When it comes to sending money to each other, there are many different programs and methods available. There are some apps that offer people the freedom to move and travel while at the same time still be financially connected. There are many reasons to have one set up.

When it comes to sending money to each other, there are many different programs and methods available. There are some apps that offer people the freedom to move and travel while at the same time still be financially connected. There are many reasons to have one set up.

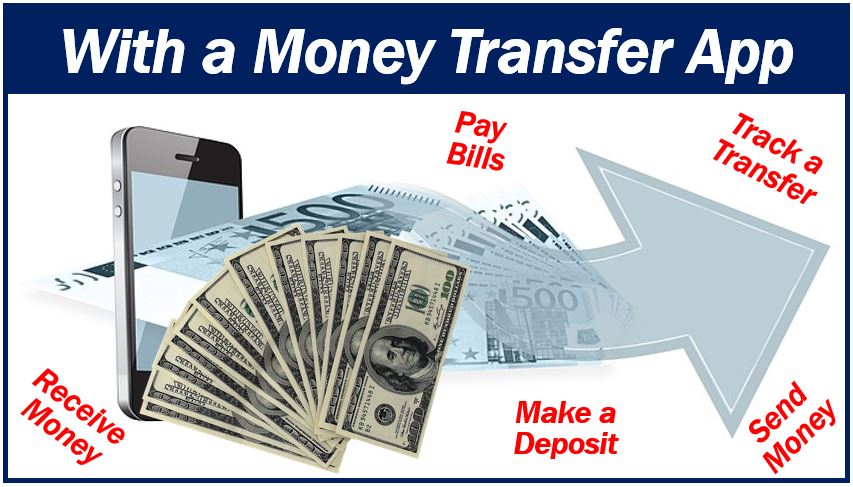

Send Money

When traveling or doing business, having a method to send money to family or clients can be a major benefit. Most money transfer apps are set up to transfer up to $10,000. In most cases, the app charges no fees and connects directly to a bank. This means that transfers are carried out securely and simply with the minimum of worry or hassle.

A bank money transfer app can be a fast and reliable way to send money to people inside and outside the country. It is also relatively more secure than most other options – it is less likely to be hacked. Mobile apps are ideal for the needs of the individual as well as the busines traveler. Users do not have to keep making currency exchange calculations every time they need to send or receive funds.

Receive Money

Money transfer apps work both ways, i.e., you can use them to send and also receive money. Users can receive money as a cash pickup, mobile credit, airtime top-up, or bank deposit. Unlike many other types of money transfers, the whole process is completed in just a matter of minutes.

For parents who have to send money to their kids, these apps are a godsend. Not only do they give parents peace of mind, but also their traveling child.

Pay Bills

Using an app to pay for bills can make traveling simple. Funds can be transfered from the banking app or mobile app to the intended recipient rapidly and without difficulty. It is safer than sending a check, which can, for example, get lost in the mail. A confirmation number is issued when the money is transferred to the financial institution. With just a few key strokes, the user can get information about how much was sent, when, and when the receiver got it.

Make a Deposit

Doing business on the road can mean trying to find a bank to deposit checks or make withdrawals. With an app that can send and receive funds, the business traveler’s employer can send money directly to their mobile account. A confirmation email and/or text will be sent directly to the corresponding account when the transaction is completed. It is as simple as that.

Transfers & Tracking

The app registers every money transfer by creating a log each time a transaction is completed. This makes it easy to monitor all your financial activities whenever you want and wherever you are. All you need is an Internet connection. You can use the app to check the status of a transfer by keying in its tracking number.

If something goes wrong, it is much easier and quicker to find out why thanks to these tracking features.

Conclusion

Since the turn of the century, transferring money electronically has become increasingly more common. Compared to three or four decades ago, how people manage their banking and financial activities have changed dramatically.

A transfer app is a useful tool for anyone who needs to transfer money around the world. It makes working easy, sending money to family simple, and takes no time at all. All that is needed is an account to get started.