Lower US IPO activity cannot be blamed on tighter regulation, researchers from the Rotman School of Management at the University of Toronto, Cornell University, and Ohio State University, reported today after carrying out an intensive study of initial public offerings (IPOs).

The study, titled “The U.S. left behind? Financial globalization and the rise of IPOs outside the U.S.”, was published in the Journal of Financial Economics.

Dramatic decline in US IPO activity

The study found significant changes in the IPO landscape worldwide over the last twenty years, including a considerable decline in IPO importance in the United States and the opposite occurring in other countries.

If US IPO activity decline is not due to tougher regulations, then what is causing it?

The decline in American IPOs cannot be explained by stricter regulations that came into force after the corporate and accounting scandals in the early 2000s, the authors wrote.

Co-author, Craig Doidge, said:

“One of the main things people point fingers at is the Sarbanes Oxley Act. We show that U.S. IPO activity became abnormally low before the Sarbanes Oxley Act was passed. The declining IPO activity was not caused by the regulatory changes in the U.S. in the early 2000s.”

Prof. Doidge believes that further research is required to find out exactly why US IPO declined so significantly.

US IPO activity especially low in small companies

The researchers gathered and analyzed data on over 33,000 IPOs from 88 different nations from 1990 to 2011. They found that American IPO activity has “generally not kept pace” with the country’s economic importance. Activity was markedly low in the US among small enterprises.

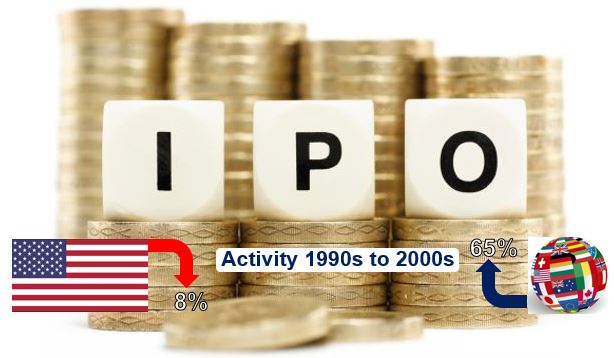

The raising of capital through IPOs among other countries rose by 65% from the 1990s to 2000s, while falling by 8% in the US.

Prof. Doidge, G. Andrew Karolyi and René M. Stulz concluded that while the US used to be the land of the IPO at one time “it is no longer so by the 2000s. Financial globalization has however benefited other countries, allowing them to overcome challenges to investment caused by weak domestic institutions.”

In January 2014, the Committee on Capital Markets Regulation expressed concern about US capital market competitiveness, which remained weak in Q4 2013. Director of the Committee, Prof. Hal. S. Scott said “I remain very concerned about the path U.S. capital markets have taken. Nothing indicates that our capital markets are on the road to competitive recovery.”

Overseas companies that raised capital in the United States in the fourth quarter of 2013 did so through private and not public markets “overwhelmingly”, the Committee reported.