The number of rigs actively exploring for oil and gas in the US dropped by 11 this week to the lowest level since November 2009, despite crude prices climbing up, according to Baker Hughes Inc – one of the world’s largest oil field services companies.

The total rig count in the week to April 29 dropped to 420, compared to the 905 rigs operating in the same week a year ago.

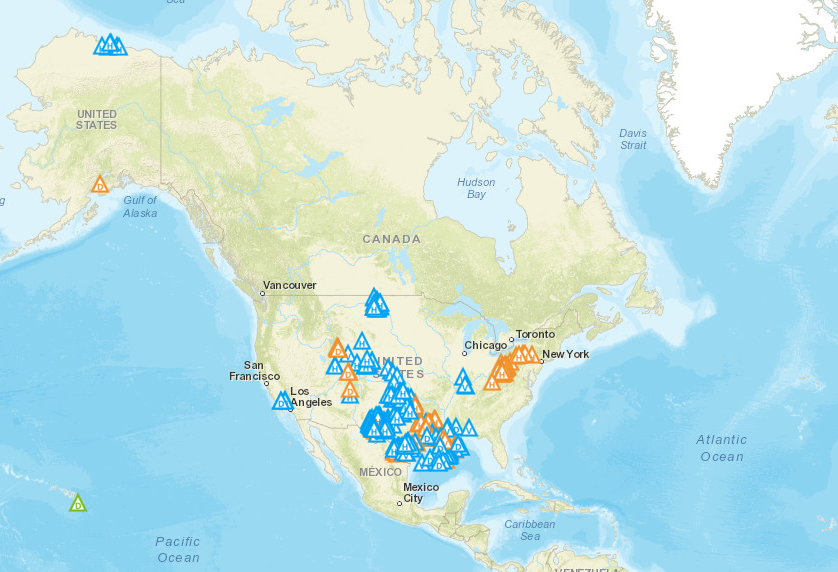

Out of the 420 active rigs, 332 were looking for oil, while 87 were exploring for gas.

Oklahoma and New Mexico both lost three rigs. Texas, Louisiana, West Virginia, and Kansas lost 2 rigs, while Colorado dropped by one.

Energy firms have slashed spending since the plunge in crude markets in mid-2014. Crude futures dropped from $107 a barrel in June 2014 to a near 13-year low around $26 in February.

However, over the past two months US crude futures have increased by almost 80 percent – reaching almost $46 on Friday.

Baker Hughes CEO Martin Craighead said at the company’s quarterly earnings release on Wednesday:

“In the second quarter, we forecast the North America rig count to fall 30% compared to the first quarter average. For the second half of the year, we project the U.S. rig count will begin to stabilize, although we do not expect activity to meaningfully increase in 2016.

“Conversely, the international rig count is predicted to drop steadily through the end of the year as we see limited new projects in the pipeline.”