Moving states within the USA can mean saving or losing hundreds of thousands and even millions of dollars over their lifetime.

A free, online State Tax Calculator can help people compare how much they would be paying out in taxes if they moved to another state. The Calculator was developed by the National Center for Policy Analysis. Its creators say it is a first-of-its-kind tool.

The calculator computes the differences in several types of taxes at federal and state levels, including federal and state income taxes, sales taxes and property taxes a person would expect to pay over the rest of their lifetime when moving states.

Scott Burns, an economist, profiled the NCPA’s State Tax calculator at Asset Builder.

The calculator was developed by NCPA Senior Fellow Laurence Kotikoff. The model makes investment and saving decisions automatically for the household so that the individual can maximize personal consumption and spread it out over a lifetime.

NCPA Senior Fellow, Pamela Villarreal said “The tax burden in a new state can make a huge difference in your retirement plans.”

Villarreal gave some examples:

Moving from California to Alaska is a money saver – a 40-year-old male who earns $100,000 a year and moves to Alaska from California will have an extra $4,213 per year to spend, for the rest of his life. If that extra money were saved and left to his children, they would receive over three times his yearly income ($351,700).

Moving from New Jersey to Wyoming is also a money saver – a woman aged 40 years earning $500,000 per year who moves to Wyoming from New Jersey will have an extra $12,200 spare cash each year for the rest of her life. If she were to save this money for the rest of her life it would build up to $1 million.

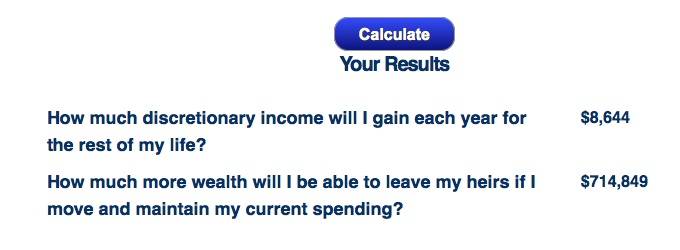

I pretended to be 21 years old earning $100,000 per year, wanting to move from New York to Texas. The calculator gave me this result.

Kotlikoff said:

“Moving to tax-friendly states can make a major difference to your lifetime living standard. This unique tool considers your income, housing costs, and the three big taxes that matter most to your move — income, sales, and property taxes.”

Villarreal said “The tax impact is much greater at higher incomes. High income taxpayers have a lot to gain by fleeing high-tax states. When they leave, the average taxpayer gets stuck with the higher tax burden.”

Rich people moving from Vermont to Texas save millions – a 40-year old entrepreneur who earns $1m per year and moves to Texas from Vermont will have an extra $38,000 spare cash each year. If this were saved during the rest of his/her lifetime, it would amount to $3.2 million.

Villarreal said “We’re already seeing some high-profile examples of tax-saving relocations. Golfer Phil Mickelson’s comments about moving out of California are one example. Another is LeBron James’s choice to play for the Miami Heat rather than NBA teams in higher tax states, like New York, Illinois and California.”

Moving states – what would happen to celebrities?

The State Tax Calculator was created for the average consumer. However, if one were to put celebrities’ data into it, the results are interesting, Villarreal said.

- Jay Leno would have an extra $93,776 a year ($4,284,899 over the course of his lifetime) if he moved to South Dakota from New York.

- Mitt Romney moving to New Hampshire from Utah would have an extra $872 per year, if saved annually for the rest of his life he would have accumulated an extra $36,122.

- Peyton Manning ended up with $172,398 less spare cash each year when he moved to Colorado from Indiana, a loss of $15,197,993 over a course of his lifetime.

- A move by Barack Obama to Hawaii from Illinois would mean $5,009 each year less in spendable income, which translates into a lifetime loss of $312,402.