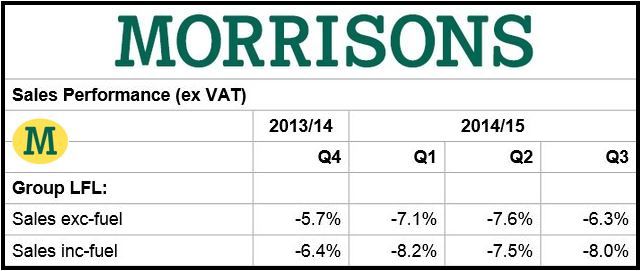

The UK’s fourth-largest supermarket chain Morrisons posted a 6.3% decline in sales. The Bradford-based company has started price matching the discounters in its drive to maintain and then gain market share.

The like-for-like sales decline for the quarter ending on November 2nd was not as steep as the 7.1% and 7.6% falls reported in the previous two quarters respectively.

Groups sales, excluding fuel, fell by 3.6% in the quarter.

The sales fall, which does not include fuel or business from new stores, comes as the ‘big four’ – Tesco, Asda, Sainsbury’s and Morrisons – face fierce competition from Lidl, Aldi and other discounters.

Sainsbury’s is responding by joining up with Danish discount chain Netto.

A three-year restructuring plan is underway at Morrisons, which aims to save £1 billion. Earlier this year it said it would be cutting its workforce by 2,600.

(Source: Wm Morrison Supermarket plc. “Q3 Interim Management Statement – 13 weeks to 2 November 2014″)

Morrisons is the only major supermarket to take the discounters head on with price-matching, according to CEO, Dalton Philips.

The company has launched a Match & More price match and points card, which it claims is a price match guarantee against Lidl, Aldi, as well as Asda, Sainsbury’s and Tesco. If a card holder shows there is a cheaper comparable grocery item in another supermarket, they will automatically get the difference back in points on their card.

Mr. Philips said:

“In May, we announced that we were lowering our prices permanently. Now we’re launching Match & More the most comprehensive price match and points scheme in the UK. Because it price matches the discounters, the Match & More card will provide the ultimate guarantee about Morrisons’ value-for-money.”

Morrisons says it remains confident it can reach its full year 2014/2015 target. It expects underling profit before tax to by in the £335m-£365m range rather than the wider £325m-£375m it had previously forecast, after new business development costs of £65 million and one-off costs of £70 million.