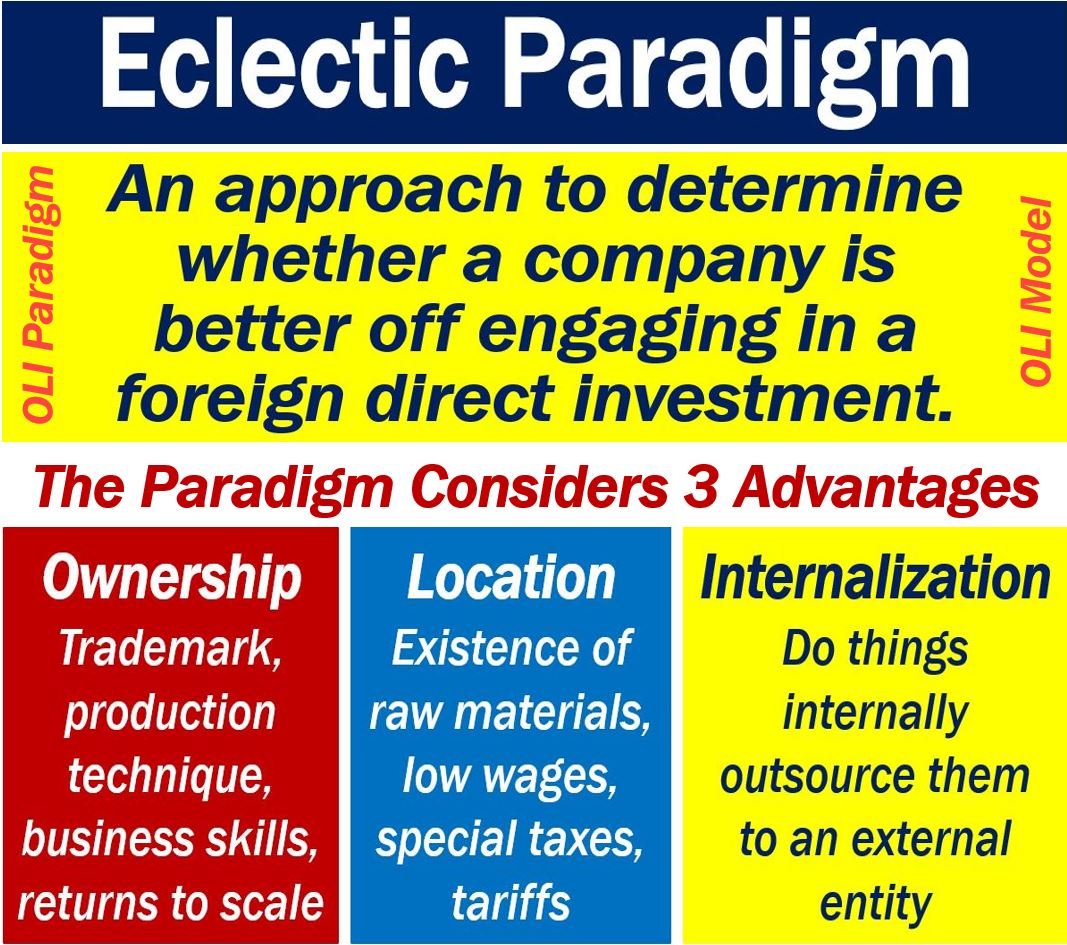

The eclectic paradigm is a business approach that analyses whether a company should make a foreign direct investment. It is a holistic economic model to determine whether a business should expand abroad through foreign direct investment. The eclectic paradigm is a theory that provides a three-tiered framework for companies to follow. They follow the frameworks when deciding whether they should invest abroad.

The eclectic paradigm theory posits three kinds of advantages for a multinational company:

1. Ownership.

2. Location.

3. Internalization.

Hence, we also refer to it as the OLI paradigm, OLI framework, or OLI model. OLI stands for Ownership, Location, and Internalization.

Three eclectic paradigm advantages

Ownership advantages

These are all about the competitive advantages of the company that seeks to engage in foreign direct investment (FDI).

A competitive advantage is an edge over competitors, i.e., something its rivals don’t have. Specifically, an edge regarding the provision of a product or service.

For example, Mercedes’ competitive advantage is reliability. In other words, Mercedes’ vehicles break down less often than other vehicles.

The greater a company’s competitive advantage, the more likely it is to engage in FDI.

Location advantages

The term ‘location advantages’ refers to the alternative countries for undertaking the value-adding activities of the multinational company.

Internalization advantages

Is it more advantageous for the company to do things internally or have an external entity do them?

Perhaps outsourcing is a good option if the foreign companies, for example, do a better job. Maybe they can also do it more cheaply and have better local market knowledge.

Put simply; would it be better to make the product in that foreign country or to outsource the work?

To outsource means to farm out work to a third party rather than doing it in-house.