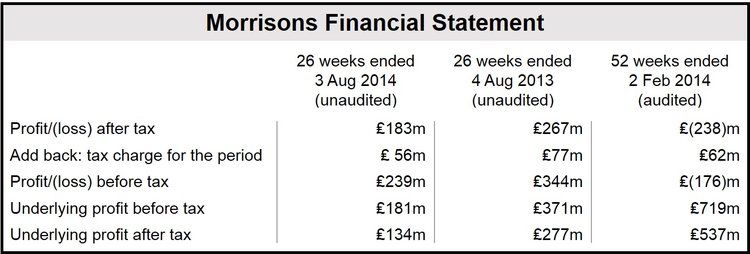

Morrisons profits fell by 51%, according to its half-year results to August 3, to £181 million from £371 million during the same period last year – the lowest profit for eight years. Like-for-like sales (excl. VAT) declined 7.4%.

Earlier this year, the supermarket chain reduced prices in its attempt to stop shoppers from drifting to discounters such as Lidl and Aldi, a move that severely hurt profits.

Sir Ian Gibson, Non-Executive Chairman, described market conditions as “tough”, adding that the industry is going through an unprecedented change. He assured investors that Morrisons is on the right path with building the foundations for a better future.

Sir Ian said:

“The Board is confident of the new strategy and Morrizons financial position remains strong. In line with the policy we set out in March, we are increasing the interim dividend by 5% to 4.03p, and confirm our commitment to pay a total dividen for 2014/15 of net less than 13.64p.”

Good signs from 3-year plan

Morrisons CEO, Dalton Philips, said the company is six months into a 3-year plan that had been set out in March. Even though it is early days, he says he is encouraged by the progress made so far.

Mr. Philips said:

“There is an enormous amount of change and modernization flowing through our course business, much of it enabled by new systems. Price investment, in-store improvements, and better products were all key components of the work undertaken in the first half, and the Morrisons card launches soon.”

“Our new growth channels – online and convenience – are progressing well, and our cost-savings and cash flow plans are both on track to achieve our ambitious three-year targets.”

(Data source: Wm Morrison Supermarkets PLC)

Morrisons outlook

The company is certain it will generate ₤2 billion in cash and ₤1 billion in cost savings over the next 36 months.

While like-for-like sales are yet to improve, Morrisons says there are some promising initial trends. “Our initiatives are on track and we anticipate that these will start to benefit our sales performance towards the end of the second half (of this year).”

Underlying pre-tax profit expectations remain unchanged at ₤325 million to £327 million, after discounting £65 million of new business development costs and £70 million of one-off costs.

UK’s changing grocery market

The UK grocery market is shifting away from the “big four” – Tesco, Sainsbury’s, Morrisons and ASDA – and moving towards low priced outlets such as Aldi and Lidl, says Kantar WorldPanel.

Today, 53% of British consumers say they have shopped at Lidl and/or Aldi during the last 12 weeks.

The list below shows how major supermarket chains’ market shares have changed from 12-weeks ending on August 18, 2013 (figure in brackets), to 12-weeks ending on August 17, 2014:

- ↓ Tesco: 28.8% (30.2%),

- ↑ ASDA: 17.2% (17.1%),

- ↓ Sainsbury’s: 16.4% (16.5%),

- ↓ Morrisons: 11% (11.3%),

- ↓ The Cooperative: 16.4% (16.6%),

- ↑ Waitrose: 4.9% (4.4%),

- ↑ Aldi: 4.8% (3.7%),

- ↑ Lidl: 3.7% (3.6%).

Among the “big four”, only ASDA managed to increase market share.

Grocery price rises slowing down

In August, grocery price inflation (annualized) was just 0.2%, its lowest level in eight years.

Grocery inflation has been kept down by fierce competition among the major supermarket chains, plus the declining prices of stable items such as milk, break and vegetables.