A new survey finds while nearly half of UK firms applied for funding in the past year, few were aware of finance options outside of traditional bank loans and overdrafts.

The British Chambers of Commerce and Bibby Financial Services surveyed 1,011 firms across the UK one month before the June referendum voted to leave the European Union.

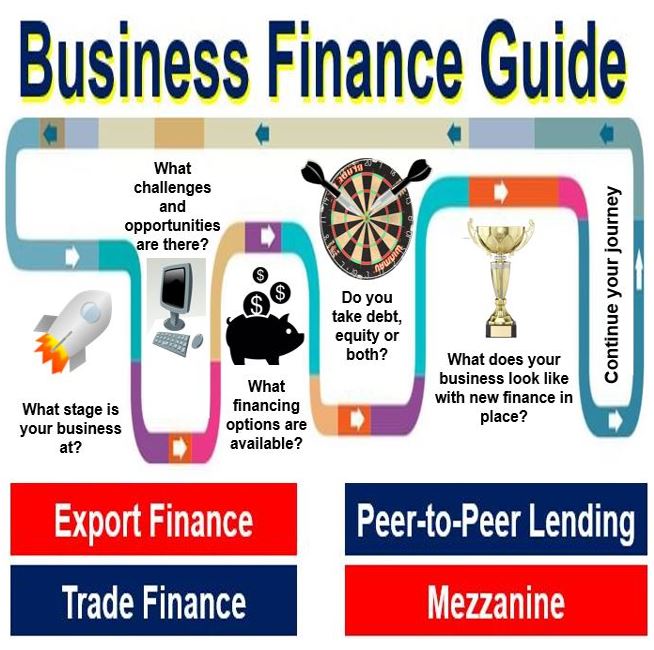

They found many businesses were unaware of alternative finance options – such as peer-to-peer lending, mezzanine finance, and export or trade finance.

Did you know there are several finance options available for your small business. Find out about them in the Business Finance Guide. (Image: adapted from the Business Finance Guide)

Did you know there are several finance options available for your small business. Find out about them in the Business Finance Guide. (Image: adapted from the Business Finance Guide)

UK firms appear to be most aware of overdraft facilities (92.8 percent) and least aware of mezzanine finance (18.8 percent).

Business owners seek funding for a number of reasons. The new survey shows 47.7 percent of UK firms applied for finance in the last year. Of these, 42 percent gave expansion as the main reason, followed by easing cash flow (26 percent) and funding start-ups (14 percent).

The key findings show that:

– 21 percent of UK firms said availability of finance has declined in last 3 years

– This compares with 23 percent who said routes to finance had improved

– The four finance options firms were most aware of were: overdrafts, bank loans, commercial credit cards, and leasing/hire purchase

– The four finance options they were least aware of were: mezzanine finance, angel finance, peer-to-peer funding, and trade finance.

Mezzanine finance is a cross between debt and equity funding that businesses typically use to finance expansion. It gives the lender the right to own equity or earn interest from it if the borrower does not pay back the loan.

Angel finance is where individual investors – dubbed business “angels” – invest their own money in return for a share of the equity. Peer-to-peer or P2P lending is where individual lenders are matched to borrowers through online services.

Export or trade finance refers to flexible, short-term loans linked to specific import or export transactions.

Low appetite for finance?

Dr Adam Marshall, Acting Director General of the British Chambers of Commerce, says even before the EU referendum, the results reveal a “low appetite for finance” among UK firms.

He says the findings imply many firms were already treading water and putting off plans for expansion well before the high-profile campaigns of the referendum.

The survey found 54 percent of the firms that secured finance but rejected it said the interest rate offered was too high, while 39 percent said the collateral required was too high.

This begs the question of whether the “appetite” would change if the perceived menu were different. Would more firms take up financing if they knew the full range of funding options?

David Postings, Global Chief Executive of Bibby Financial Services appears to favour this conclusion. He notes that many small and medium enterprises (SMEs) still appear to go to traditional sources of funding first. And yet, he notes, “there are a growing range of options available and it’s important that businesses consider forms of finance that fit their own requirements.”

To learn more about types of finance for different stages or challenges in a business, see this interactive map. The map is part of the Business Finance Guide produced by the Institute of Chartered Accountants in England and Wales (ICAEW) and the British Business Bank.

Video – Business Finance Options

In this British Business Bank video, its CEO Keith Morgan and Head of Corporate Finance at ICAEW, David Petrie, discuss the Business Finance Guide and how it can help smaller companies make more informed funding decisions.