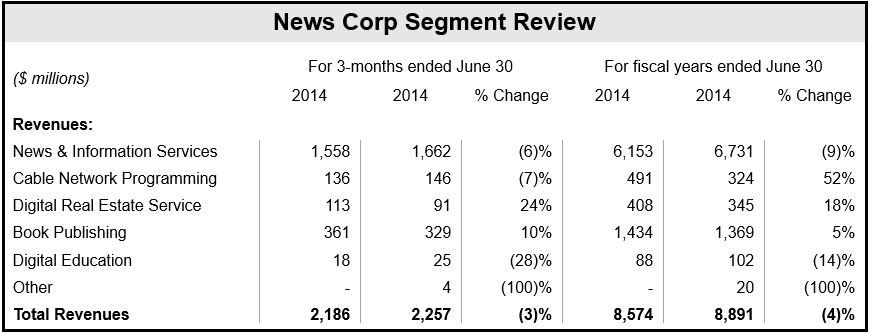

News Corp Q4 sales fell by 3% to $2.19 billion. The company informed that income from both advertising and subscriptions dropped during the quarter. In 2013, News Corp was split into two companies, with 21st Century Fox owning the media and entertainment unit while the new News Corp became the publishing business.

News Corp, like many major publishers, is struggling in the transition from print to digital.

Excluding the impact of acquisitions, divestitures and foreign currency fluctuations, revenue fell by 1%.

In the fourth fiscal quarter (ending June 30, 2014), falling profit in the news and information segment were greater than the increased earnings from its Australian digital real-estate unit and book publishing.

The company added that shrinking circulation of newspapers in Australia and the UK was partly offset by increased cover prices.

The subscription price for the Wall Street Journal and WSJ.com was raised.

Small profit after large loss last year

For the fourth quarter (ending June 30), the company made a profit of $12 million (2 cents per share) compared to a $1.12 billion loss in Q4 2013 following large impairment and restructuring charges.

EBITDA (earnings before interest, taxes, depreciation & amortization) dropped by 2% to $127 million, reflecting in part lower costs related to the company’s phone-hacking scandal in the UK. One year ago, legal and other costs linked to the scandal totaled $39 million, compared to $16 million in the quarter ending June 30, 2014.

(Data source: News Corp)

Print advertising slump

News Corp’s news and information segment continued posting steep declines in advertising revenue, especially print advertising.

Revenue in the news and information segment, which includes newspapers, dropped by 6%, with advertising and circulation revenue falling by 9% and 4% respectively. EBITDA plunged 38% to $131 million, caused partly by higher marketing spending and relocation costs (both in the UK).

HarperCollins

Its publishing wing continued posting strong gains. EBITDA jumped by 50% to $33 million on 10% increased revenue. Book sales were driven by Veronica Roth’s ‘Divergent’ series.

In the fourth quarter, electronic books represented 22% of consumer revenue, compared to 19% in Q4 last year.

On August 1, News Corp completed the acquisition of the romance publisher Harlequin Enterprises. The takeover was partly motivated by the company’s desire to reap foreign markets.

CEO Robert Thomson said regarding the results:

“We finished our first full year as the new News Corp and made significant progress in achieving the mission we articulated at the outset – to be more global and more digital through organic growth, product launches and strategic acquisitions. Thanks to the exciting e-evolution of News Corp’s leading global brands, we are enjoying enhanced engagement with our expanding paid audiences, underscoring the growth potential of our diverse portfolio.”

“In addition to acquiring Storyful in December, strengthening our video reach and depth, we completed the Harlequin acquisition last week – which brings an international digital platform to HarperCollins. REA, our digital real estate services company, continues to show impressive top- and bottom-line growth, while importantly, expanding to new markets – most recently in Southeast Asia through an investment in iProperty. While we are operating in a challenging advertising environment, our results highlight the diversification of our portfolio and our cost discipline, leading to improved free cash flow and a firm foundation for sustained growth.”

News Corp is based in New York City. It employes 27,000 people.

21st Century Fox withdrew Time Warner acquisition attempt

After trying to acquire paid TV giant Time Warner, Rupert Murdoch announced earlier this month that 21st Century Fox (Fox) was withdrawing and would no longer pursue a takeover.

While describing his desired merger as a “unique opportunity to bring together two great companies,” Mr. Murdoch said that despite using a friendly approach, Time Warner’s management “refused to engage with us to explore an offer which was highly compelling.”

Fox had made a $80 billion offer for Time Warner, which was rejected.

Mr. Murdoch said his company also withdrew because Fox’ shares price had slumped during the acquisition attempt, which contributed to his decision to withdraw.

According to Fox, its Board of Directors authorized a $6 billion share buyback program for the next twelve months.