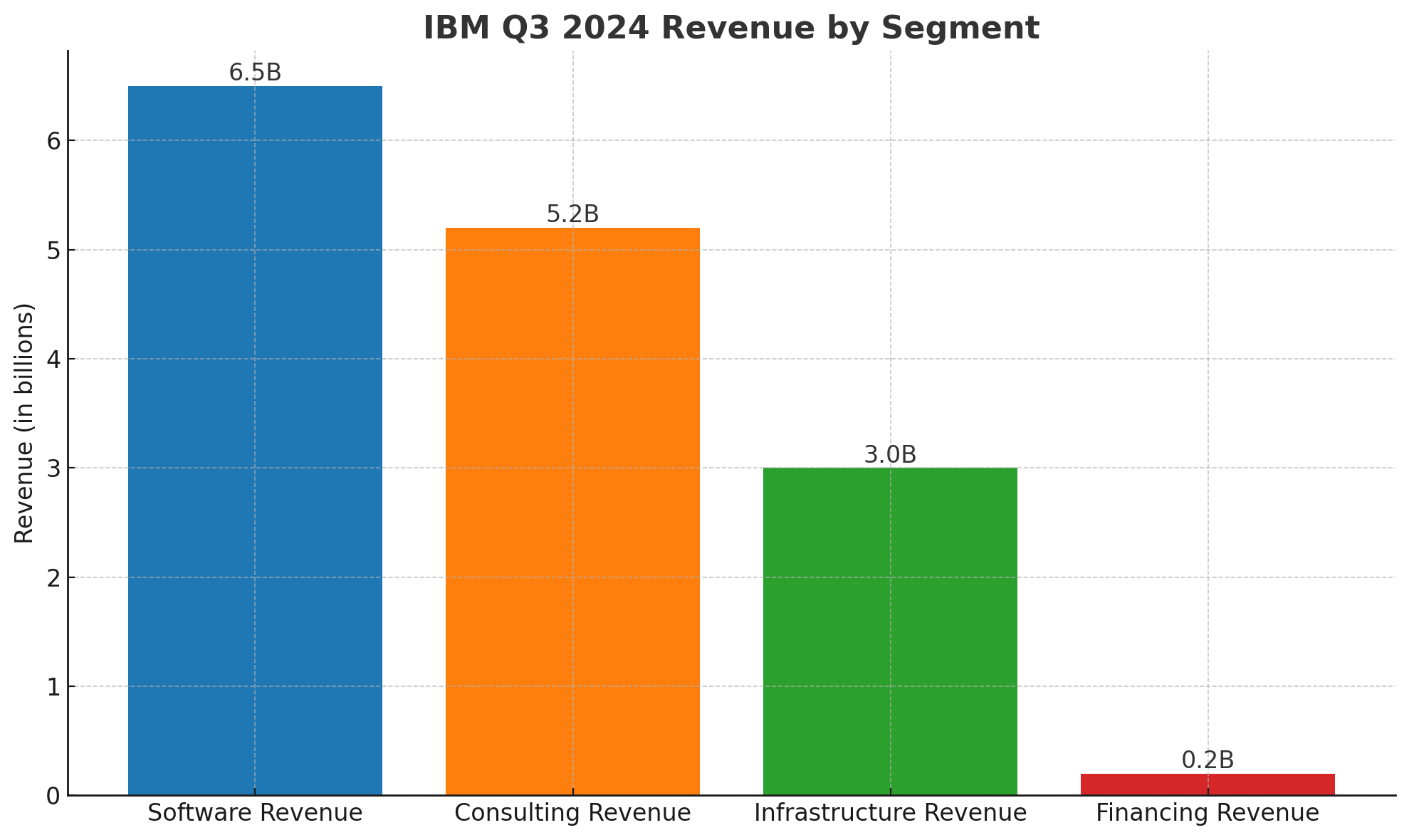

Revenue rose 1% in the third quarter (compared to the year before) to $15.0 billion, with sales in its software business up 10% to $6.5 billion.

IBM’s software business reported solid growth in revenue nearly across the board, with Red Hat up 15%, Automation up 13%, Data and AI up 5%, and Security down 1%.

“Our investments are paying off in Software as we’ve repositioned our portfolio in recent years. In the third quarter, Software delivered broad-based growth and now represents nearly 45 percent of our total revenue. Our ongoing focus on product mix, coupled with our productivity initiatives enables us to continue to drive operating leverage in our underlying profit performance,” said James Kavanaugh, IBM senior vice president and chief financial officer.

“With our strong cash generation, we are well-positioned to continue investing for growth while returning value to shareholders through dividends.”

However, its three other key segments all reported a decline in revenue. Consulting revenue was down 0.5%, Infrastructure revenue fell 7%, while revenue for its Financing business dropped 2.5%.

Arvind Krishna, IBM chairman, president and chief executive officer, commented:

“Our third-quarter performance was led by double-digit growth in Software, including a reacceleration in Red Hat. We continue to see great momentum in AI as our models are trusted, fit-forpurpose, and lower cost, with performance leadership. Our generative AI book of business now stands at more than $3 billion, up more than $1 billion quarter to quarter.”

Krishna added: “Heading into the final quarter of 2024, we expect fourth-quarter constant currency revenue growth to be consistent with the third quarter, with continued strength in Software. We are confident in our ability to deliver more than $12 billion in free cash flow for the year, driven by continued expansion of our operating margins.”

Data source: IBM 3Q 2024 Earnings Announcement