Earlier this year Microsoft almost acquired the world’s largest software maker Salesforce

According to CNBC, Microsoft and the San Francisco-based cloud-computing firm reached advanced talks.

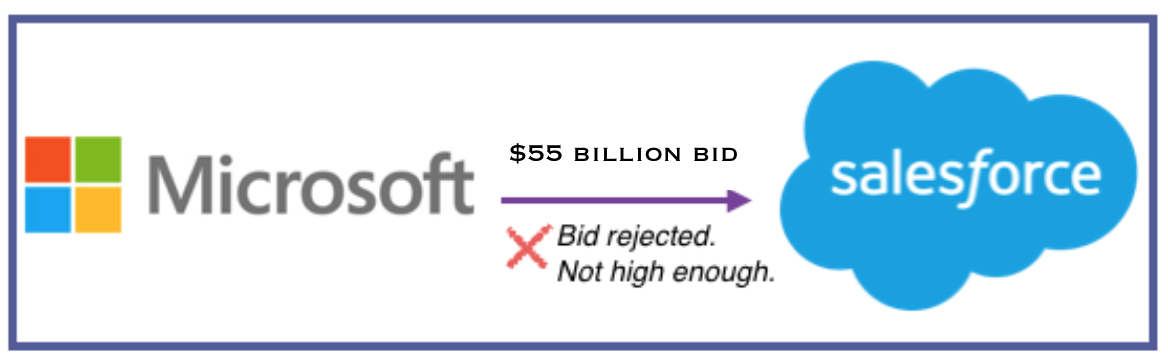

Microsoft reportedly offered as much as $55 billion to acquire Salesforce.

However, Salesforce CEO Marc Benioff rejected the bid as it wasn’t enough – he wanted something in the region of $70 billion.

Microsoft has over $95 billion in cash and cash-equivalents that it could have used to buyout Salesforce, which has a market valuation of over $49 billion.

If the deal did come to fruition it would have been one of the largest tech acquisitions in history, and the largest for Microsoft – which acquired Skype for $8.5 billion in 2011.

Salesforce is one of the leading cloud computing companies. It pioneered customer relationship management in the cloud – an area in which it competes heavily with Microsoft in.

But the two companies are complementary in other areas, and a merger would have helped Microsoft broaden its enterprise cloud strategy.

Microsoft insiders have told Reuters that the tech giant has made no recent offers, suggesting that the negotiations have ended.

Salesforce expects full year revenue of $7 billion

For the first quarter Salesforce posted revenue of $1.51 billion and expects revenue for the full year to be as high as $7 billion – making it one of the best performing cloud-based application company.

Benioff commented on the company’s first quarter results:

“Salesforce has surpassed the $6 billion annual revenue run rate faster than any other enterprise software company, and our current outlook puts us on track to reach a $7 billion revenue run rate later this year.”

For the current quarter Salesforce expects revenue of $1.59 billion, generating adjusted profit of between $0.17 and $0.18.