Mining companies in Canada are considering investing in renewable energy as a way to further bring down greenhouse gas emissions and stabilize energy costs.

So say Energy and Mines, an events arm of Ottawa-based Canadian Clean Energy Conferences, a firm that also researches energy innovation in mining. Adrienne Baker, one of their directors, says:

“Carbon pricing in Canada is having an impact on the energy choices of mines.”

In the mining industry, greenhouse gas emissions arise primarily from burning fossil fuels for energy.

In the mining industry, greenhouse gas emissions arise primarily from burning fossil fuels for energy.

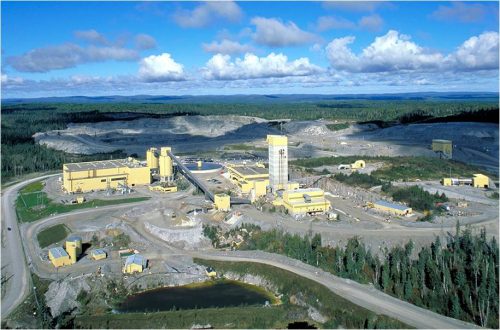

Image: Barrick Gold.

Many big mining firms operating in Canada – such as Barrick Gold, IAMGOLD, AurCrest Gold, Goldcorp, and TMAC Resources – are already investing in renewables and/or mine electrification.

According to Energy and Mines, they are doing this to “significantly reduce their carbon exposure, stabilize energy costs and boost social license to operate.”

Carbon is increasingly becoming a “commercial liability” and this is pushing Canada’s mining sector to look at using renewable energy options for remote sites.

Mining firms are also including renewable energy alternatives in feasibility studies for new operations.

Baker says, “The projects these mines are doing and the approaches they are taking to energy are models for the entire sector to mitigate carbon risk and address energy challenges.”

Climate change policies

Earlier this year, the Mining Association of Canada (MAC) – whose members include some of Canada’s largest mining companies – put forward several recommendations for designing nationwide climate change policies.

One recommendation was to establish a broad-based carbon price that is applicable to all sectors of the Canadian economy. Another was to support capital investment in technologies that lower emissions.

According to the Canadian Industrial End Use Data Analysis Centre (CIEEDAC), metal and non-metal mines in Canada – excluding coal and oil sands mines – accounted for 1.1 percent of the country’s total greenhouse gas emissions in 2014.

Among Canada’s mining companies, greenhouse gas emissions arise primarily from burning fossil fuels for energy.

Carbon floor price

Canada’s prime minister Justin Trudeau said recently that his government will bring in a carbon “floor price” minimum of $10 a tonne in 2018, rising by $10 each year to $50 a tonne by 2022.

A carbon floor price is essentially a tax where firms who generate power from fossil fuels have to pay for the right to pollute based on the amount of carbon in their greenhouse gas emissions.

As part of the COP21 accord – the Paris agreement on climate change – Canada has pledged to cut greenhouse gas emissions by 30 percent from 2005 levels by 2030.

Energy and Mines say the Paris agreement is also pushing mining leaders in other signatory countries with large mining sectors – including Chile, Argentina, and South Africa – to account for carbon exposure in their energy plans.