Kroger sales increased 4.6 percent in the first quarter of 2014, pushing shares up by 5.1% to $49.66 in early trading today. America’s biggest grocery chain reported adjusted net income (excl. charges) of $557 million or $1.09 per diluted share, compared to $481 million and 0.92 cents respectively last year, exceeding Wall Street expectations. The retailer says grocery consumers appear to be gaining more confidence in the economy.

The strong financial results were boosted by Kroger’s $2.44 billion acquisition of Harris Teeter Supermarkets, Inc., a deal that was approved in 2013 and completed in January 2014. Harris Teeter added more than 200 supermarkets to Kroger’s number of outlets, mainly in the U.S. southeast.

Kroger’s Simple Truth line of natural, organic foods, which the company predicts will become a billion dollar brand within 24 months, has helped it pull shoppers from Sprouts Farmers Market Inc. and Whole Foods Market Inc.

Rodney McMullen, Kroger’s chief executive officer, said:

“Kroger associates continue to enhance our connection with all customers and achieve our key performance measures, which are allowing us to achieve our growth strategy and create shareholder value.”

“Our strong first quarter results set us up to deliver a 12-15% net earnings growth rate for the year, partly due to the benefit of Harris Teeter, compared to our long-term growth rate of 8-11% plus the growing dividend. We are pleased to start the year with growth momentum while also returning $1.1 billion in cash back to shareholders this quarter through our buyback program.”

Greater consumer confidence, but economy still fragile

Higher-than-expected sales have continued into this current quarter, Kroger informs. The company adds that shoppers are not cutting back any more on the types of products they would normally avoid during hard times.

Even though customers perceive the economy to be undergoing a rebound, Mr. McMullen warned that the recovery remains fragile, especially for lower-income families.

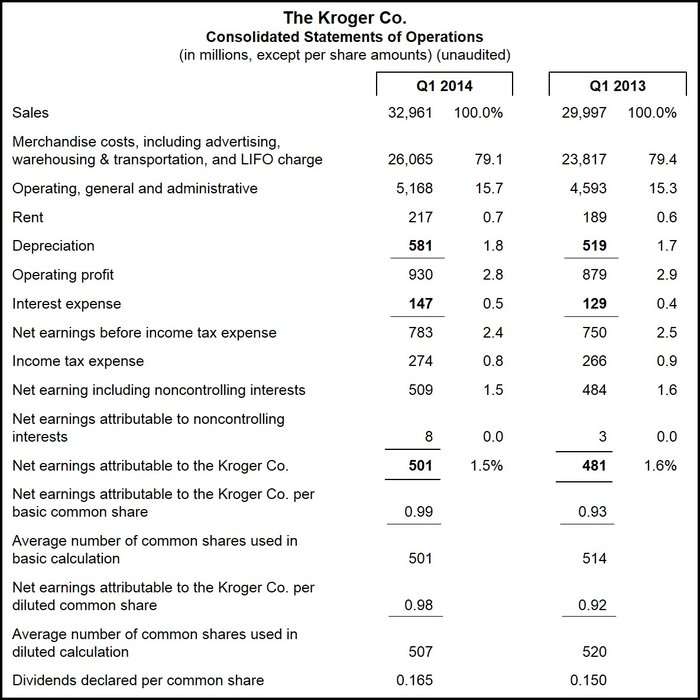

Total sales rose by 9.9% to $32.96 billion in Q1 2014 compared to $30 billion in Q1 2013. Sales, not including fuel, rose by 11.4% compared to Q1 2013.

A $28 million LIFO charge was recorded in Q1 2014 compared to $17 million in Q1 2013. Its LIFO estimate for the year has increased from $55 million to $90 million.

FIFO gross margin stood at 21.01 of sales for Q1 2014. Excluding fuel, FIFO gross margin rose 1 basis point compared to Q1 2013.

Share buybacks and dividends

Over the last twelve months, Kroger managed to return over $1.9 million to shareholders through dividends and buybacks. As foreseen in the company’s original guidance, in the first quarter, 25.7 million common shares were repurchased for $1.1 billion.

Capital investments, which include purchases of leased facilities and M&A (mergers and acquisitions) reached $709 million in Q1 2014, compared to $640 million during the same quarter last year.

Return on invested capital was 13.5%, about the same as it was last year (on a rolling four quarters 52-week basis).

Net total debt increased by $3.4 billion to $11.3 billion. This includes debt related to the acquisition of Harris Teeter, as well as Kroger’s share repurchases.

Fiscal 2014 Guidance

The company has raised and narrowed its adjusted net earnings to a range of $3.19 to $3.27 per diluted share for fiscal 2014, compared to its original guidance of $3.14 to $3.25 per diluted share.

Its long-term net earning per diluted share growth rate guidance stands at 8% – 11%, plus a growing dividend.

Kroger’s identical supermarket sales growth guidance (excl. fuel) has been raised to 3% to 4% for fiscal 2014, versus its original guidance of 2.5% to 3.5%.

Kroger predicts that its organic brand “Simple Truth” will be worth over $1 billion within two years.

About Kroger

The Kroger Company was founded by Bernard Kroger in 1883 in Cincinnati, Ohio. It is the biggest supermarket chain in the US by revenue and the country’s second-largest retailer (after Walmart). It employs 375,000 workers and is the fifth largest retailer worldwide.

Kroger has:

- 2,642 supermarkets and multi-department stores. The retail outlets trade under several local banner names, including Smith’s, Ralphs, QFC, King Soopers, Jay C, Harris Teeter, Fry’s, Fred Meyer, Food 4 Less, Dillons, City Market, and Kroger.

- 787 convenience stores,

- 324 fine jewelry stores,

- 1,261 supermarket fuel centers,

- 37 processing plants.