Inflation, or the CPI (Consumer Prices Index), declined by 0.1% in the 12-month period to September 2015, after posting no change (0.0%) in the year to August 2015, according to a bulletin published by the Office for National Statistics (ONS).

The ONS is part of the UK Statistics Authority, a non-ministerial department that reports directly to Parliament.

A basket of goods and services that cost £100 in September 2014, would have cost £99.90 one year later (September 2015). September’s figure was below analysts’ predictions of 0% growth.

According to the ONS, a smaller than usual increase in clothing prices plus declining motor fuel prices were the main contributors to September’s fall in the rate.

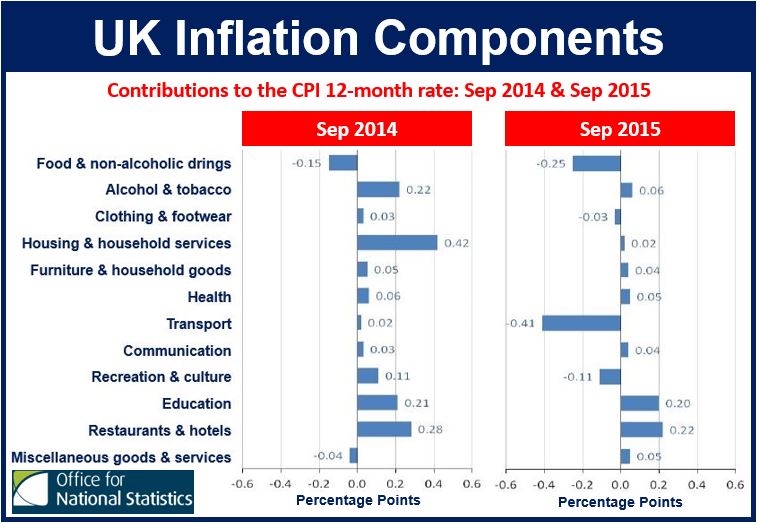

In the 12-month period ending September 2015, three components drove down the index. (Source: Office for National Statistics)

In the 12-month period ending September 2015, three components drove down the index. (Source: Office for National Statistics)

In the 12-month period to September 2015, motor fuels and food prices fell by 14.9% and 2.5% respectively. These two groups reduced the 12-month CPI rate by about 0.8 of a percentage point in September.

The UK’s inflation rate has been at or around zero percent for most of this year.

CPIH, which the ONS stresses is not a National Statistic, grew by 0.2% in the 12-month period to September, compared to 0.3% in August. In August this year, the CPIH’s status was removed pending work to improve methods for measuring owner occupiers’ housing costs in the index. CPIH is CPI plus Housing (owner occupiers’ housing costs).

The CPI declined by 0.1% between August and September this year, compared with virtually no change between the same two months in 2014. The ONS says this is the first time the CPI has fallen between August and September.

Moneywise quoted Vicky Redwood, chief UK economist at Capital Economics, who said:

“Deflation returned in the UK in September, although it is likely to be another very brief and shallow affair. Inflation could stay negative for another month or two, but it is still likely to rebound at the turn of the year when the previous bigger falls in energy prices drop out of the annual comparison. So we still think that the risks of a more serious period of deflation are low.”

Negative inflation good for consumers, but…

Declining prices help reduce household bills. With wage growth picking up recently, British consumers’ spending power has finally received a significant boost.

However, central banks and governments are wary of falling prices, because they can eventually cause the economy to slow down, and even slide into a recession.

If consumers expect prices to continue falling, they tend to postpone their purchases. If you are considering buying a new TV and expect prices to fall, you may decide to wait a while to see if you can get better deals later on.

If consumers are not spending, companies sell less. If companies sell less their profits fall, they may start laying off workers, and will take measures to reduce their costs (including workers’ wages).

In the last quarter of the 20th century, Japan went through nearly 20 years of deflation plus recession.

In an interview with the Financial Times, Michael Saunders, an economist at Citigroup, said regarding the UK’s inflation rate:

“We expect that inflation will again undershoot consensus and MPC forecasts in the next year or two. External conditions remain disinflationary, and previous experience suggests that the full effect of these pressures takes a while to feed through.”

Update – October 15th, 2015: The ONS reported that UK unemployment fell to 5.4%, a seven-year low.