Mortgage approvals in October were 16% lower than in October 2013, compared to a 10% drop in September versus September 2013, the British Bankers’ Association (BBA) informed on Tuesday.

Chief Economist at the BBA, Richard Woolhouse, said:

“Despite softening in the housing market, consumers continue to show confidence in the economy with unsecured borrowing at its highest growth rate in years. At the same time we all continue to make the most of new ISA rules, stashing more in our savings accounts over the course of the last year.”

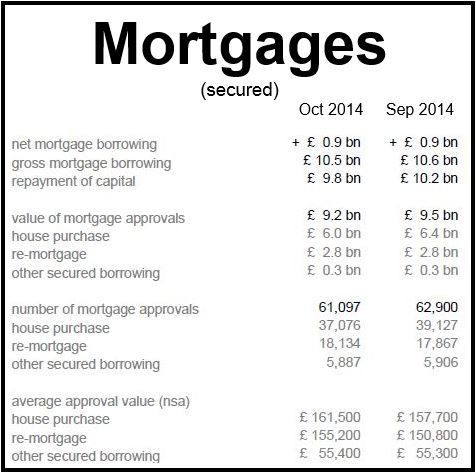

Gross mortgage borrowing totaled £10.5 billion, which was 2% higher than in October 2013. Even though demand fell, the overall mortgage stock continued to grow and was 1.6% higher in October than in the same month last year, the BBA wrote.

The implementation of the Mortgage Market Review earlier in 2014 led to a temporary bottleneck in the mortgage approval process, the BBA explained. After recovering slowly in June “recent figures indicate that overall approval numbers have slowed.”

In October 2014, house purchase approvals fell by -16%, remortgages by -21%, and equity withdrawals by -34%, compared to October 2013.

Source: British Bankers’ Association.

Unsecured loan demand

Demand for unsecured loans has increased, reflecting an easier borrowing environment and better household finances.

After contracting for a long period, net borrowing through personal loans and overdrafts is “now showing sustained annual growth,” the BBA said.

After factoring in increased coverage, spending was marginally stronger than the previous month. However, repayments overall exceeded spending, so annual growth has declined in recent months.

Business borrowing down

Borrowing by non-financial firms declined in the year to October by £13.9 billion. Most of the decrease, however, was within the real estate sector, an area where firms have been actively cutting their bank borrowing.

Regarding business borrowing, the BBA wrote:

“There is positive and sustained growth in the manufacturing, wholesale and retail sectors. Outside of real estate annual growth in borrowing by the real economy in October is the same as it was a year ago at -3.3%.