The International Monetary Fund (IMF) recently upped its economic growth prediction for China for the year 2023, citing improved consumption and new policy measures declared by Beijing.

A Closer Look at the Revised Forecast

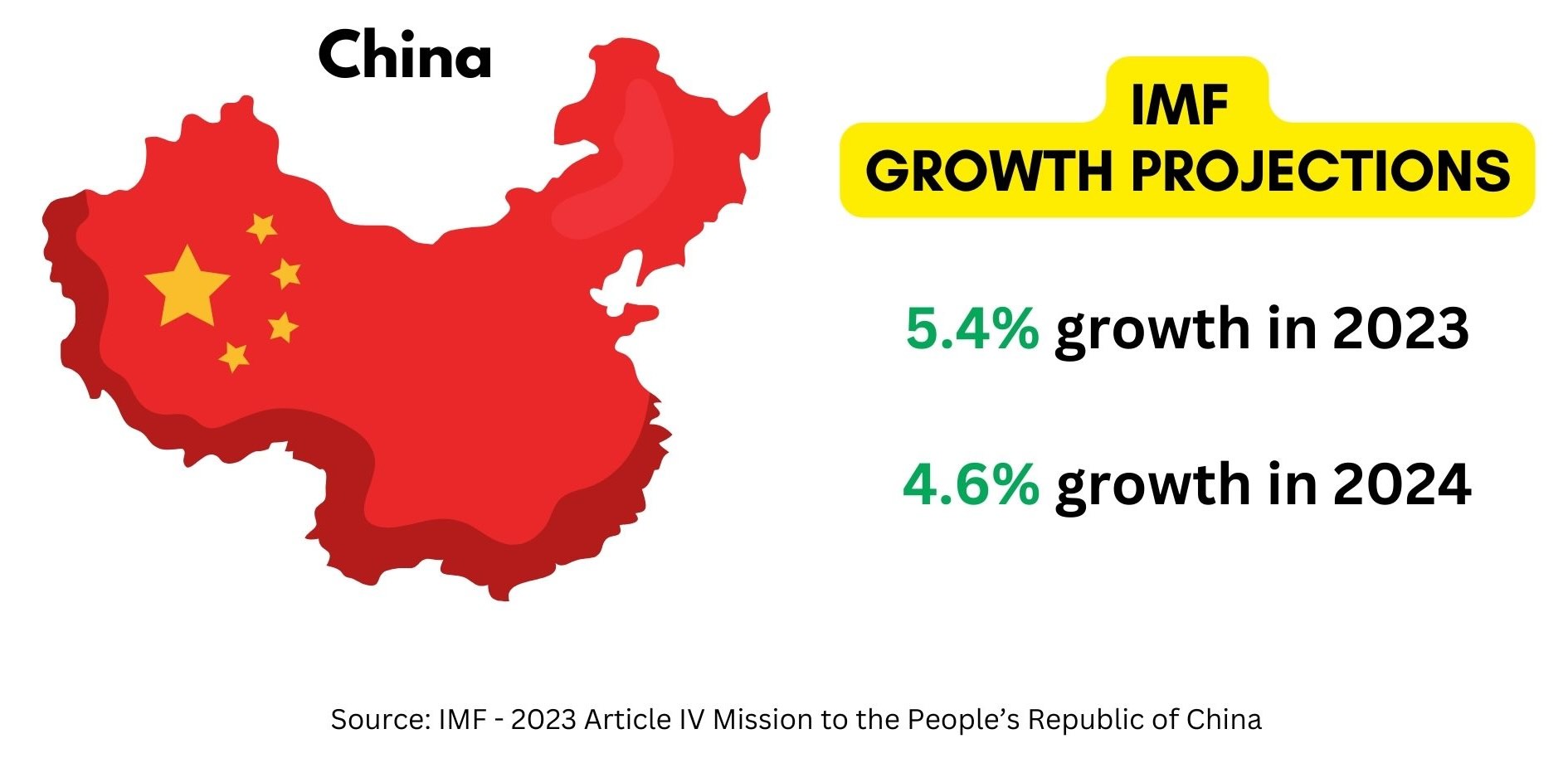

IMF’s First Deputy Managing Director, Gita Gopinath, unveiled the revised forecast in a press conference held in Beijing. The institution now projects China’s GDP to grow by 5.4% in 2023, up from an initial estimate of 5.0%. The outlook for 2024 has also been increased to 4.6% from 4.2%.

The upward revision reflects a robust rebound in domestic demand, particularly consumption, following the reopening of the economy. This is in contrast to last year when the economy expanded by just 3.0%, well below the official target of 5.5%, due to stringent Covid-19 measures.

“The Chinese economy is on track to meet the government’s 2023 growth target, reflecting a strong post-COVID recovery. Real GDP is projected to grow by 5.4 percent in 2023 and slow to 4.6 percent in 2024 amid continued weakness in the property sector and subdued external demand. These projections reflect upward revisions of 0.4 percentage points in both 2023 and 2024 relative to October WEO projections due to a stronger-than-expected Q3 outturn and recent policy announcements. Core inflation is projected to increase to 2.1 percent by end-2024 as output gap continues to narrow. Over the medium term, growth is projected to gradually decline to about 3½ percent by 2028 amid headwinds from weak productivity and population aging.”

Factors Fuelling the Upward Revision

There are several key factors that contributed to the IMF’s decision to upgrade China’s growth forecast:

- Stronger-than-expected Q3 Growth: China’s economy grew 4.9% in the third quarter of 2023, beating expectations and bolstering forecasts for full-year growth.

- New Policy Announcements: The revised forecast also factors in new policy support that was recently announced by Beijing. In October, the Chinese government announced that it would issue one trillion yuan ($137 billion) of sovereign bonds to boost infrastructure spending.

- Persistent Consumer Demand: Despite a slowdown in the property market, consumer demand remained resilient, driving domestic economic growth.

Remaining Challenges in the Property Sector

Despite the positive outlook, the IMF warns that the property market remains a significant challenge. The real estate sector, which contributes to about a quarter of China’s GDP, has been experiencing recurring crises over recent years, with major companies crippled by large debt amounts.

Gopinath emphasized that more action is needed to expedite recovery in the property market and lower economic costs. She suggested that non-viable property developers should exit the market faster, housing prices should adjust more flexibly, and there should be an increase in central government funding for housing completion.

The Question of High-Quality Growth

In addition to a higher growth rate, China is also striving for what it refers to as “high-quality growth”. According to Gopinath, high-quality growth involves shifting away from an investment-driven growth model to a consumption-driven one. It also includes strengthening the social safety net to encourage households to spend rather than save, and transitioning to a green economy.

Navigating Financial Risks

Financial stability risks remain a significant concern. Gopinath warned that financial institutions have lower capital buffers and growing asset quality risks. To combat this, improvements to local governments’ fiscal transparency and risk monitoring are necessary to prevent new vulnerabilities from emerging.

Addressing Local Debt

Local debt is another prominent issue. It has reached 92 trillion yuan ($12.6 trillion), equivalent to 76% of China’s economic output in 2022, up from 62.2% in 2019. Gopinath recommended that the central government should carry out coordinated fiscal framework reforms and balance-sheet restructuring to address local government debt strains.

In conclusion, the IMF’s upward revision of China’s economic growth forecast is a testament to the country’s resilience and strategic policy making. However, the challenges in the property sector, financial risks, and local debt require careful monitoring and strategic interventions to ensure sustainable, high-quality growth.